So-known as “market tourists” are fleeing from Bitcoin (BTC), departing only lengthy-term investors holding and transacting within the top cryptocurrency, based on blockchain analytics firm Glassnode.

In the This summer 4 Week Onchain report, Glassnode analysts stated June saw Bitcoin get one of their worst-performing several weeks in 11 years, having a lack of 37.9%. It added activity around the Bitcoin network reaches levels concurrent using the greatest area of the bear market in 2018 and 2019, writing:

“The Bitcoin network is approaching a condition where just about all speculative entities, and market vacationers appear to have been purged in the asset.”

However, regardless of the almost complete purge of “tourists,” Glassnode noted significant accumulation levels, proclaiming that the balances of shrimps — individuals holding under 1 BTC, and whales — individuals with 1,000 to five,000 BTC, were “increasing meaningfully.”

Shrimps, particularly, begin to see the current Bitcoin prices as attractive and therefore are accumulating it for a price of just about 60,500 BTC monthly, which Glassnode states is “the most aggressive rate ever,” equal to .32% from the BTC supply monthly.

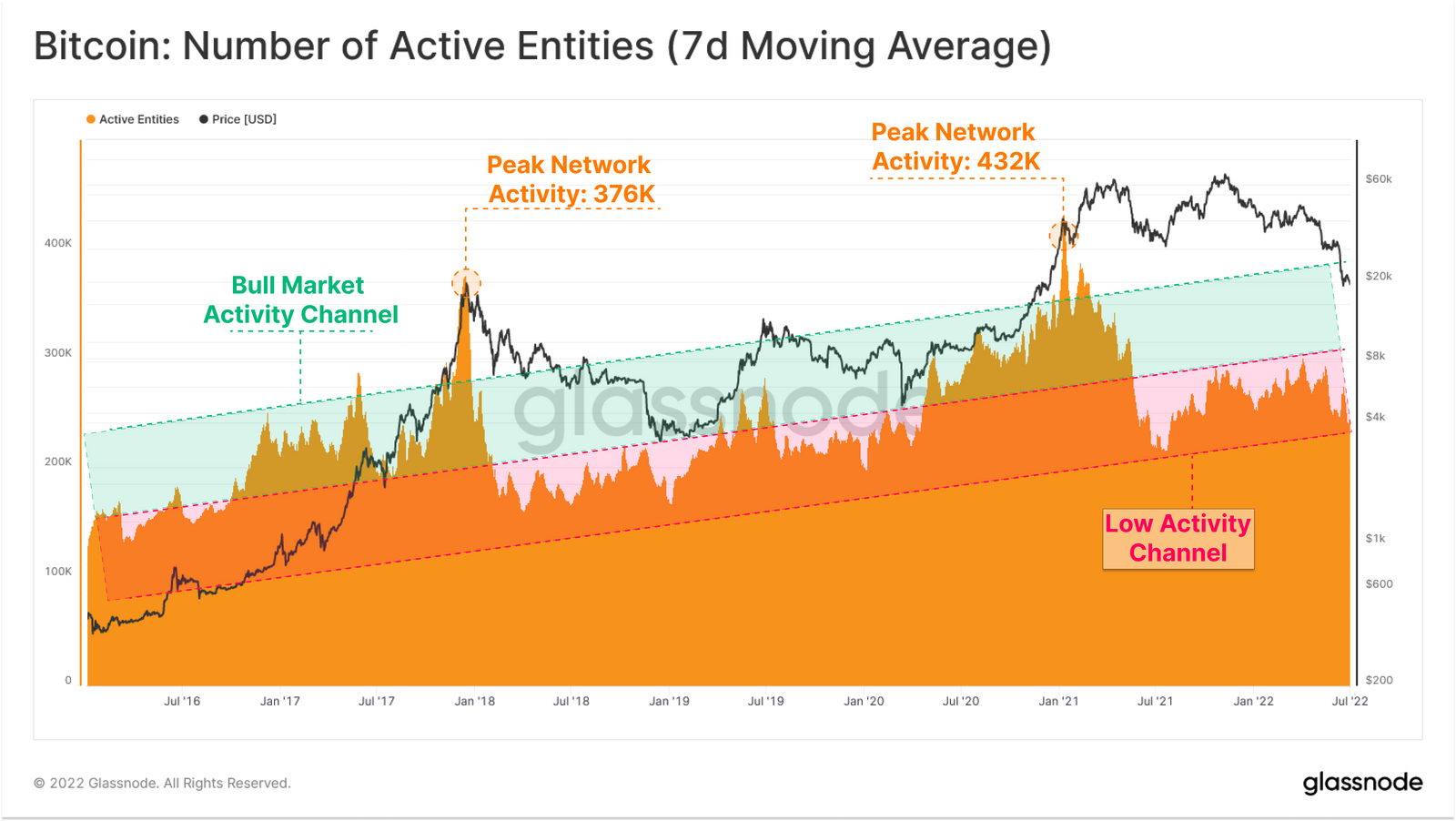

Explaining the purge of those tourist-type investors, Glassnode says both the amount of active addresses and entities have experienced a downtrend since November 2021, implying new and existing investors alike aren’t getting together with the network.

