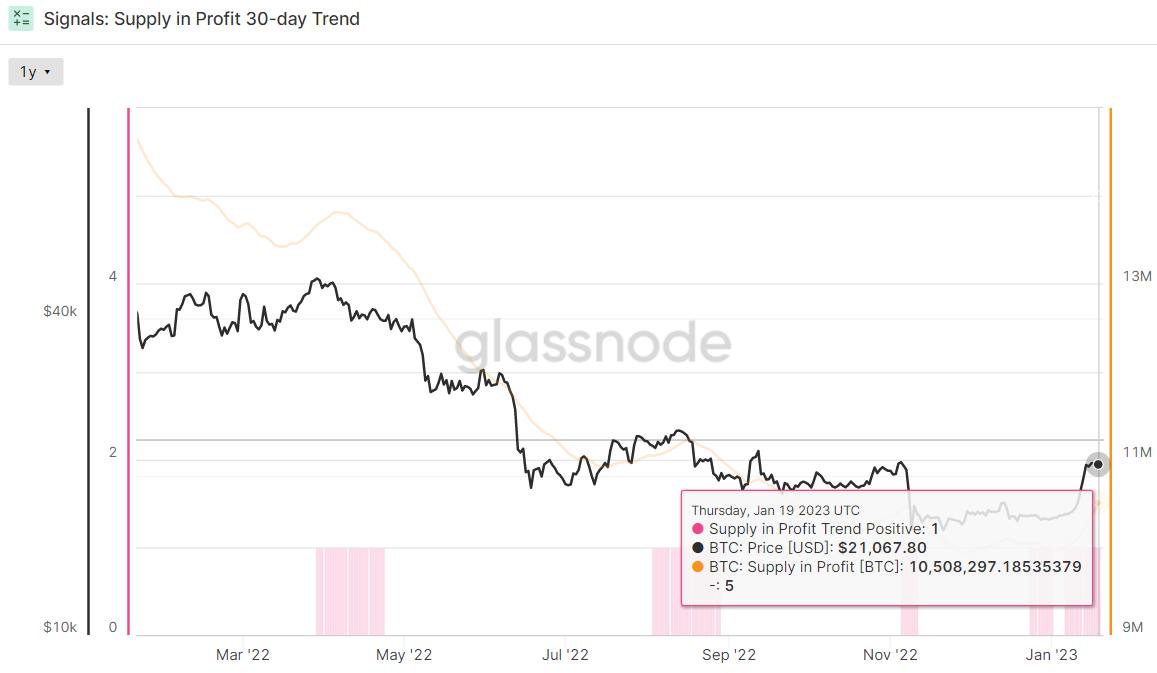

A 30-day Exponential Moving Average of the amount of Bitcoins which are “in profit” – i.e. were acquired at any given time once the BTC cost was lower – hit a couple-month high in 19th of The month of january, based on crypto data as well as on-chain analytics firm Glassnode.

In wake from the latest Bitcoin rally which has seen the world’s largest cryptocurrency by market capital get back the $21,000 carrying out a near 30% rally since the beginning of the month, Glassnode’s 30-day EMA of Bitcoin Supply in Profit rose to in excess of 10.5 million coins. That’s its greatest since last September. At the moment, you will find 19.27 million Bitcoins in circulation of the total 21 million that may be found.

Consequently, the availability in Profit Trend has become positive, states Glassnode. “During positive market trends, the level of BTC supply which was acquired at affordable prices has a tendency to increase, putting more supply into an unrealized profit,” the crypto analytics firm explains.

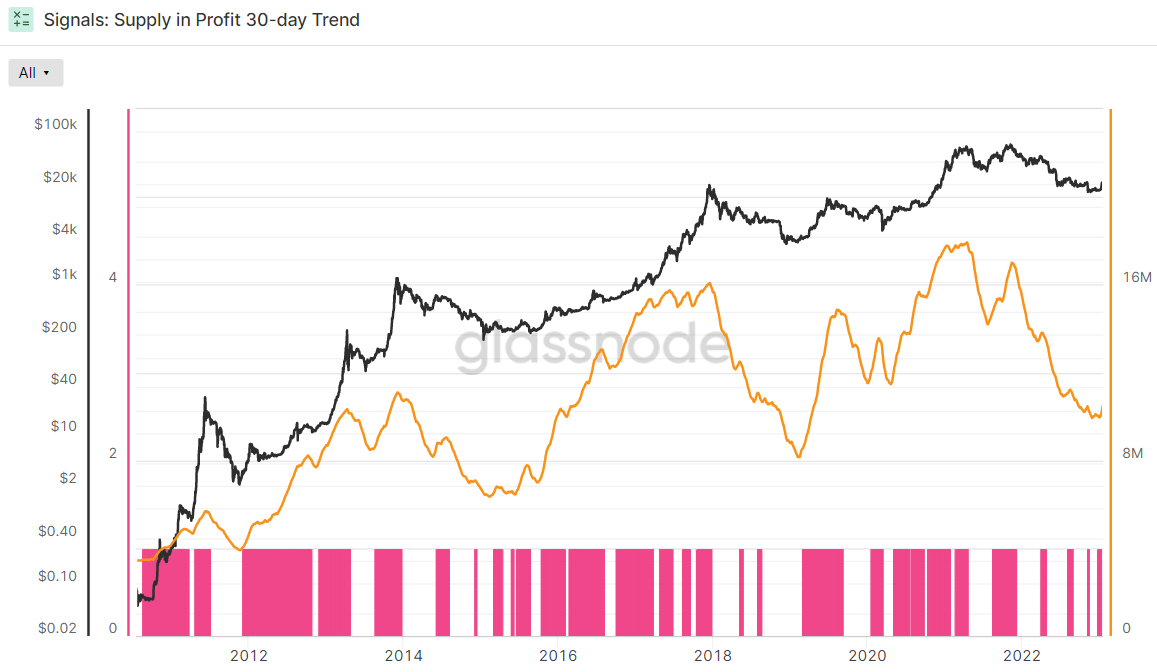

“As such, macro trend shifts in the level of Supply in Profit can signal whenever a heavy power of investor cost basis has lately transitioned between unrealized profit, or loss,” Glassnode adds. “Often these occur near macro market cycle changes”.

Supply in Profit Hits Greatest Since May 2022

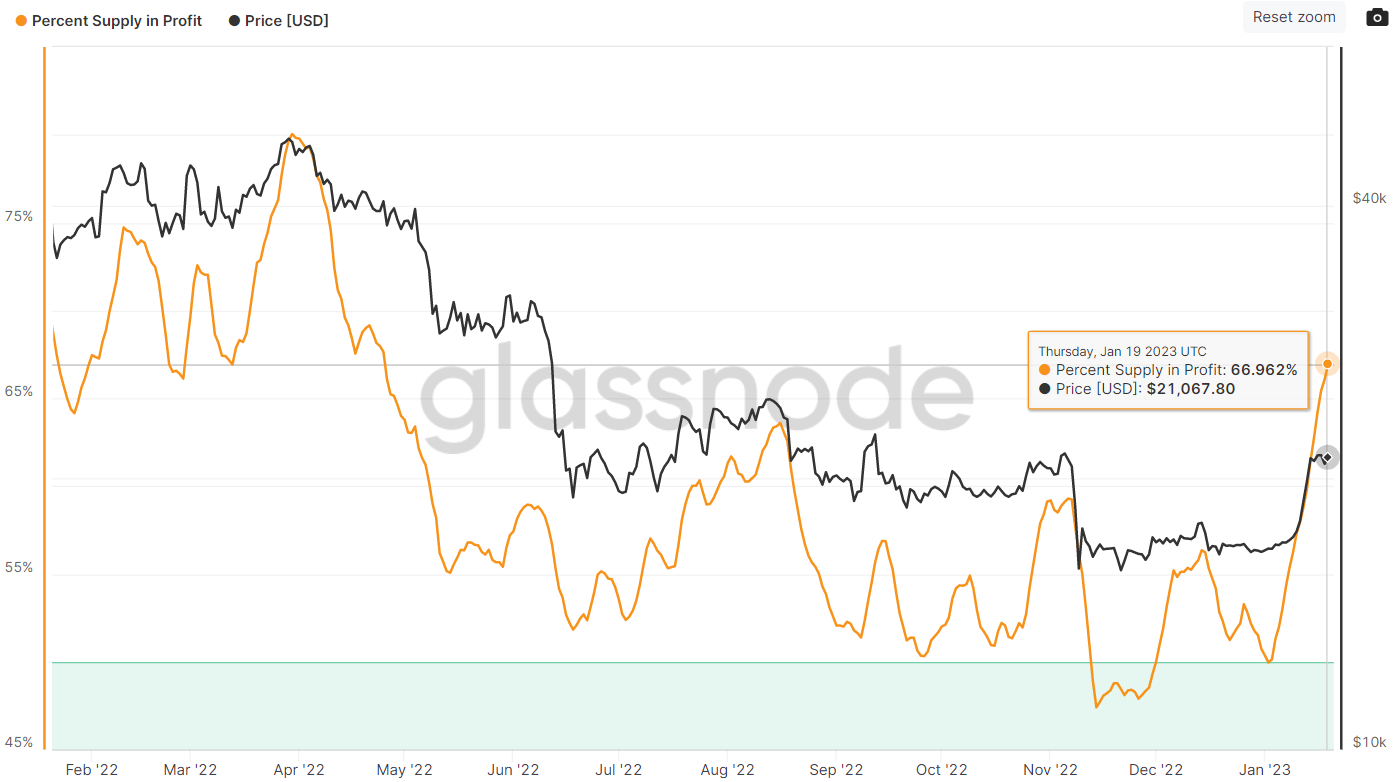

The above mentioned indicator uses an EMA to be able to provide a less volatile result, potentially functioning like a better signal of the turn on the market. However a more fundamental way of measuring Supply in Profit also appears to become delivering a bullish signal.

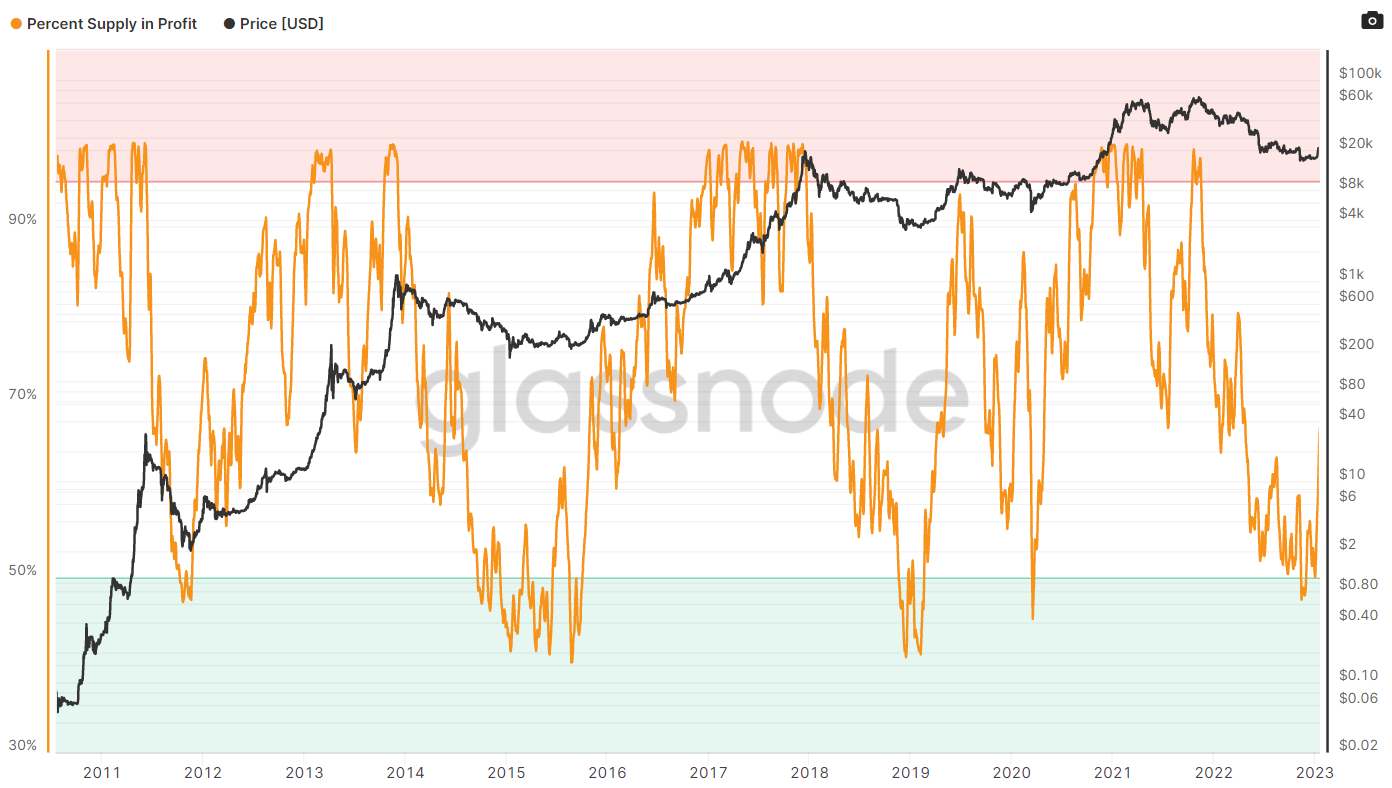

Based on Glassnode, 66.9% of Bitcoins were in profit on Thursday the 19th of The month of january, up from around 50% in the turn of the season. Which means around 12.9 million Bitcoins last moved once the cost was lower.

Searching in a longer-term good reputation for Glassnode’s more fundamental Supply in Profit metric, a recovery from under 50% frequently occurs in front of the oncoming of a bull market.

