Bitcoin (BTC) will get over the FTX “black swan event” much like other setbacks, buying and selling team Stockmoney Lizards believes.

Inside a tweet on November. 12, the most popular commentator contended the week’s occasions were really not new for Bitcoin.

FTX “a genuine black swan event”

Despite falling 25% in days, BTC/USD isn’t condemned because of the insolvencies impacting FTX, Alameda Research and perhaps other major crypto companies.

For Stockmoney Lizards, the unravelling, while sudden, isn’t hugely dissimilar to liquidity crises from earlier in Bitcoin’s history.

“We have indeed seen a genuine black swan event, the FTX personal bankruptcy,” it stated.

“The good reputation for BTC has such occasions and also the market will get over it as being it did previously.”

An associated chart flagged similar “black swan” moments in the past, stretching to the Mt. Gox hack in 2014.

Two other notable occasions were the hack of exchange Bitfinex in 2016 and also the March 2020 COVID-19 mix-market crash.

As Cointelegraph reported, ex-FTX executive Zane Tackett even provided to copy Bitfinex’s liquidity recovery plan from the moment of their $70 million loss by developing a token. FTX subsequently filed for Chapter 11 personal bankruptcy within the U . s . States.

Reactions have incorporated frank appraisals from the crypto industry, with Filbfilb, co-founding father of buying and selling suite Decentrader, forecasting a multi-year process of recovery.

Changpeng Zhao, Chief executive officer of Binance, which at some point planned to purchase FTX, has cautioned the industry continues to be “challenge a couple of years.”

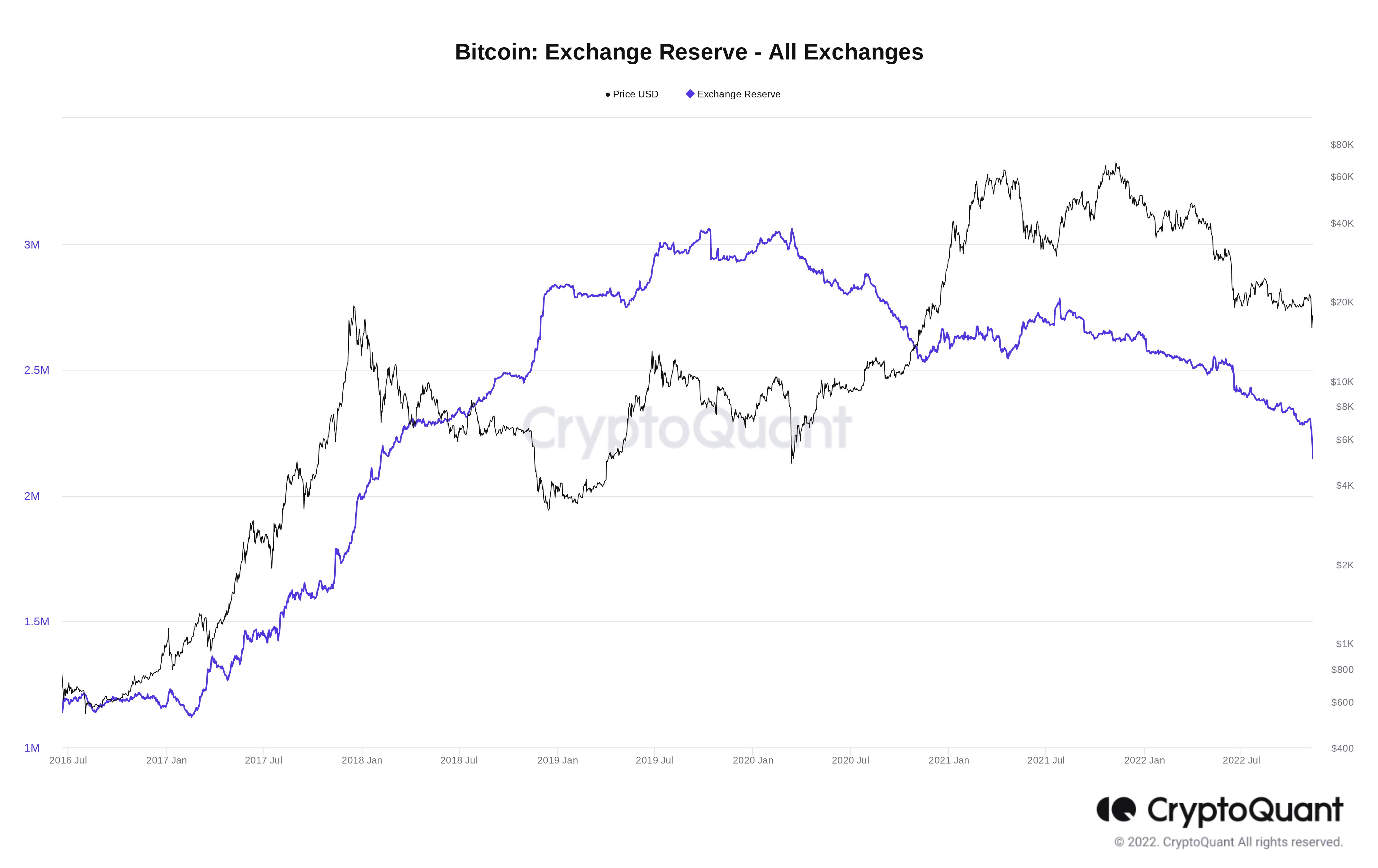

Exchange BT reserves near five-year low

Meanwhile, losing user confidence has already been turning up in declining exchange balances.

Related: Hodlers in loss take a seat on 50% of BTC supply after $5.7K Bitcoin cost dip

Based on data from on-chain analytics platform CryptoQuant, the BTC balance of major exchanges has become at its cheapest since Feb 2018.

The platforms tracked by CryptoQuant finished November. 9 and 10 lower 35,000 and 26,000 BTC, correspondingly. Both days were multi-month records, nevertheless not surpassing the only-day tally from Jun. 17 — 67,600 BTC.

Exchange outflows continue being monitored by industry analysts, included in this CryptoQuant contributor, Maartunn.

More broadly, voices happen to be contacting social networking users to withdraw funds from custodial wallets.

“Bitcoin exchanges are operated by individuals who learned fiat finance,” Saifedean Ammous, author from the popular book, “The Bitcoin Standard,” authored partly of the Twitter publish.

“Gambling with depositors’ cash is normal & healthy on their behalf, because within the fiat system the central bank destroys the currency to bail them out each time it is going wrong.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.