Bitcoin (BTC) drifted near $21,000 around the August. 22 Wall Street open because the new week started with no rebound.

European commodity surge hammers euro

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD neglecting to summon a comeback after last week’s 11.6% losses.

The happy couple place in fresh multi-week lows under $20,800 over the past weekend, subsequently staging a modest relief bounce to circle $21,200 during the time of writing.

Anxiousness over European markets and also the approaching U . s . States Fed Jackson Hole symposium led to a downbeat mood on risk assets. The S&P 500 lost 1.8% within two hrs of opening, as the Nasdaq Composite Index shed 2.2%.

In Europe, gas and electricity prices surged again over fears that supplies from Russia might be throttled harder and earlier than expected.

OOPS! German benchmark electricity cost leaped >25% on Monday to pass through €700 per megawatt-hour the very first time. The amount is all about 14 occasions the periodic average in the last 5 years. pic.twitter.com/gMQZkk7ncB

— Holger Zschaepitz (@Schuldensuehner) August 22, 2022

Consequently, the euro fell below parity using the U.S. dollar the very first time since This summer.

“The finish of summer time sees the euro back pressurized, partially since the dollar is bid and partially since the Damoclean sword hanging within the European economy isn’t disappearing,” Package Juckes, an overseas exchange strategist at Societe Generale, authored inside a note quoted by Bloomberg.

As Cointelegraph reported, the euro had been facing multiple headwinds, with inflation within the Eurozone still climbing in This summer as opposed to the U . s . States.

Below 200-week moving average “harmful to bulls”

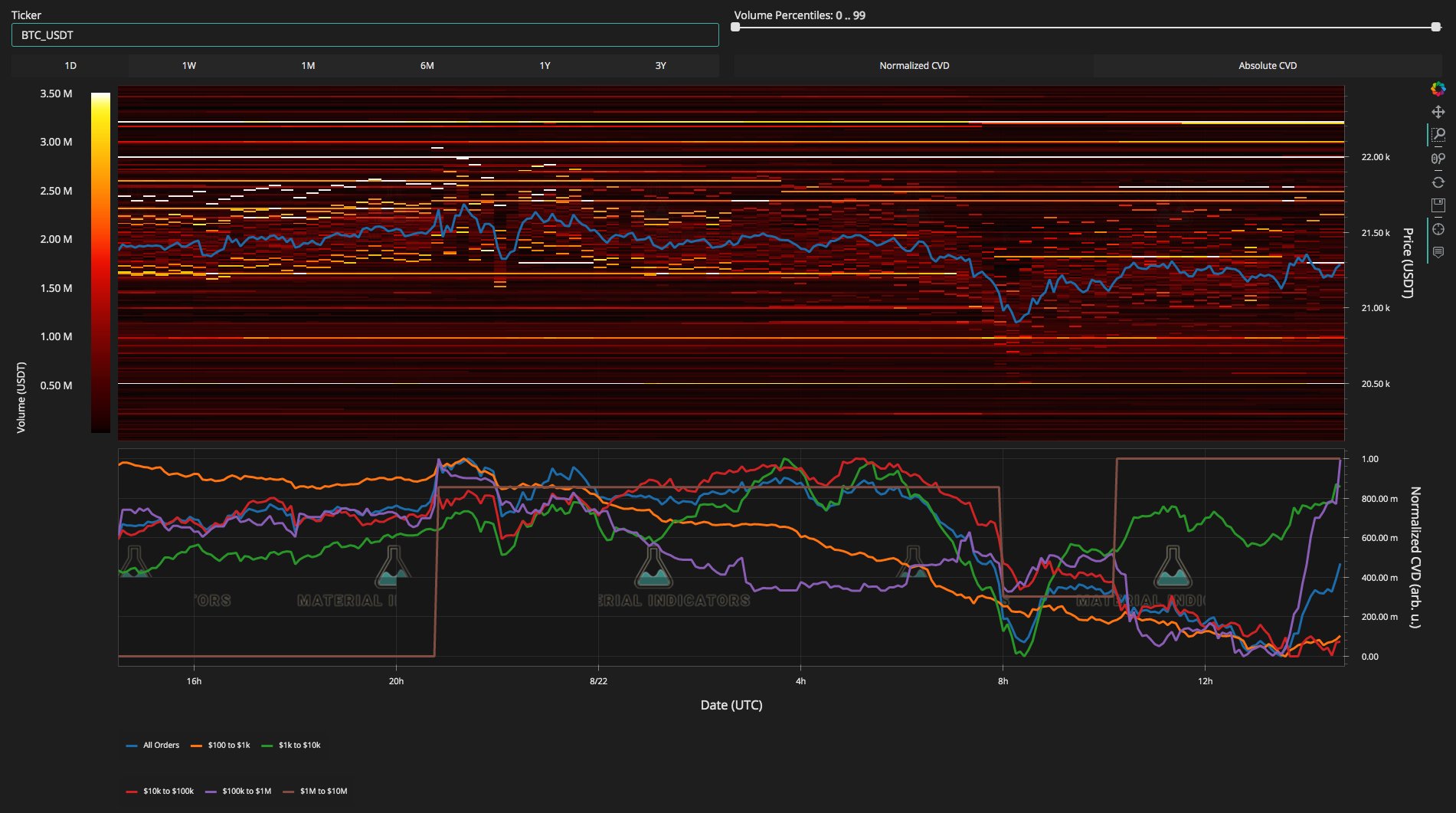

Analyzing the problem, on-chain analytics resource Material Indicators nevertheless were built with a silver lining for traders on shorter timeframes.

Related: BTC to get rid of $21K despite miners’ capitulation exit? 5 items to know in Bitcoin now

The weekend dip had still seen the marketplace preserve lows from This summer, it noted, and therefore the 2022 “bear market rally,” which in fact had taken BTC/USD above $25,000, could still create a return.

Nevertheless, as lengthy as Bitcoin traded below its critical 200-week moving average (WMA) near $23,000, the problem favored bears.

Protecting the LL means the Bear Market Rally could get back momentum when we find some good economic data now, but phone #BTC weekly chart shows signs that any potential rally is going to be short resided. Losing the 200 WMA isn’t good for bulls. If 50 and 100 WMAs mix it’s worse. pic.twitter.com/j19Vp7SkiS

— Material Indicators (@MI_Algos) August 22, 2022

An additional publish demonstrated data in the order book of major exchange Binance, with a few of the largest-volume whales trying to obvious a sell wall immediately above place cost.

Adopting a likewise upbeat take on the lengthy term, trader and analyst Rekt Capital meanwhile contended that purchasing BTC below $35,000 still symbolized a “bargain.”

The region around that cost level represents a zone of major exchange volume, the one that will figure like a major hurdle should place cost action mind greater.

In 2015, #BTC bottomed 547 days prior to the Halving

In 2018, $BTC bottomed 517 days prior to the Halving (discount March 2020 crash)

If Bitcoin will bottom 517-547 days prior to the approaching April 2024 Halving…

Then your bottom will exist in Q4 this season#Crypto #Bitcoin

— Rekt Capital (@rektcapital) August 22, 2022

Additional research from Rekt Capital nevertheless predicted a macro cycle low arriving Q4 if BTC/USD would repeat the timing of previous macro lows from 2015 and 2018.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.