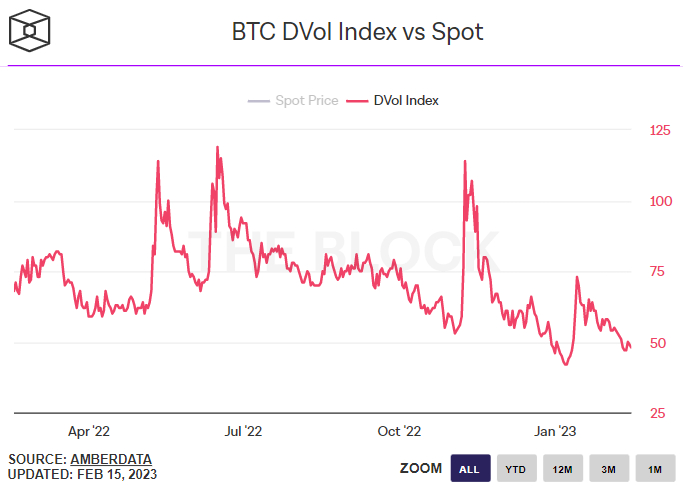

In wake of Tuesday’s US Consumer Cost Index (CPI) data, which confirmed an anticipated begin Mother cost pressures and revealed a smaller sized-than-expected loss of the YoY rate of inflation, Deribit’s Bitcoin Volatility Index (BTC DVol) surprised some analysts by remaining broadly unchanged. The possible lack of movement within the BTC DVol, that was last at 48 on Wednesday versus 50 on Monday and stays a little way above record lows, matches the publish-CPI mood observed in the Bitcoin market.

Bitcoin, last altering hands around $22,800, has rallied about $1,000 or 4.5% from the pre-US CPI data levels on Tuesday and it is up around 4.7% around the week. That’s despite Tuesday’s CPI data and more powerful-than-expected US Retail Sales data on Wednesday mixing to push US 2-year yields around 10 bps to date now, and also the US Dollar Index (DXY) up around .5%.

The move’s in US bond and foreign currency markets reflect markets upping their US Fed tightening bets. Based on the CME’s Given Watch Tool, the chances from the Given raising rates of interest by a minimum of 75 bps (to a minimum of a 5.25-5.50% target range) are actually seen at above 50%, as implied by 30-Day Given Funds futures prices data. That’s up from your implied possibility of only around 6.% this time around recently.

Bitcoin’s Surprising Resilience

Given moves across bond and foreign currency markets, many analysts are shocked at Bitcoin’s resilience. Greater yields typically weigh on Bitcoin as 1) Bitcoin is really a non-yielding asset, therefore the so-known as “opportunity cost” of holding it increases as short-term US rates of interest rise and a pair of) greater yields upon us bonds, a good thing that’s considered risk-free, lessens the incentive to carry assets which are considered dangerous, like Bitcoin, which many view like a new, speculative financial technology.

Meanwhile, when greater short-term yields are now being driven by anticipation of tighter Given policy, then that may also be construed as greater perils of less strong US growth/an economic depression, as greater rates of interest weigh on business activities. Less strong growth expectations can usually be assumed to harm risk-sensitive assets like stocks and crypto.

But Bitcoin is nevertheless still possessing the lion’s share of 2023’s rally. The cryptocurrency still trades up around 38% this season versus 47% when at its early Feb highs around $24,000. And, as already noted, options financial markets are not pointing to stormy waters ahead. On the other hand, the BTC DVol only has printed at current or ‘abnormal’ amounts 11 occasions in Bitcoin’s history, suggesting investors are situated to have an incoming duration of historic cost calm.

What This Signifies For that BTC Cost

If options financial markets are right, Bitcoin will probably remain rangebound within the coming days and several weeks. Analysis of major support and resistance levels shows that Bitcoin could remain marooned inside a $20,000-$25,000 range. The $20,000 level is essential due to its mental significance and the existence of Bitcoin’s 200-Day Moving Average and Recognized Cost just beneath it. The $25,000 level, meanwhile, is a vital degree of support-switched-resistance from 2022.

For Bitcoin to stay rangebound within the coming several weeks is sensible when thinking about macro, on-chain and network fundamentals. Around the one hands, quarrelling for any continuation of January’s ferocious rally along with a surge to fresh all-time highs for the short term is impractical poor a Given that continues to be set on hiking rates of interest a minimum of a couple of more occasions to tame US cost pressures.

However, various metrics still signal the inexorable development of the Bitcoin network – mining hash power and non-zero balance wallet addresses both lately hit all-time highs. Meanwhile, various on-chain indicators will also be signaling the bear market of 2022 seems to become over. Just like a rally towards all-time highs feels unlikely, an outbreak under 2022’s lows also feels improbable.