Bitcoin (BTC) bears will be in control since November. 11, subduing BTC cost below $17,000 on every 12-hour candle. On November. 28, a drop to $16,000 shattered bulls’ hope the 7% gains between November. 21 and November. 24 were enough to mark a cycle low at $15,500.

Probably the most likely offender was an unpredicted change in 127,000 BTC from the Binance cold wallet on November. 28. The large Bitcoin transaction immediately triggered fear, uncertainty and doubt, however the Binance Chief executive officer, Changpeng Zhao, subsequently announced it had been a part of an auditing process.

Regulatory pressure has additionally been restricting BTC’s upside after reports on November. 25 demonstrated that cryptocurrency finance company Genesis Global Capital along with other crypto firms were under analysis by securities regulators within the U . s . States. Frederick Borg, director from the Alabama Securities Commission, confirmed that it is condition and many other states are investigating Genesis’ alleged ties to securities laws and regulations breach.

On November. 16, Genesis announced it’d temporarily suspended withdrawals, citing “unparalleled market turmoil.” Genesis also hired restructuring advisors to understand more about all possible options, including although not restricted to a possible personal bankruptcy, reported by Cointelegraph on November. 23.

Let us take a look at derivatives metrics to higher know how professional traders are situated in the present market conditions.

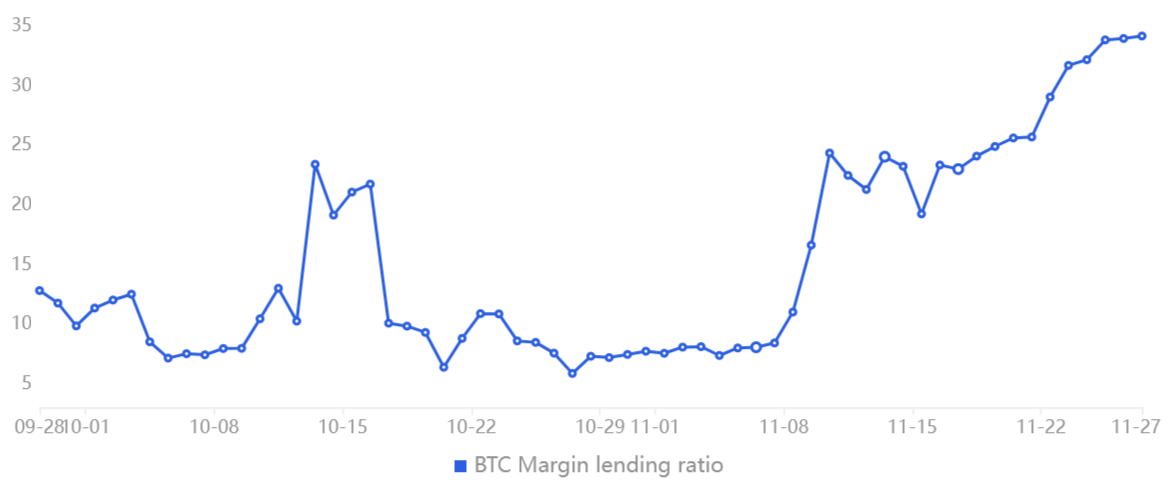

Margin markets show leverage longs in a 3-month high

Margin markets provide understanding of how professional traders are situated since it enables investors to gain access to cryptocurrency to leverage their positions.

For example, it’s possible to increase exposure by borrowing stablecoins to purchase Bitcoin. However, Bitcoin borrowers are only able to short the cryptocurrency because they bet on its cost declining. Unlike futures contracts, the total amount between margin longs and shorts is not always matched.

The above mentioned chart implies that OKX traders’ margin lending ratio elevated from November. 20 to November. 27, signaling that professional traders elevated their leverage longs throughout the 6% dip toward $15,500. Presently at 34, the metric favors stablecoin borrowing with a wide margin — the greatest in three several weeks — indicating traders have stored their bullish positions.