Other Signals Also Flashing Eco-friendly

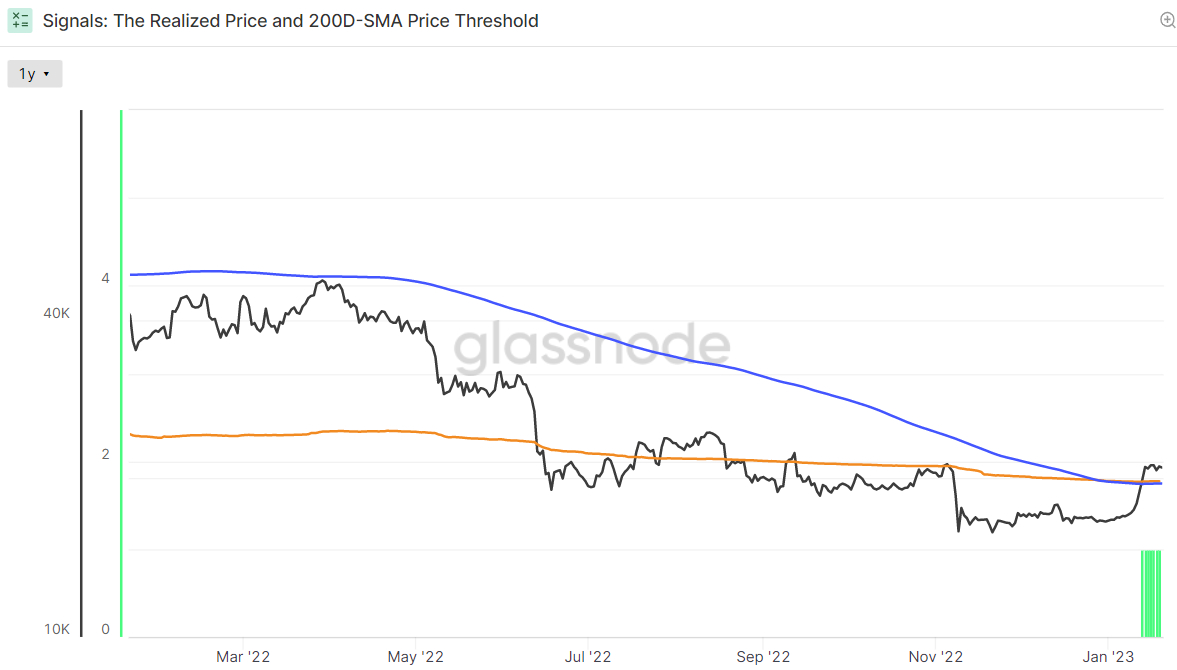

Multiple other technical as well as on-chain indicators have began flashing eco-friendly the bear market of 2022 may be over. For instance, Bitcoin’s latest push greater which has seen it recover above $21,000 from the finish of 2022 levels around $17,000 has witnessed the world’s largest cryptocurrency by market capital break to northern its 200-Day Moving Average and Recognized Cost, each of which sit just below $20,000.

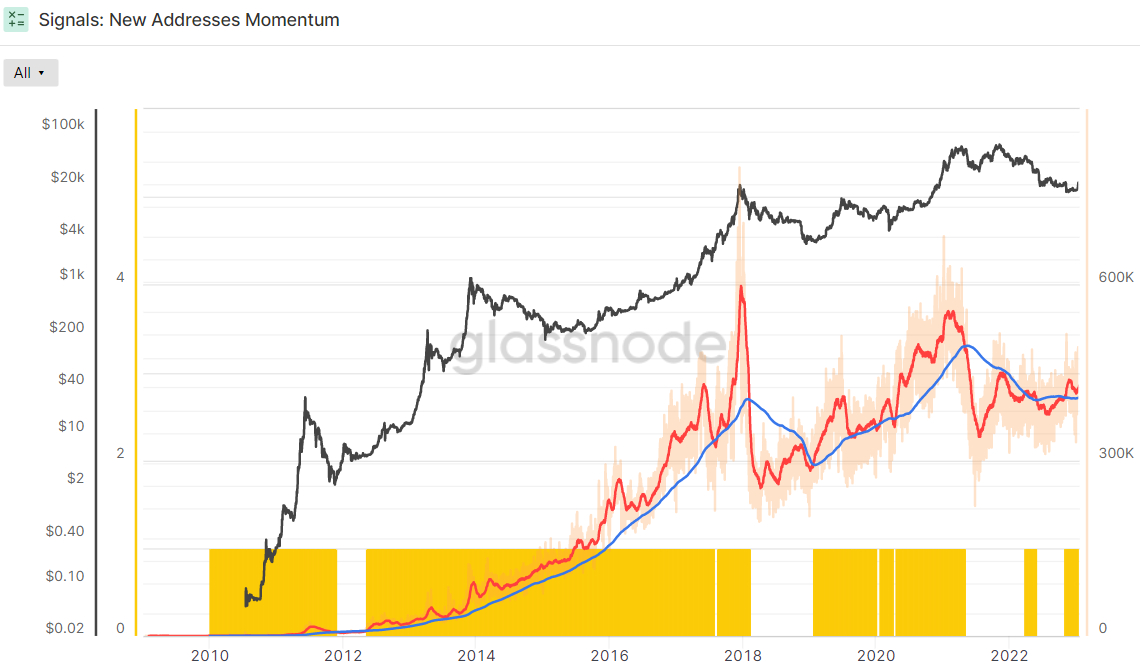

Momentum in new addresses also lately required a turn for that better, using the 30-day simple moving average (SMA) lately jumping over the 200-day SMA, a shift which frequently occurs at the beginning of a Bitcoin bull market.

Meanwhile, based on analysis from pseudonymous Twitter account @CryptoHornHairs, Bitcoin seems to become tracking almost exactly consistent with a lengthy-term market cycle that repeats itself roughly every 4 years. Based on @CryptoHornHairs, Bitcoin is at the outset of the bullish stage from the cycle, getting just come via a 364-day downturn.

