The Bitcoin (BTC) chart has created a symmetrical triangular, which presently holds a good vary from $28,900 to $30,900. This pattern continues to be holding for pretty much two days and may potentially extend for an additional two days before cost constitutes a more decisive movement.

For individuals not really acquainted with technical analysis, a symmetrical triangular could be either bullish or bearish. For the reason that sense, the cost converges in a number of lower peaks and greater lows. The decisive moment may be the support or resistance breakthrough once the market finally establishes a brand new trend. Thus, the cost could bust out either in direction.

Based on Bitcoin derivatives data, investors are prices greater likelihood of a downturn, but recent enhancements in global economic perspective usually takes the bears unexpectedly.

The macro scenario has improved and BTC miners are remaining busy

Based on Cointelegraph, macroeconomic conditions driven through the U . s . States helped drive crypto markets greater on May 23. Prior to the market opened up, U . s . States President Joe Biden announced intends to cut trade tariffs with China, boosting investors’ morale.

Based on the latest estimates, Bitcoin’s network difficulty will reduce by 3.3% at its next automated readjustment now. The modification would be the largest downward shift since This summer 2021 and it is obvious that Bitcoin’s downtrend has challenged miners’ profitability.

Still, miners aren’t showing indications of capitulation even while their wallets’ movements to exchanges hit a 30-day have less May 23, based on on-chain analytics platform Glassnode.

While miners’ sentiment and flows are essential, traders also needs to track how whales and market markers are situated within the futures and options markets.

Bitcoin derivatives metrics are neutral-to-bearish

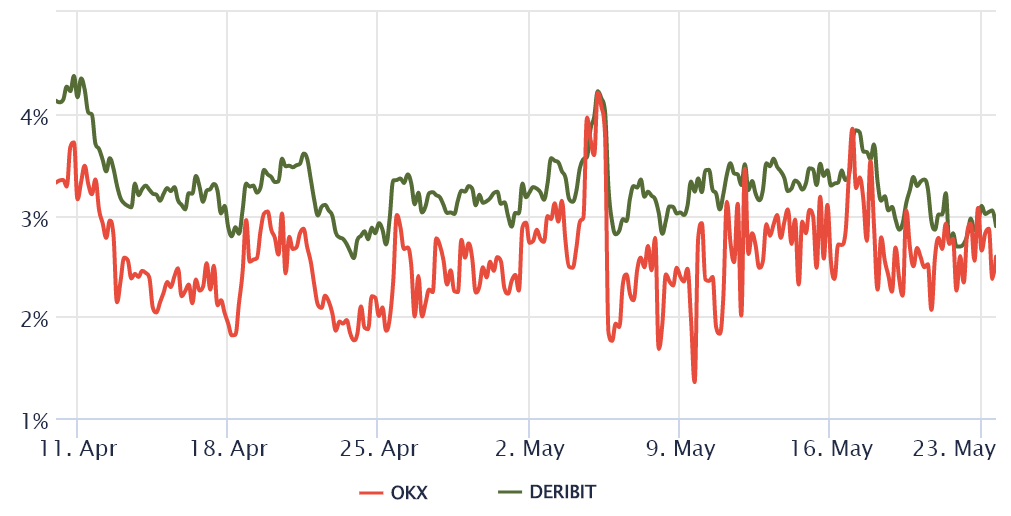

Retail traders usually avoid quarterly futures because of their fixed settlement date and cost difference from place markets. However, the contracts’ greatest advantage is the possible lack of a fluctuating funding rate hence, the prevalence of arbitrage desks and professional traders.

These fixed-month contracts usually trade in a slight premium to place markets because sellers are requesting more income to withhold settlement longer. This case is famous technically as “contango” and isn’t only at crypto markets. Thus, futures should trade in a 5% to fifteenPercent annualized premium in healthy markets.

Based on the above data, Bitcoin’s basis indicator continues to be below 4% since April 12. This studying is normal of bearish markets, but the truth that it’s not deteriorated following the sell-off lower to $25,400 on May 12 is encouraging.

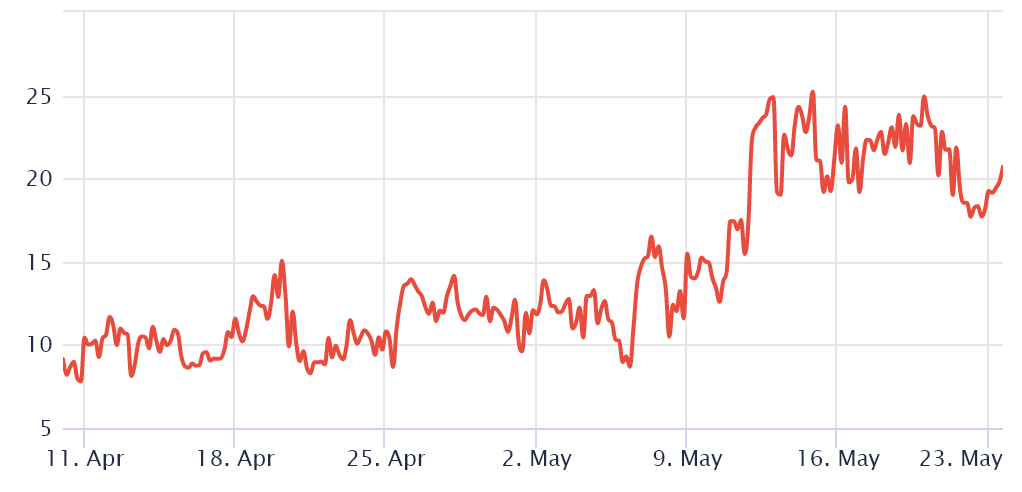

To exclude externalities specific towards the futures instrument, traders also need to evaluate Bitcoin options markets. The 25% delta skew is very helpful since it shows when Bitcoin arbitrage desks and market makers are overcharging for upside or downside protection.

If option investors fear a Bitcoin cost crash, the skew indicator will move above 12%. However, generalized excitement reflects an adverse 12% skew.

The skew indicator moved above 12% on May 9, entering the “fear” level as options traders overcharged for downside protection. Furthermore, the current 25.4% was the worst studying ever registered for that metric.

Related: Bitcoin targets record eighth weekly red candle while BTC cost limits weekend losses

Be brave when the majority are fearful

In a nutshell, BTC options financial markets are still stressed which shows that professional traders aren’t positive about taking downside risk. Bitcoin’s futures premium continues to be somewhat resilient, however the indicator shows too little interest from leveraged lengthy buyers.

Going for a bullish bet might appear contrarian at this time, but simultaneously, an unpredicted cost pump would take professional traders unexpectedly. Therefore, it makes a fascinating risk-reward situation for Bitcoin bulls.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision