An increasing narrative among crypto and traditional asset class investors that Bitcoin might really be considered a viable safe place against potential turmoil within the traditional fiat-based fractional reserve banking system helps propel the BTC to fresh multi-month highs versus its major altcoin peers now.

Based on TradingView, Bitcoin dominance (i.e. the proportion from the cryptocurrency market’s total capital adopted by Bitcoin) hit its greatest level in nine several weeks above 45.5% on Wednesday. Which comes following the BTC/ETH exchange rate hit its greatest level since November around 15 the 2009 week.

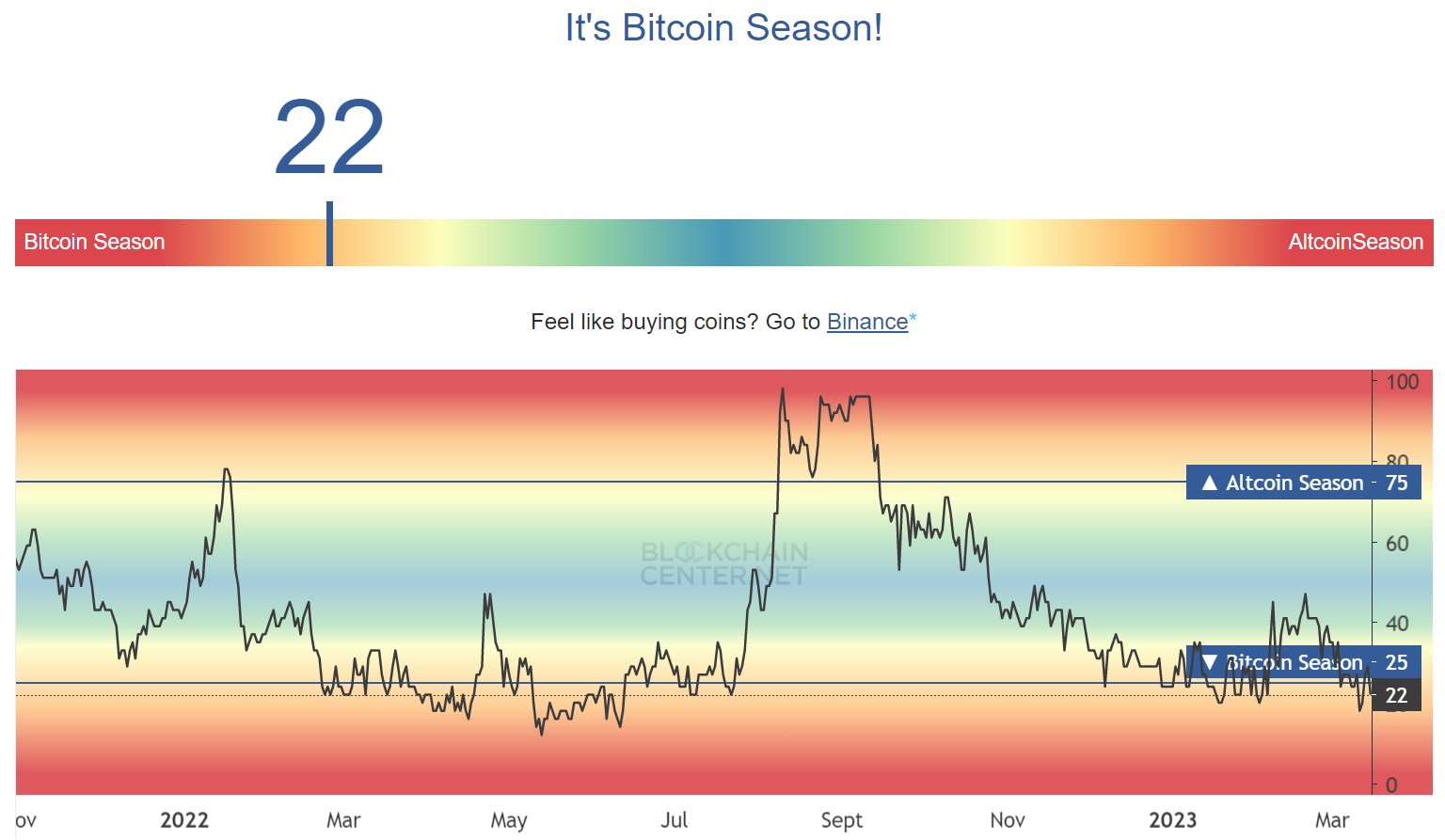

BTC/BNB, meanwhile, is near its greatest since last August around 80, BTC/XRP reaches its best levels since last September above 62,200, while BTC/ADA reaches its cheapest level since early 2021. Blockchaincenter.net’s Altcoin Season Index has thus slumped firmly back to “Bitcoin Season” (understood to be scores below 25, using the current score 22), lower from late Feb highs within the 47 area.

Can Bitcoin Hit $30,000?

Bitcoin’s leap in dominance uses the cryptocurrency hit its greatest levels since last June within the mid-$26,000s the 2009 week, a sensational recovery from last week’s dip to new two-month lows underneath the $20,000 level. Last week’s dip was triggered by broader risk-off flows following a spate of crypto/tech-friendly US banks went under.

This week’s recovery was triggered by a mix of bullish factors, analysts think, including 1) a positive response from US government bodies to backstop deposits and a pair of) launch a brand new bank liquidity program (which helped USDC, a vital area of the crypto market’s plumbing, recover to its $1 peg), and three) expectations that the chance of a banking crisis would deter the Given from participating in substantial further rate hikes.

These narrative around Bitcoin as being a safe place against trouble within the traditional economic climate can also be touted to possess helped, just because it is being touted as boosting Bitcoin versus its major crypto rivals. What the reason for the rebound, analyst cost predictions have grown to be substantially more bullish.

Technical signals look great Bitcoin rebounded strongly from the recent retest from the 200DMA and Recognized Cost (both just below $20,000), an indication the bull marketplace is robust, and also the recent breakout above $25,200-400 area resistance is considered as opening the doorway to some run greater for the next resistance area within the $28,000 area.

On-chain indicators that may signal whenever a bear marketplace is over still send good signals, as discussed within this recent article. Metrics associated with Bitcoin’s on-chain activity (like daily transactions, new address creation, daily active users, no. of addresses having a non-zero balance) generally also still trend inside a positive direction.

Traders continuously monitor the healthiness of the united states and global economic climate, with any indications of further cracks potentially adding further fuel to Bitcoin’s rally. Next week’s Given meeting is going to be another key event to look at, with this particular week’s US CPI and PPI (thankfully for that Given) providing them with some room to signal a rather less aggressive tightening outlook. That may be another tailwind for Bitcoin.

If Bitcoin makes it to and break above $28,000 resistance, the doorway would then be opened up to more upside beyond $30,000 to another major resistance around within the $32,500-$33,000 area.