Bitcoin (BTC) looked set to equal its cheapest monthly close since 2020 on August. 28 as bulls unsuccessful to seize control.

Odds compare for any much deeper dive below $20,00

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD criss-crossing $20,000 with hrs before the weekly candle completed.

The happy couple have been not able to compensate for lost ground over the past weekend, and merely days in the finish from the month, even $20,000 made an appearance vulnerable as support.

During the time of writing, Bitcoin traded near $19,900 — below June’s closing cost.

“It did not matter what sort of lines or squiggles you’d in your charts,” on-chain monitoring resource Material Indicators summarized over the past weekend alongside bid and get data in the Binance order book.

“After JPow punched the marketplace hard on Friday, BTC lost the popularity coming from the June low. Now now you ask , whether that local low holds. Presently not seeing enough bid liquidity to obtain excited.”

Material Indicators was talking about the August. 26 risk asset cascade which resulted from hawkish comments by Jerome Powell, Chair from the U . s . States Fed.

Without any manifestation of a wish to curtail or reverse key rate hikes later on, Powell’s speech in the annual Jackson Hole economic symposium sent shockwaves through equities markets. U.S. stocks lost a combined $1.25 trillion at the time.

Bitcoin endured in step, even though some potential customers came forward with intends to buy below $20,000, consensus favored much deeper downside moving forward.

Popular trader Anbessa was eyeing two scenarios at the time, one involving an assistanceOr resistance switch to carry on greater and the other targeting a failure to $16,000-$17,000.

“We need to visit a great deal before becomes bullish,” fellow trader Crypto Tony put in a part of his latest update.

BTC supply held baffled gets near 50%

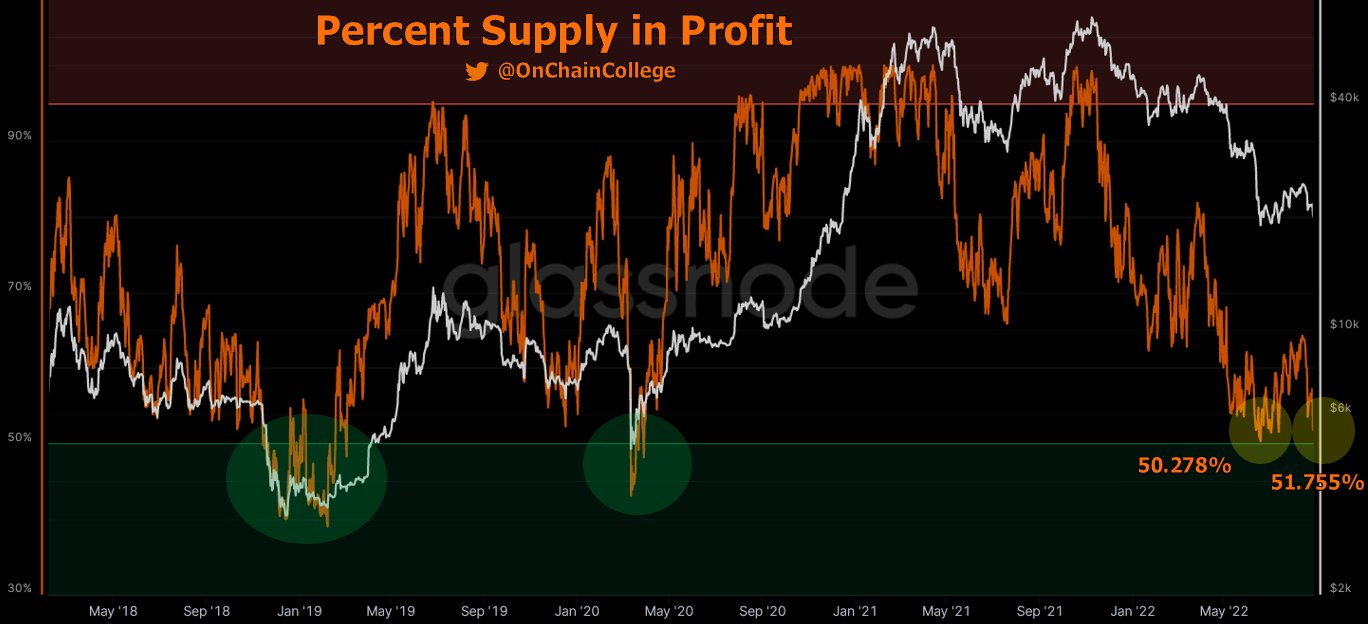

For analytics account On-Chain College, meanwhile, an indication of encouragement originated from on-chain data covering hodler profitability.

Related: Bitcoin risks worst August since 2015 as hodlers brace for ‘Septembear’

The most recent cost drop decreased the proportion from the BTC supply in profit, which proportion was now approaching levels only observed in previous macro market bottoms.

“I’ve been waiting all bear marketplace for the Bitcoin Percent of Supply in Profit to decrease below 50%,” On-Chain College commented.

“In June, it bounced just above at 50.28%. Presently, it’s at 51.76%. This metric dropped below 50% in each and every prior bear market + March 2020.”

As Cointelegraph reported in the weekend, hodlers still cold-keep BTC supply with growing conviction.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.