This time around a week ago, Bitcoin appeared as if it may be near mustering a vital short-term bullish breakout. The world’s largest cryptocurrency by market capital had created a bullish short-term climbing triangular pattern and appeared as if it had been going to break over the key $25,200-400 area, opening the doorway for any quick run greater for the next major section of resistance around $28,000.

As things happened, a mix of macro headwinds (per month of strong US data and hawkish Given speak that pressed US yields and also the dollar greater and US stocks lower) and US regulatory concerns among a widening crypto attack stored the bulls away. Bitcoin wound up falling about 3.% a week ago and it is already another approximately 1.5% lower now.

At current levels within the low $23,000s, Bitcoin is about the mid-reason for February’s $21,400-$25,300ish range. And traders/investors appear to become betting that rangebound conditions will ensue for a while. A minimum of, that’s the content that Bitcoin options financial markets are delivering.

Bitcoin Volatility Expectations Drop After Failure to interrupt $25K

Based on data presented through the Block, Deribit’s Bitcoin Volatility Index (DVOL) has dropped dramatically during the period of the final week, apparently as a result of Bitcoin’s latest failure to interrupt above $25,000, which may have likely led to significant (probably bullish) near-term volatility. The DVOL was last at 50, lower from 60 this time around a week ago. It is not far beyond the record lows it printed in The month of january at 42, right before the 2023 crypto rally really got going.

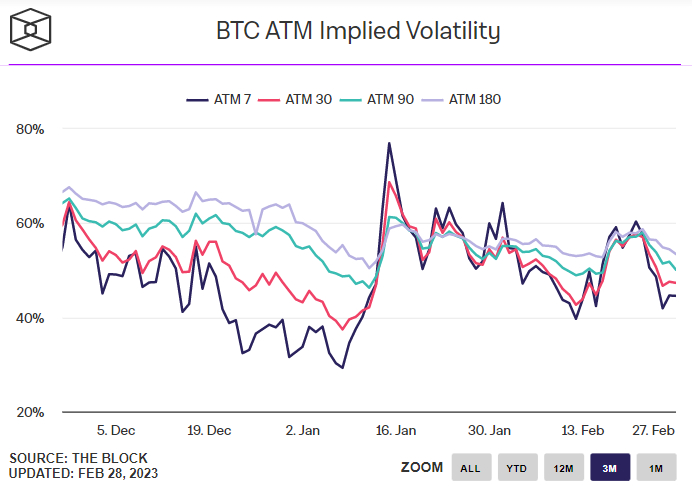

Individually, Implied Volatility based on the prices of At-The-Money (ATM) options has additionally dropped dramatically, with short-term volatility expectations experiencing and enjoying the sharpest move lower. Based on data presented through the Block, Bitcoin’s 7-day Implied Volatility was last at 44.55%, lower from 60.33% this time around a week ago. 30, 60 and 180-Day Implied Volatility are also lower dramatically to 47%, 50% and 53.5% from 57%, 58% and 58% correspondingly this time around a week ago.

Options Markets Mixed around the BTC Cost Outlook

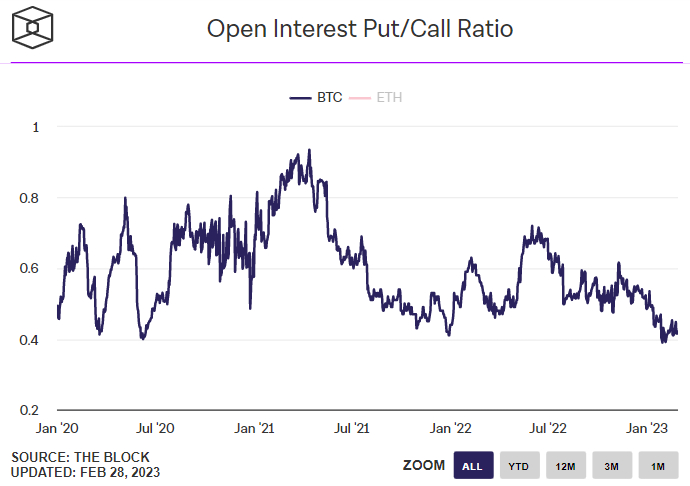

When it comes to what options financial markets are saying concerning the outlook for Bitcoin, the image is mixed. Around the one hands, the ratio between open interest normally bearish Put and normally bullish Call options sits firmly within the favour from the latter group, and almost to some record degree. Based on data presented through the Block, outdoors Interest Put/Call Ratio was last .42, barely over the record lows it hit earlier this year at .39.

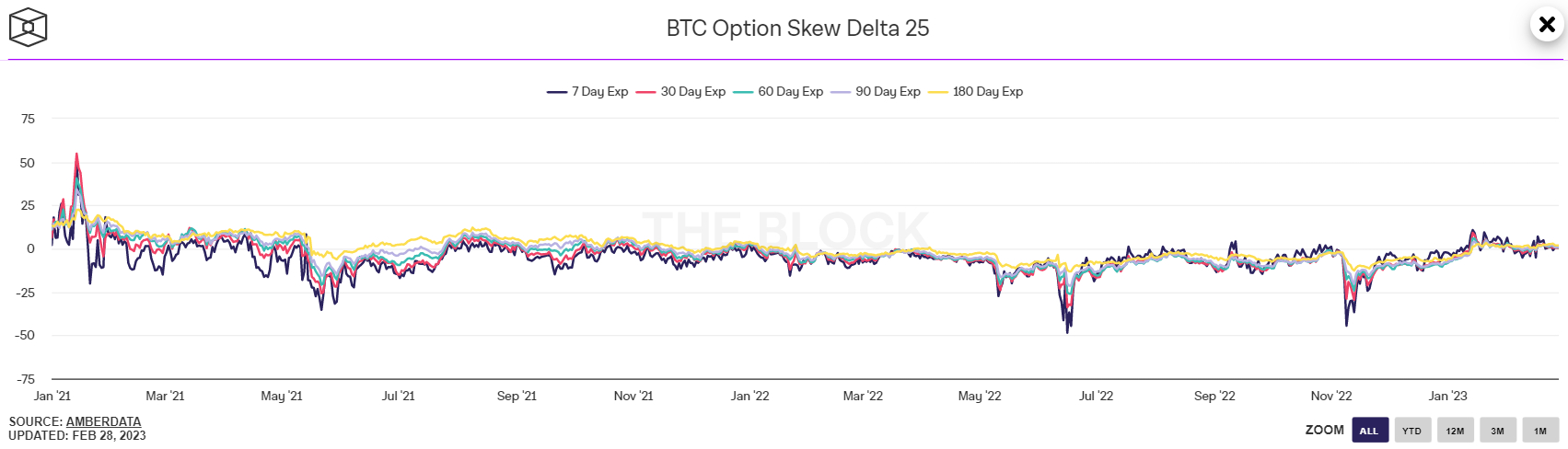

However, the Bitcoin 25% Delta Skew for options expiring in 7, 30, 60, 90 and 180 days is negligable, implying an unbiased positioning bias. The 25% delta options skew is really a popularly monitored proxy for that degree that buying and selling desks are gone or undercharging for upside or downside protection through the put and call options they’re supplying investors.

Put options give a trader the best although not the duty to market a good thing in a predetermined cost, while a phone call option gives a trader the best although not the duty to purchase a good thing in a predetermined cost. A 25% delta options skew above shows that desks are charging more for equivalent call options versus puts. This means there’s greater interest in calls versus puts, which may be construed like a bullish sign as investors tend to be more wanting to secure protection against (or bet on) a boost in prices.