Leverage buyers overlooked the current dip to $15,500

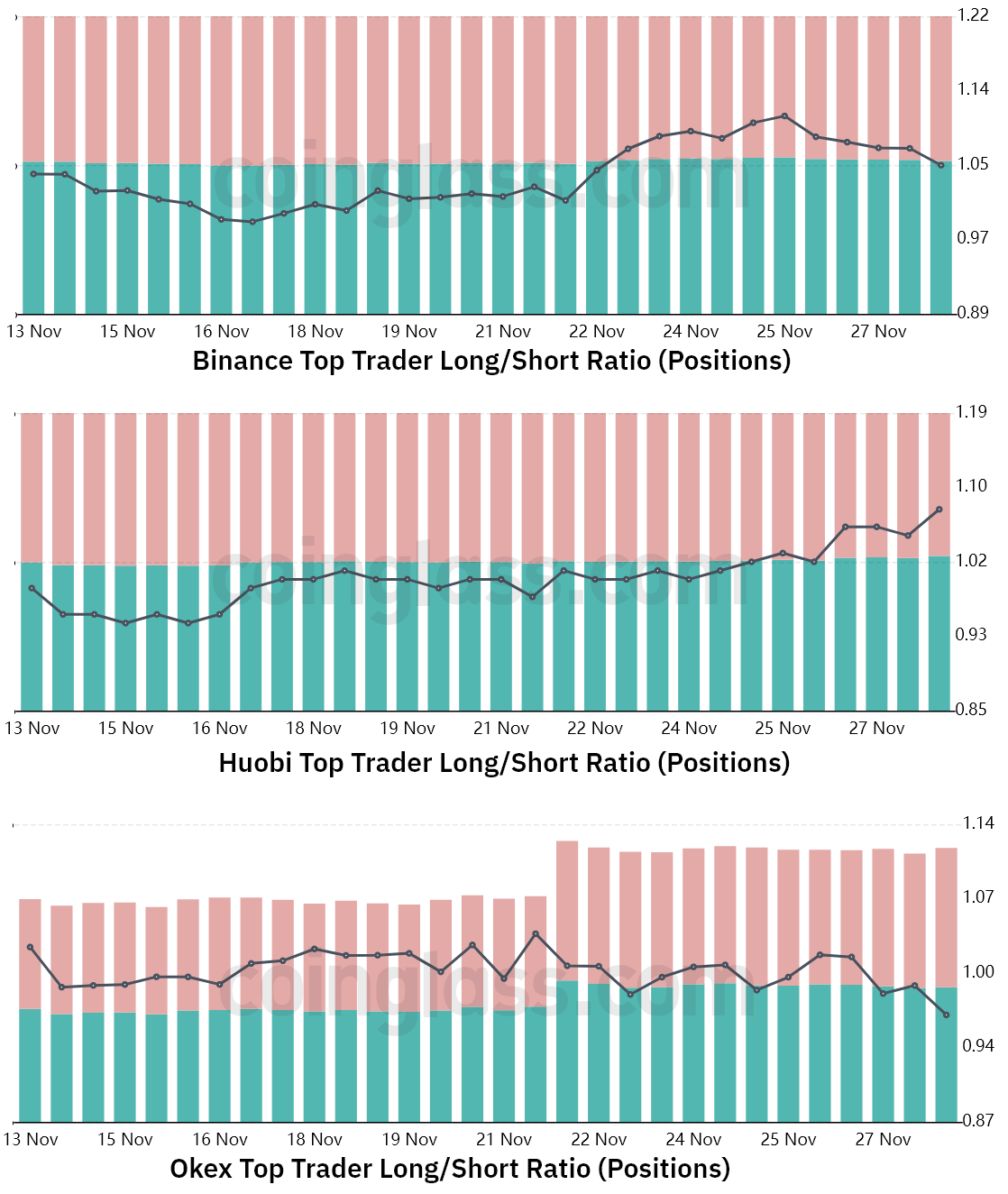

The lengthy-to-short metric excludes externalities that may have exclusively impacted the margin markets. Additionally, it gathers data from exchange clients’ positions around the place, perpetual and quarterly futures contracts, thus offering better information about how professional traders are situated.

You will find periodic methodological discrepancies between different exchanges, so readers should monitor changes rather of absolute figures.

Despite the fact that Bitcoin unsuccessful to interrupt over the $16,700 resistance, professional traders have stored their leverage lengthy positions, based on the lengthy-to-short indicator.

For example, the ratio for Binance traders improved somewhat from 1.00 on November. 21, but ended the time at 1.05. Meanwhile, Huobi displayed an increased rise in its lengthy-to-short ratio, using the indicator moving from 1.01 to at least one.08 within the 7 days until November. 28.

At crypto exchange OKX, the metric slightly decreased from .99 on November. 21 to .96 on November. 28. Consequently, typically, traders are confident enough to help keep adding leverage to bullish positions.

Related: US House committee sets 12 ,. 13 date for FTX hearing

The $16,200 support demonstrated strength, suggesting that traders are turning bullish

Both of these derivatives metrics — margin and top trader’s lengthy-to-short — claim that size leverage sellers didn’t back the Bitcoin cost correction to $16,000 on November. 28.

A bearish sentiment might have caused the margin lending ratio to visit below 15, pushing the lengthy-to-short ratio reduced. You should observe that even pro traders can misinterpret the marketplace, however the present studying in the derivatives market favors a powerful $16,000 support.

Still, whether or not the cost revisits $15,500, bulls shouldn’t be concerned because the derivatives indicators withheld neutral-to-bullish on November. 21 and additional improved throughout the week.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.