Bitcoin (BTC) hovered above $16,000 around the November. 28 Wall Street open as analysts diverged on what to anticipate in the next market move.

Bitcoin place cost near key support

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD maintaining the $16,000 support level during the time of writing among misgivings over China’s effect on risk assets.

Following a modestly greater weekly close, the happy couple still lacked volatility as you commentator cautioned of the “teleport” toward $12,000 should $16,000 break.

“When it breaks below 16k, it teleports to 12k-14k,” Il Capo of Crypto was adamant.

Popular Twitter account Credible Crypto requested in which the volatility choose to go, while Crypto Tony likewise identified $16,000 like a line within the sand for their own buying and selling strategy.

“Finally some movement .. Stop-loss firmly remains at $16,000, and can close if hit to check out shorts when we start to shut underneath the support zone and switch into resistance,” a part of a tweet read at the time.

Fellow trader Pentoshi meanwhile centered on macro triggers as Chinese protests within the country’s COVID-19 containment strategies considered on sentiment.

The S&P 500, he predicted, was due a rejection next, setting a dark tone for any lengthy-term downtrend to carry on.

$19,500 turn into the brand new BTC cost ceiling

Others came focus on the approaching monthly close among too little catalysts elsewhere at the beginning of a few days.

Related: New BTC miner capitulation? 5 items to know in Bitcoin now

Beyond an origin of potential volatility, trader and analyst Rekt Capital noted that Bitcoin’s monthly closing cost would determine its longer-term cost range.

“When BTC lost the ~$19500 level as support… It broke lower in to the ~$13900-$19500 Monthly Range,” he described at the time.

“Monthly Candle Close is on its way soon. A Regular Monthly Close below ~$19500 may likely read the ~$13900-$19500 Range since it’s new playground.”

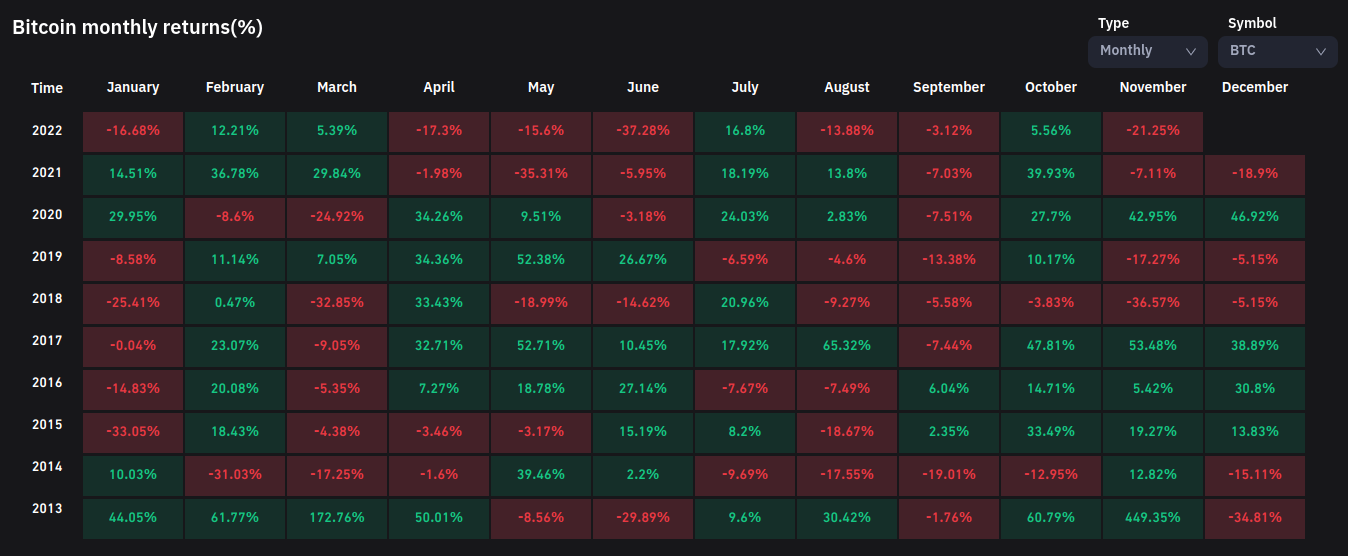

BTC/USD was lower around 21% for that month of November during the time of writing, marking its worst November performance since its last bear market year in 2018.

Cointelegraph formerly outlined potential bottom targets for that pair, included in this individuals according to performance during previous bear markets.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.