The positive correlation between your Bitcoin cost and US stock values, which arrived at an archive full of 2022, is fading. The Bitcoin bulls is going to be wishing this decoupling bodes well for Bitcoin, trained with might imply that the united states stock market’s ongoing struggles may be becoming a lesser headwind for that world’s largest cryptocurrency.

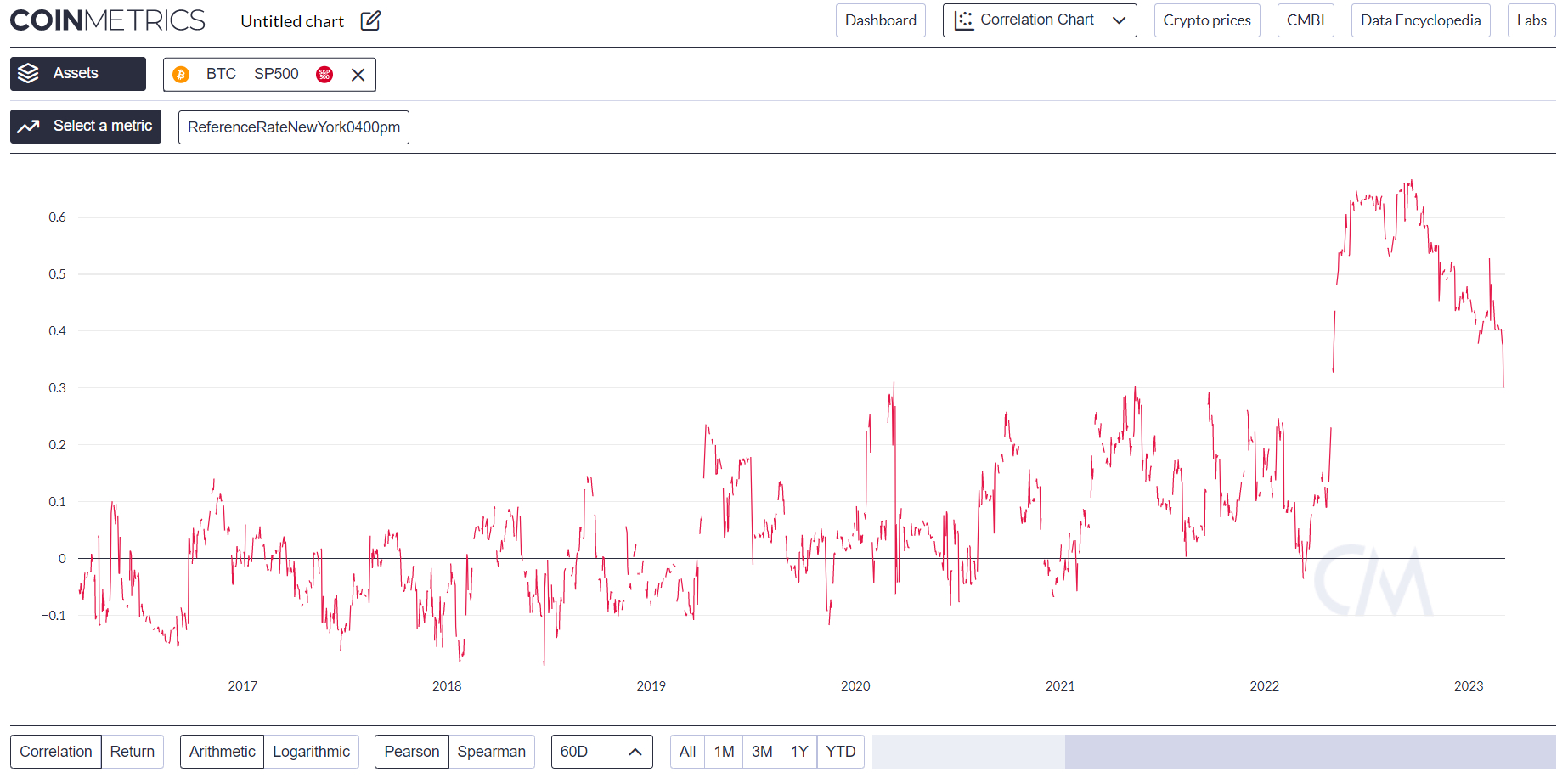

Based on a chart presented by CoinMetrics, the 60-day Pearson correlation between your BTC cost and also the closing cost from the S&P 500, probably the most broadly adopted US equity market benchmark, fell to the cheapest level since April 2022 at .30 the 2009 week.

The correlation had hit an exciting-time a lot of .667 in September 2022, after rising dramatically earlier around as crypto and equity prices cratered in symphony among concerns in regards to a more powerful-than-expected get in US inflationary pressures and also the resultant tightening response in the US Fed.

The autumn within the correlation backward and forward asset classes is available in wake of crypto’s impressive rally since the beginning of the entire year. Bitcoin was last up around 35% around the year, as the S&P 500 expires an even more modest 4.%.

Could a lesser Correlation to Stocks Mean the Bear Marketplace is Over?

Bitcoin’s elevated correlation to all of us equity markets within the latter 1 / 2 of 2022 would be a obvious feature from the ongoing bear market that, through the lows in November, saw BTC pull around 77% lower from the 2021 record highs at $69,000.

Just before then, the 60-day Pearson correlation between Bitcoin and also the S&P 500 had only been up to .3 on the couple of occasions, and would frequently fall below zero. The couple of years prior to 2022 when Bitcoin’s correlation to all of us stocks was much less strong were characterised by significant cost gains.

Bitcoin acquired over 2,000% from the 2018 lows just above $3,000 to the 2021 record highs. Bulls is going to be wishing that the lower correlation between Bitcoin and stocks, as was the situation within the late-2018 to late-2021 period, winds up as being a feature of the approaching bull market.

Equity investors fear the Fed’s aggressive efforts to stymie US inflation, that is presently remaining stickier than expected using the US economy outperforming expectations, can lead to a much deeper corporate earnings recession later around, dealing an additional blow to stock valuations which have already taken a blow in the greater risk-free interest rate (i.e. greater Government bond yields).

That is why no one is betting on the near-term boost in US stock values back towards record highs. However a less strong correlation might allow Bitcoin to rally this season, despite ongoing pessimism concerning the outlook for all of us equities. However, the pullback within the BTC cost from the recent above $25,000 highs has led to some on-chain indicators associated with Bitcoin market profitability delivering a less bullish signal around the outlook for that world’s largest cryptocurrency by market cap. Some fear that Bitcoin might be headed back below $20,000 soon.