Regardless of the rally in Bitcoin which has seen prices jump around 27% since the beginning of the entire year, on-chain data shows that Bitcoin whales aren’t while using pump being an chance to market their holdings. Based on some analysts this can be a manifestation of confidence the recent rally signal the beginning of an extended-lasting bull market.

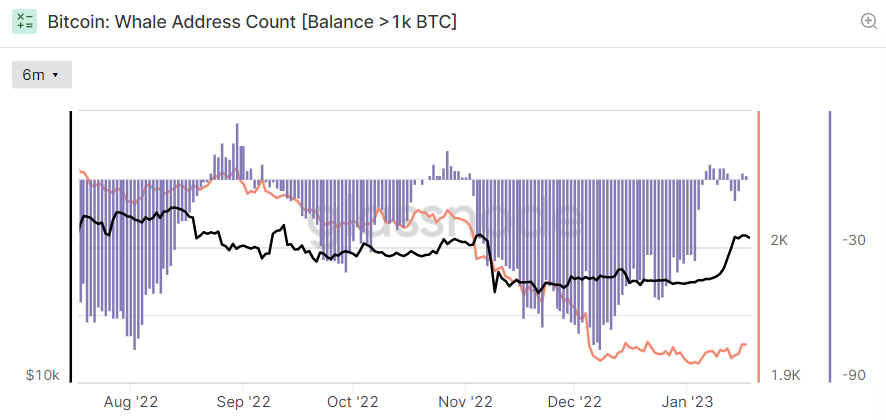

Based on data from crypto analytics firm Glassnode, the amount of Bitcoin addresses holding between 1,000 to 10,000 Bitcoins (approximately-known as whale addresses) has continued to be broadly steady just above 1,900 since the beginning of December. Shark bitcoin addresses, which hold anything between 100 to at least one,000 Bitcoins, also have held steady in number in recent days. Based on Glassnode, there is last around 14,000 of these.

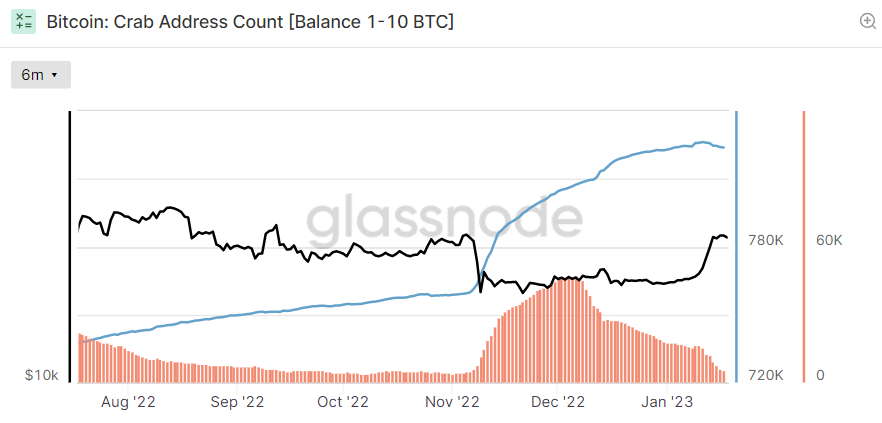

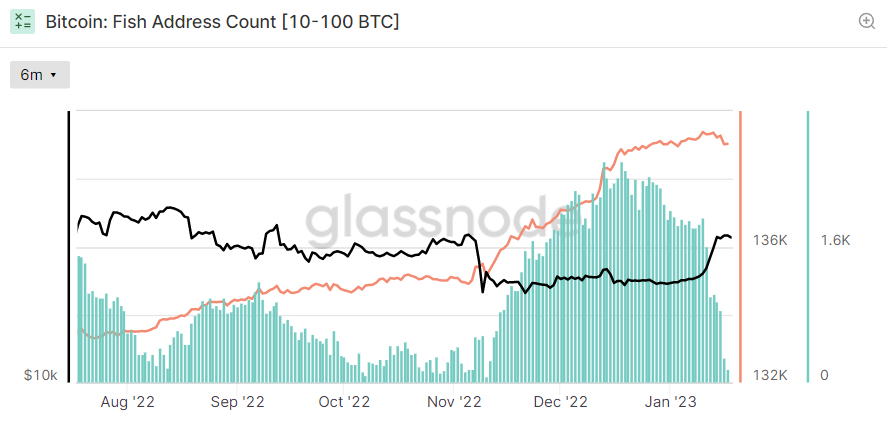

The Fish and Crabs Happen To Be Accumulating

Bitcoin bulls is going to be very happy to realize that two important address cohorts have ongoing to amass the world’s largest cryptocurrency by market capital in recent days and also at an faster pace because the collapse of FTX at the begining of November. Based on Glassnode, the amount of Crab Bitcoin address (which hold 1-10 Bitcoins) had risen from under 760,000 before the FTX collapse to shut to 830,000 by a week ago.

Over the same time frame period, the amount of Fish addresses (which hold 10-100 Bitcoins) has leaped from around 135,000 to shut to 140,000, near its record high.

This means that medium to large sized Bitcoin investors 1) used the stop by cost triggered through the collapse of FTX like a dip buying chance and a pair of) aren’t selling their holdings as prices recover to their pre-FTX implosion level.

Small Investors Yet to Pile In

Large and mega sized Bitcoin investors are clearly proven solid indications of 1) attempting to purchase the dip and a pair of) hesitant to sell in to the rally in recent days and several weeks. However the Bitcoin bulls shouldn’t get too excited at this time.

That’s because we’re yet to determine an acceleration within the development of new Shrimp addresses (holding under 1 Bitcoin) that typically occurs during bull markets. Indeed, based on Glassnode data, the amount of Shrimp addresses has flatlined around 42 million within the last couple of days, after having a short-resided bump to almost 43 million within the immediate aftermath from the FTX collapse.

If the number begins to quickly rise, as happened duration of rapid Bitcoin cost gain, for example during 2019 and late 2020 to early 2021, that will signal that smaller sized retail investors are once more getting involved, which will be a bullish sign.