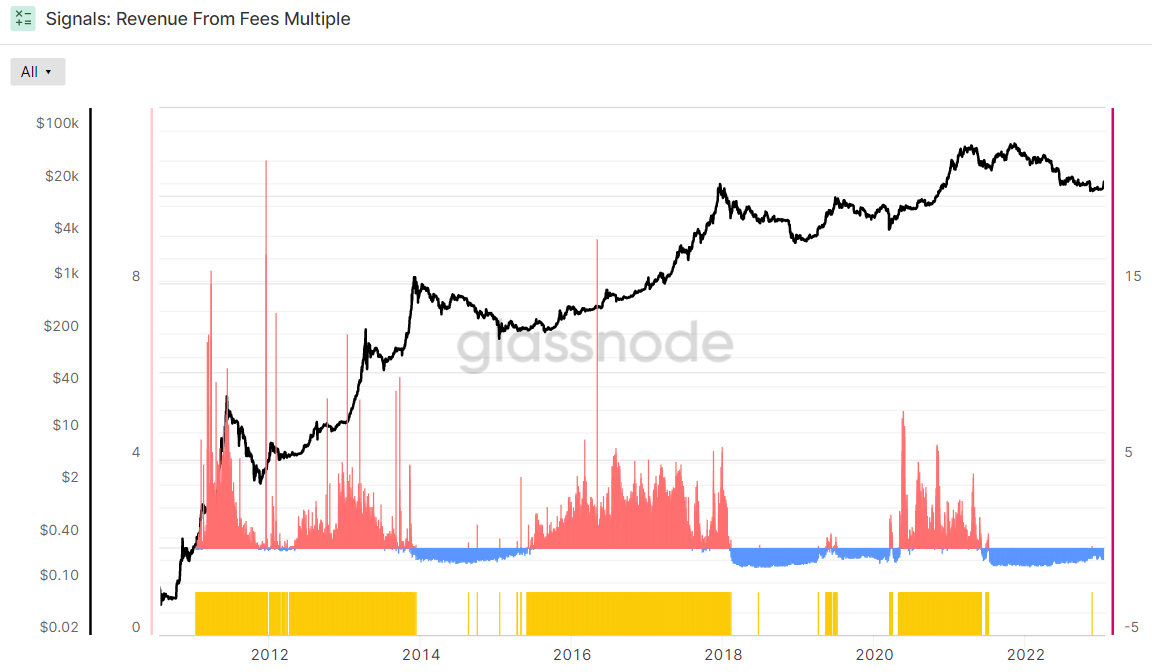

But Bulls Beware, Revenue From Charges Momentum Isn’t There

Glassnode’s Revenue From Charges Multiple continues to have an adverse 2-year Z-score close to -.41. The Z-score is the amount of standard deviations below or above the mean of the data sample. In cases like this, Glassnode’s Z-score is the amount of standard deviations below or above the mean Bitcoin Fee Revenue from the last 2-years.

“A sustained uptick in fee revenue like a proportion from the total reward signifies that Bitcoin blocks are full, and there’s growing interest in transaction activity,” the crypto analytics firm states. “Given the restricted blocksize of Bitcoin, it has in the past provided an invaluable early indicator of the macro trend transfer of the network demand profile”. Bitcoin’s weak Fee Revenue momentum ought to be a warning sign for that bulls, because it implies weak on-chain activity.

Where Next For BTC?

So, all of the signals aren’t quite there yet to suggest a sustained rapid Bitcoin rally. But bulls should have no fear. 2023 is (most likely) likely to be nothing beats 2022. Inflation in america inflation and growth are easing quickly and the majority of the united states Federal Reserve’s rate of interest hiking cycle has likely recently been completed. Markets and lots of analysts expect merely a couple of more hikes, despite still hawkish talk in the world’s most significant central bank, after which an easing bias entering 2024.

Many crypto analysts hope the deleveraging cycle which has seen the collapse of numerous industry titans from Three Arrows Capital, Celsius, FTX and, most lately, Genesis, is nearing maturity. Analysts will also be wishing for positive regulatory developments in key markets like the US this season, like a resolution around the SEC versus Ripple suit and additional progress perfectly into a broad crypto regulation bill.

It’s most likely not reasonable to anticipate the interest rate of the month’s rally to carry on, however a ongoing crawl greater (presuming no further economic/industry shocks) is possibly around the cards. For the short term, a rest above $21,500 would open the doorway to some rally for the key $25,500 balance area.