Cryptocurrency traders were caught unexpectedly following the March. 13 consumer cost index report demonstrated inflation within the U . s . States rising by .6% in September in comparison to the previous month. The marginally greater-than-expected number caused Bitcoin (BTC) to manage a 4.4% cost correction from $19,000 to $18,175 in under three hrs.

The abrupt movement caused $55 million in Bitcoin futures liquidations at derivatives exchanges, the biggest amount in three days. The $18,200 level was the cheapest since Sept. 21 and marks an 8.3% weekly correction.

It’s worth highlighting the dip under $18,600 on Sept. 21 lasted under 5 hrs. Bears were likely disappointed like a 6.3% rally required put on Sept. 22, causing Bitcoin to check the $19,500 resistance. An identical trend is going on on March. 13 as BTC presently trades near $19,000.

The stock exchange also reacted negatively because the tech-heavy Nasdaq Composite index moved lower 3% following the inflation data was launched. Following the initial panic selling, Nasdaq adjusted to some 2% daily loss as analysts reaffirmed their expectations toward a .75% rate of interest increase through the U.S. Fed Committee in November.

Investors grew to become much more bearish after BlackRock Corporation (BLK) reported a 16% stop by profit versus the year before. Meanwhile, financial heavyweights JPMorgan Chase (JPM) and Morgan Stanley (MS) are going to set of Friday.

Unlike U.S. President Joe Biden’s appeal, Saudi Arabia’s secretary of state for foreign matters released an uncommon statement on March. 13 protecting the business from the Oil Conveying Countries’ production cut. The White-colored House desired to delay the choice until following the midterms. Nonetheless, the oil producer group made the decision to lower the availability target by two million barrels each day starting in November.

Many of these developments are growing investors’ bearish feelings and to obtain a better gauge on which is going on within the crypto sector traders need to look at derivatives data to find out if investors were surprised following the 4.4% dip below $18,200.

Futures markets were bearish within the last month

Retail traders usually avoid quarterly futures because of their cost difference from place markets. They’re, however, professional traders’ preferred instruments simply because they avoid the fluctuation of funding rates that frequently happens in a continuous futures contract.

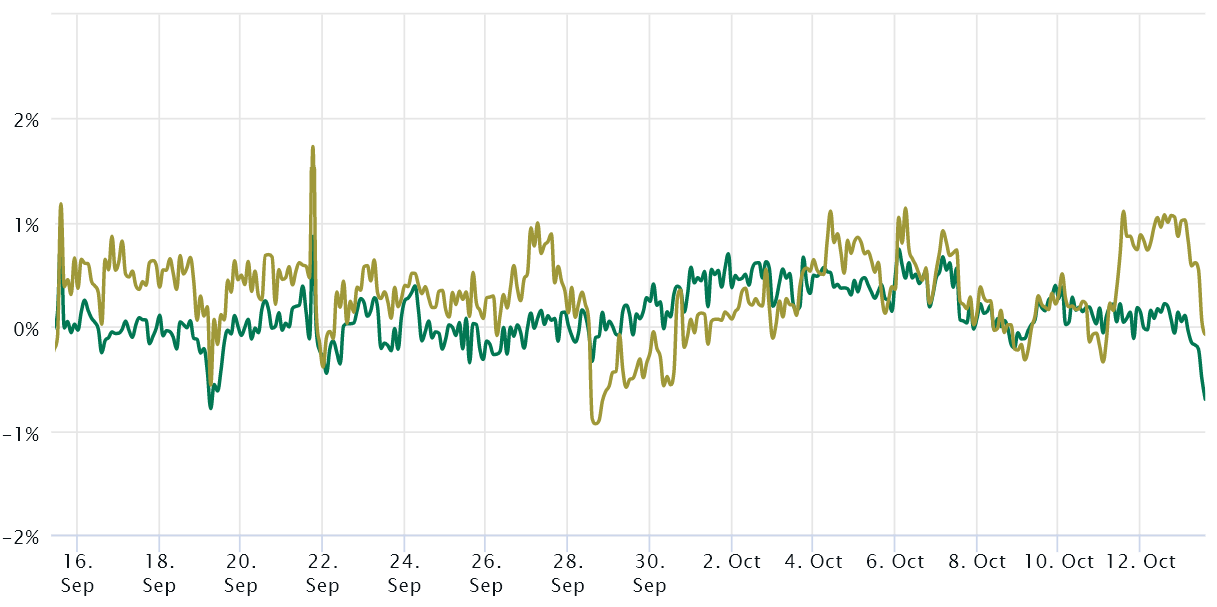

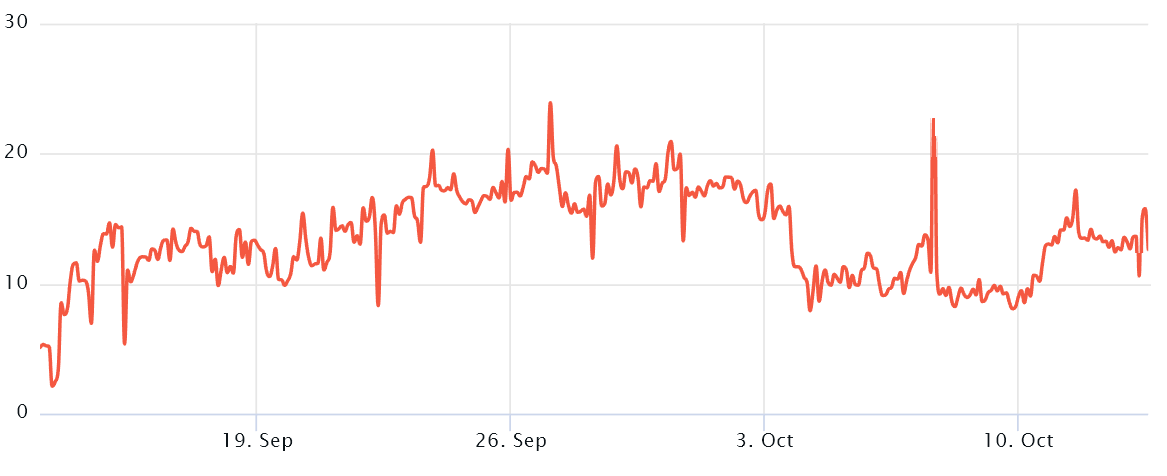

The indicator should trade in a 4% to eightPercent annualized premium in healthy markets to pay for costs and connected risks. Derivatives traders have been neutral to bearish within the last month since the Bitcoin futures premium continued to be below 1% the whole time.

This data reflects professional traders’ unwillingness to include leveraged lengthy (bull) positions regardless of the inexpensive. However, you have to also evaluate the Bitcoin options markets to exclude externalities specific towards the futures instrument.

Option traders are reluctant to provide downside protection

The 25% delta skew is really a telling sign when market makers and arbitrage desks are overcharging for upside or downside protection. For instance, in bear markets, options investors give greater odds for any cost dump, resulting in the skew indicator to increase above 12%. However, bullish markets have a tendency to drive the skew indicator below negative 12%, meaning the bearish put choices are discounted.

The 30-day delta skew have been over the 12% threshold since March. 10, signaling that options traders were less inclined to provide downside protection. Both of these derivatives metrics claim that the Bitcoin cost dump on March. 13 may have been partly expected, which is the relatively low effect on liquidations.

More to the point, the current bearish sentiment continued to be following the CPI inflation was announced. Consequently, whales and markers are less inclined to include leverage longs or offer downside protection. Thinking about the weak macroeconomic conditions and global political tension, the chances presently favor the bears.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.