Address activity has fallen from over a million daily active addresses in November 2021 close to 870,000 each day in the last week. Similarly, active entities, a collation of multiple addresses of exactly the same person or institution, are actually roughly 244,000 each day, which Glassnode states is about the “lower finish from the ‘Low Activity’ funnel usual for bear markets.”

“A retention of HODLers is much more apparent within this metric, as Active Entities is usually trending sideways, suggestive of a reliable base-load of users,” the analysts added.

The development of recent entities has additionally dived to lows in the 2018 to 2019 bear market, using the user-base of Bitcoin hitting 7,000 daily internet new entities.

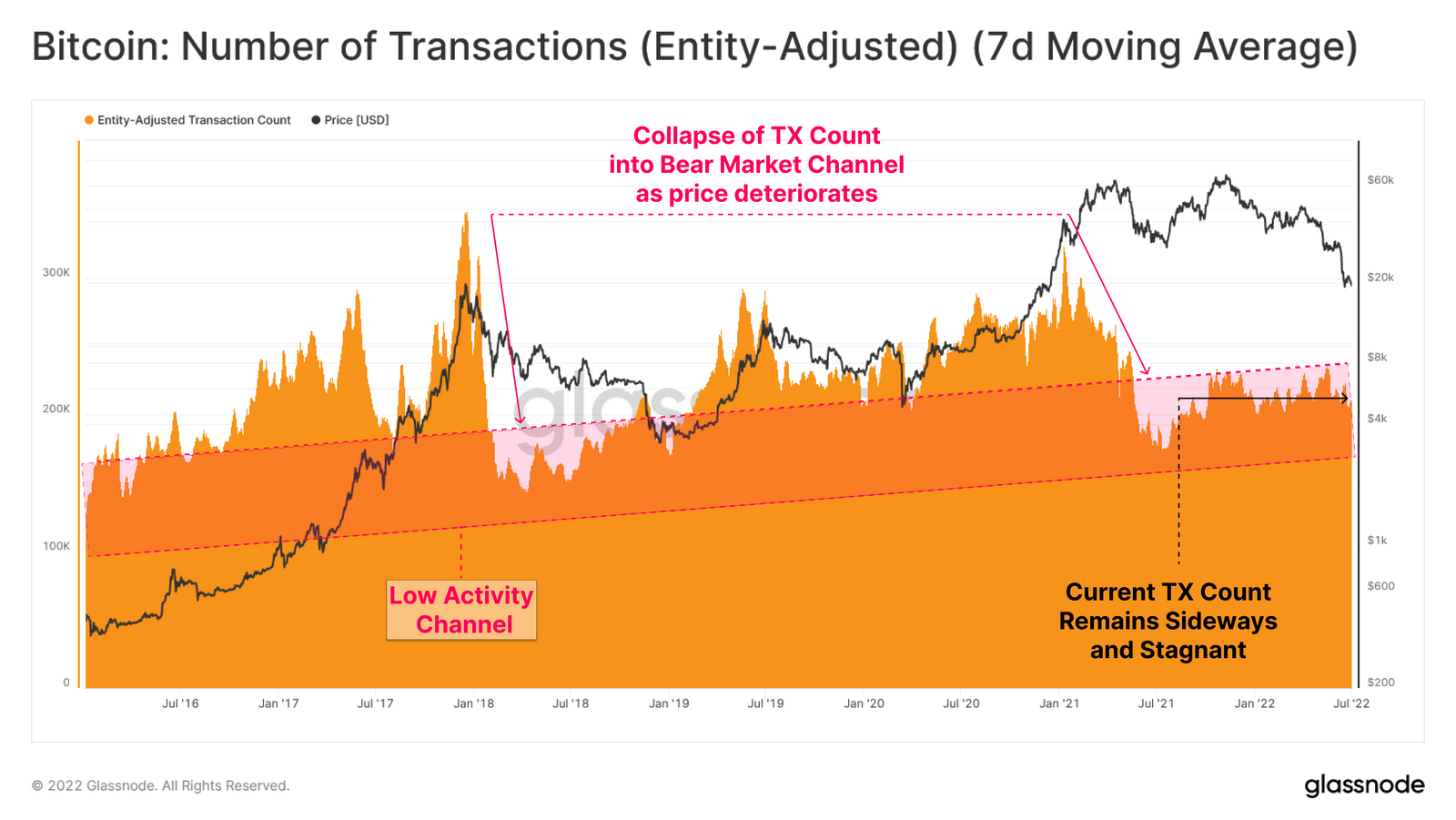

The transaction count remains “stagnant and sideways,” which signifies too little new demand but additionally implies that holders are now being retained with the market conditions.

Related: Institutional investors shorting Bitcoin composed 80% of weekly inflows

Driving home its point, Glassnode figured that the amount of addresses having a non-zero balance, individuals that hold a minimum of some Bitcoin, continues hitting all-time-highs and it is presently sitting in excess of 42.3 million addresses.

Past bear markets saw a purge of wallets once the cost of Bitcoin collapsed. Still, with this particular metric indicating otherwise, Glassnode states it shows an “increasing degree of resolve among the typical Bitcoin participant.”