Bitcoin (BTC) looked set to ditch $17,000 following the 12 ,. 16 Wall Street open as U . s . States equities ongoing to fall.

Analyst: $240BNB “is not but air below it”

Data from Cointelegraph Markets Pro and TradingView tracked new intraday lows of $16,743 for BTC/USD on Bitstamp.

The happy couple had abruptly dived nearly 3% earlier within the day, compounding losses, which immediately adopted one-month highs.

Ongoing concerns over largest global exchange Binance pervaded the atmosphere, these coming regardless of the best efforts of Chief executive officer, Changpeng Zhao, to eliminate what he known as “FUD.” As Cointelegraph reported, longtime crypto traders were similarly skeptical from the credibility from the “craziest rumors” concerning the crypto exchange sector.

Nevertheless, markets declined to provide them a rest, and beyond Bitcoin, warnings elevated within the fate of Binance’s in-house token, Binance Gold coin (BNB).

BNB/USD fell to close $240 at the time, marking its cheapest levels since This summer.

“BNB is not but air below it,” popular trader and analyst Matthew Hyland acknowledged.

“As the next largest non-stable crypto, whether it crashes here it is going to drag the entire crypto market lower by using it.”

The move given into bearish traders’ longer-term plan, with Il Capo of Crypto particularly already with a bottom below $50.

Pressure elevated around Binance itself at the time, using its evidence of reserves report deleted by auditor Mazars Group, which added it would not work with crypto industry clients.

Inside a square-off on Twitter, meanwhile, Zhang openly ridiculed a publish from blunt television personality Jim Cramer, who stated he “would trust my money more in Draftkings than i’d binance.”

“Now we’re safe!” Zhang responded.

Crypto limps lower with U.S. stocks

Related: Bitcoin Father Christmas rally unlikely, based on on-chain and derivatives data

Beyond crypto, U.S. stocks saw another weak performance in the open, the S&P 500 lower around 1.4% during the time of writing.

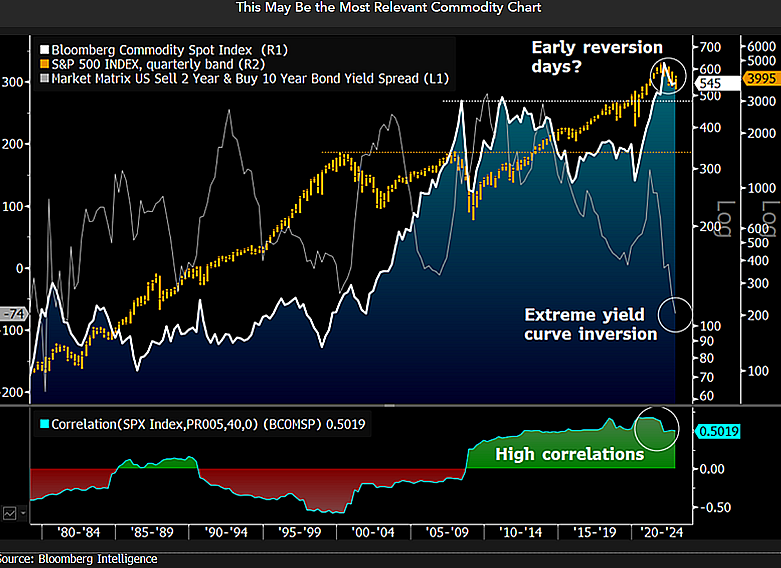

For Mike McGlone, senior commodity strategist at Bloomberg Intelligence, the problem wasn’t badly as it might appear.

“Normal Reversion Can Seem To Be Just like a Crash – The tendency for correlations to gravitate to at least one-to-1 when the stock exchange declines can be a primary factor for those assets in 2023, particularly goods,” he authored partly of commentary alongside an explanatory chart.

Earlier, McGlone nevertheless cautioned the marked was displaying potential similarities towards the period prior to the 1929 Wall Street Crash.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.