Bitcoin (BTC) whales are again accumulating BTC, with increasingly more traders now thinking about what these whales realize that average folks don’t.

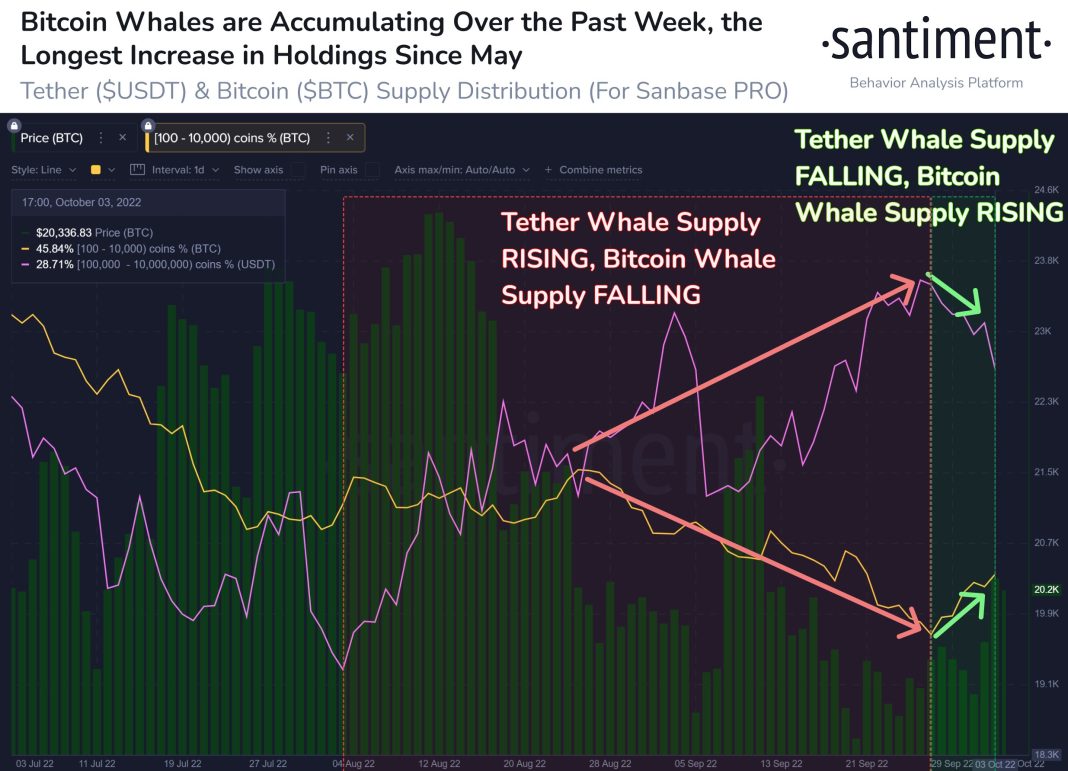

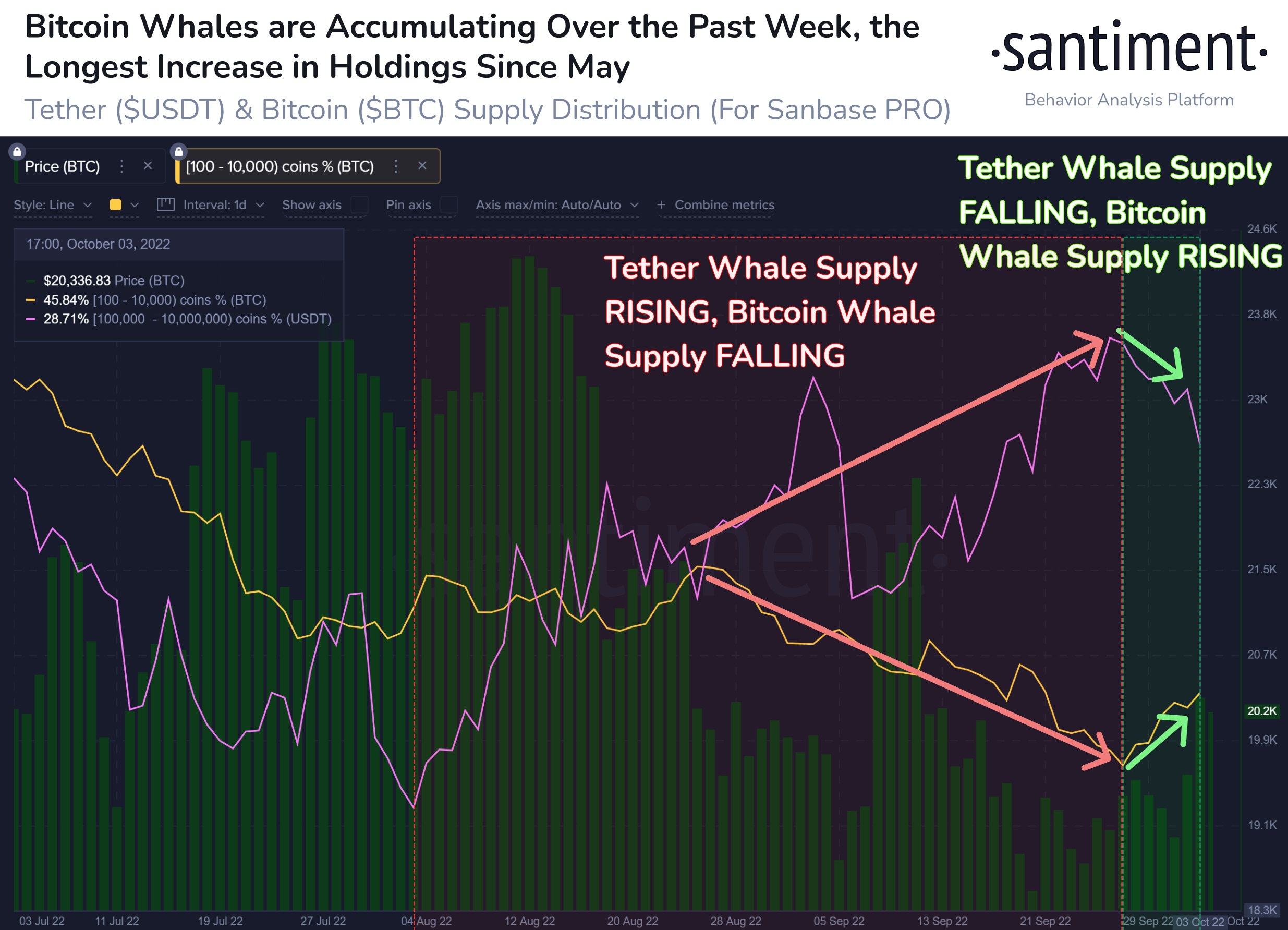

Based on data in the crypto analytics platform Santiment, the so-known as Bitcoin whales, understood to be wallet addresses holding between 100 BTC and 10,000 BTC, have added as many as 46,173 BTC for their holdings since September 27.

Inside a tweet printed the 2009 week, Santiment known as the rise a “sustained accumulation” by whales and noted this continues to be “a rarity in 2022.” The firm added that the rise in BTC holdings originates as large holdings from the stablecoin Tether (USDT) have dropped.

The finding signifies that a few of the largest players within the Bitcoin ecosystem are utilizing stablecoins to increase their BTC holdings. This implies that any cost rallies observed in recent days have probably been stablecoin-driven, without support from the significant degree of fiat inflows.

It’s broadly supported the crypto community that giant inflows of fiat currency into Bitcoin along with other cryptocurrencies is essential for any new bull sell to establish itself inside a sustainable way.

Still, it shouldn’t be an unexpected that whales are some of the first to put themselves for potential future rallies within the Bitcoin cost. Consequently, the career seen previously couple of days might be a sign the wealthiest Bitcoin holders are actually betting that macroeconomic conditions will improve moving forward which this can ultimately help BTC move greater.

Meanwhile, this news that whales are actually accumulating BTC uses Santiment at the end of September reported that whale holdings of Bitcoin had dropped towards the cheapest level in 29 several weeks, creating only 45.72% from the circulating BTC supply.

Inside a tweet at that time, the firm attributed the autumn in whale investment interest to “fears of inflation along with a world recession […].”