Bitcoin (BTC) ranged below $17,000 in the 12 ,. 8 Wall Street open because the U.S. dollar threatened further weakness.

Dollar dips as stocks see modest upt

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD practically flat within the 24 hrs towards the duration of writing.

With macro cues missing, analysts eyed a possible breakdown in U.S. dollar strength because the next volatility catalyst for crypto and risk assets.

The U.S. dollar index (DXY) looked set to challenge multi-day support, wicking below 105 multiple occasions at the time.

“$DXY’s very first time underneath the 100 day MA since June of ‘21,” Joe Cariasare, co-host from the Inside Bitcoin podcast, noted.

Trader and analyst Pierre added that both DXY and also the S&P 500 could nevertheless trade sideways before the Consumer Cost Index (CPI) print for November is available in on 12 ,. 13.

The big event, as Cointelegraph reported, is really a classic temporary volatility trigger.

“In the meantime, both SPX and DXY still hovering around their particular D1 200 EMA,” chart comments read.

“DXY flipping it resistance to date, while SPX sitting at D1 upward trend, important level to protect. Both searching like several they need is increasingly more chop until in a few days CPI.”

On BTC/USD, popular trader Daan Crypto Trades expected the buying and selling range to grow a absorb liquidity both above and below place.

“$BTC In an exceedingly tight range here with a lot of untapped ups and downs,” he told Twitter supporters.

“I think each one of these levels can get removed which the first move will probably be a fakeout simply to retrace and take sleep issues. Would certainly be considered a classic Bitcoin move.”

“Final phase” from the Bitcoin bear market?

Further modest tailwinds originated from U.S. stocks throughout the first hour’s buying and selling on Wall Street.

Related: GBTC ‘elevator to hell’ sees Bitcoin place cost approach 100% premium

The S&P 500 was up 1% during the time of writing, as the Nasdaq Composite Index was 1.2% greater. The move went a way to copying each day of relief in Asia, where buying and selling ended with Hong Kong’s Hang Seng 3.4% greater.

Searching at longer timeframes, however, the image continued to be downbeat on Bitcoin for a lot of.

Popular commentator Byzantine General continued record to declare the likely start of the 2022 bear market’s darkest phase.

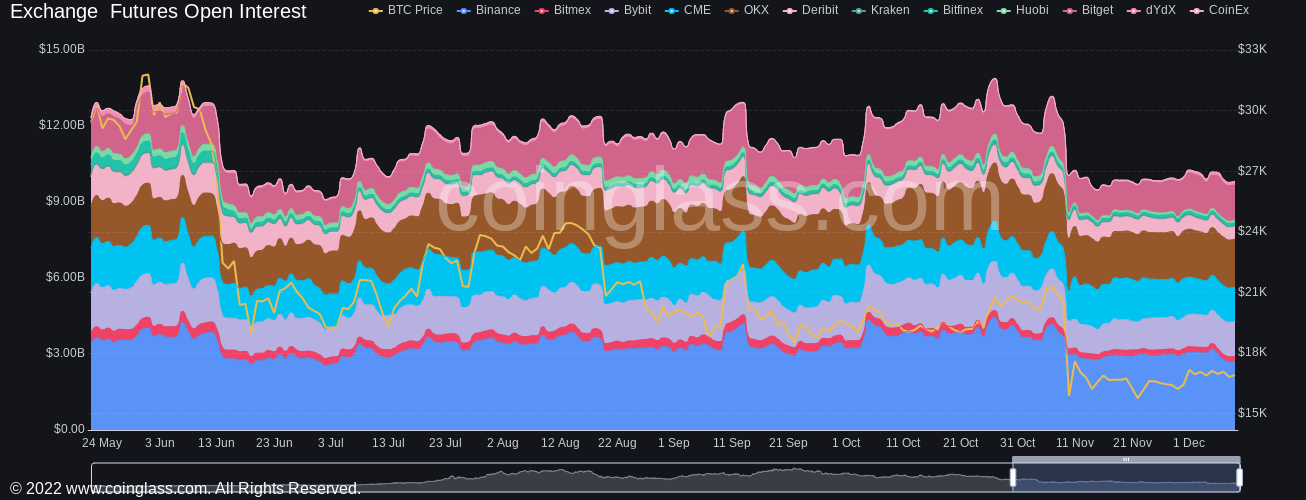

“Perps volume is within a fairly strong downtrend now. Market contracting, speculators capitulating,” he authored, talking about perpetual futures markets.

“We are most likely entering the ultimate phase from the bear. However that last phase may last pretty lengthy.”

Data from Coinglass furthermore demonstrated open curiosity about futures ongoing to say no.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.