Bitcoin (BTC) demonstrated weakness on August. 15, posting a 5% loss after testing the $25,000 resistance. The move liquidated over $150 million price of leverage lengthy positions and it has brought some traders to calculate moving back toward the yearly lower in the $18,000 range.

The cost action coincided with worsening conditions for tech stocks, including Chinese giant Tencent, that is likely to publish its first-ever quarterly revenue decline. Based on analysts, china gaming and social networking conglomerate is anticipated to publish quarterly earnings around $19.5 billion, that is 4% less than the year before.

Furthermore, on August. 16, Citi investment bank slashed Zoom Video Communications (ZM) recommendation to market, adding the stock is “high-risk.” Analysts described that the challenging publish-COVID dynamic, plus additional competition from Microsoft Teams, potentially caused a 20% stop by ZM shares.

The general bearish sentiment is constantly on the plague crypto investors, a movement explained influencer and trader @ChrisBTCbull, who pointed out that the simple rejection at $25,000 caused traders to publish sub-$17,000 targets.

After #Bitcoin did not break cost through $25000, all CT began covering the cost again $16k-17k

I believe you’re ready to open lengthy#buying and selling

— Chris (@ChrisBTCbull) August 16, 2022

Margin traders remain bullish regardless of the $25,000 rejection

Monitoring margin and options markets provides excellent insights into focusing on how professional traders are situated. For example, an adverse read happens if whales and market makers reduced their exposure as BTC contacted the $25,000 resistance.

Margin buying and selling enables investors to gain access to cryptocurrency to leverage their buying and selling position, growing returns. For instance, it’s possible to increase exposure by borrowing stablecoins to purchase yet another Bitcoin position.

However, Bitcoin borrowers are only able to short the cryptocurrency because they bet on its cost declining. Unlike futures contracts, the total amount between margin longs and shorts is not always matched.

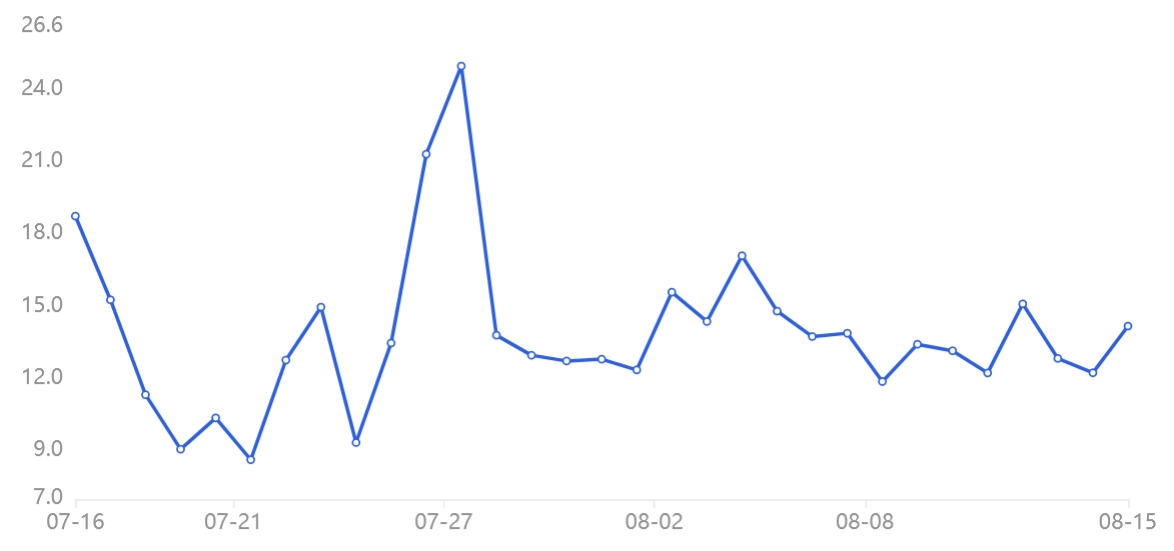

The above mentioned chart implies that OKX traders’ margin lending ratio has continued to be relatively stable near 14 while Bitcoin cost leaped 6.3% in 2 days simply to be rejected after striking the $25,200 resistance.

In addition, the metric remains bullish by favoring stablecoin borrowing with a wide margin. Consequently, pro traders happen to be holding their bullish positions, with no additional bearish margin trades become Bitcoin retraced 5.5% on August. 16.

Related: Bitcoin miners hodl 27% less BTC after 3 several weeks of major selling

Option markets hold an unbiased stance

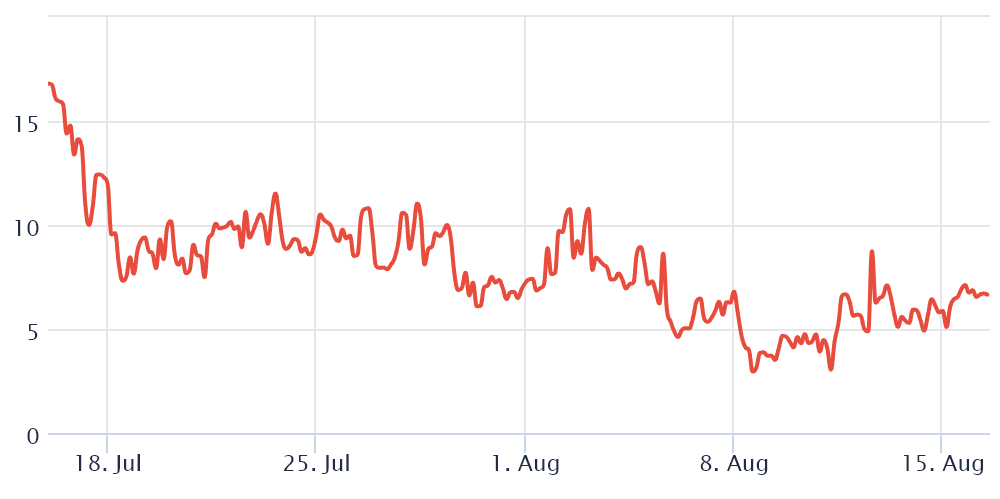

There’s uncertainty about whether Bitcoin can make another run toward the $25,000 resistance however the 25% delta skew is really a telling sign whenever arbitrage desks and market makers overcharge for upside or downside protection.

The indicator compares similar call (buy) and set (sell) options and can turn positive when fear is prevalent since the protective put options fees are greater than risk call options.

The skew indicator will move above 10% if traders fear a Bitcoin cost crash. However, generalized excitement reflects an adverse 10% skew.

As displayed above, the 25% delta skew has barely moved since August. 11, oscillating between 5% and sevenPercent more often than not. This range is recognized as neutral because options traders are prices an identical chance of unpredicted pumps or dumps.

If pro traders joined a “fear” sentiment, this metric might have moved above 10%, reflecting too little curiosity about offering downside protection.

Regardless of the neutral Bitcoin options indicator, the OKX margin lending rate demonstrated whales and market makers maintaining their bullish bets following a 5.5% BTC cost decline on August. 16. Because of this, investors should be expecting another retest from the $25,000 resistance when the global macroeconomic conditions improve.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.