Bitcoin (BTC) still risks a drop to below $7,000 within this bear market, the most recent worst-situation scenario conjecture warns.

In the latest livestream broadcasted on November. 24, buying and selling platform DecenTrader revealed targets for any BTC cost bottom.

Analyst flags “oldschool, rock-hard support” for Bitc

The newest in a number of BTC/USD forecasts, Decentrader co-founder Filbfilb mapped out a potential sub-$10,000 dip around the cards for that pair.

“In my worst situation scenario, I believe that might be most likely where we finish up, like oldschool, rock-hard support,” he stated in regards to a putting in a bid zone around $6,500.

This is when buyers would “probably start refilling their bags,” he added, noting that that much cla was roughly double the amount 2018 bear market and March 2020 COVID-19 crash lows.

While “unlikely” under current conditions, Filbfilb nevertheless contended more significant repercussions in the FTX implosion could remove bid support greater in the order book, opening the doorway for this type of capitulation event.

“Until we’ve more information, that appears unlikely, so that as I only say, I believe the truth that we haven’t dumped harder than we really really might have done is a great sign for that bulls,” he ongoing.

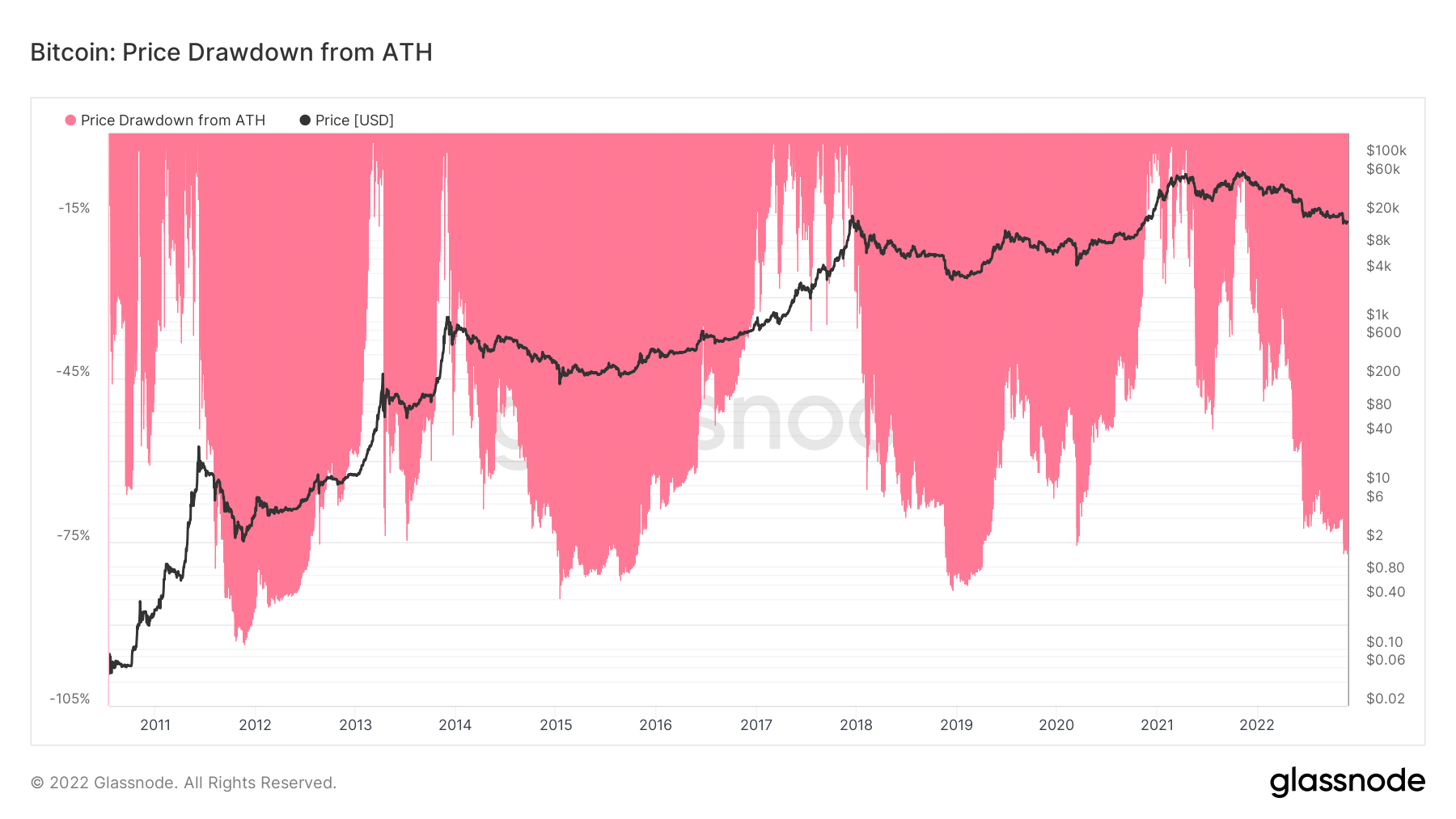

Given recent occasions, as Cointelegraph reported, BTC/USD has, actually, were able to dip less in contrast to its previous all-time highs than during previous bear markets.

An connected debate involves whether a much deeper dive is essential to complement individuals bottoms and set an finish to the present downtrend.

Filbfilb commented that for Bitcoin to set up a bottom while staying away from the worst situation scenario, crypto will have to “dodge some bullets” regarding FTX fallout, and macro markets would should also stay strong.

BTC cost navigates bear market pits

Elsewhere within the livestream, Decentrader co-founder Philip Quick, even the creator of information resource LookIntoBitcoin, described other recent chart phenomena.

Related: Will Bitcoin hit $110K in 2023? three reasons to become bullish on BTC now

Included in this was the growing quantity of Bitcoin wallets that now contain a minimum of 1 BTC, the tally soon set to mix a million the very first time.

This really is a result of exchange withdrawals considering FTX, Quick stated.

Although 18 several weeks ahead, the following Bitcoin block subsidy halving event in 2024 may also be a major narrative focus moving forward, he added.

That will also have “some positive impact on cost when it comes to attention and anticipation of this next halving event.”

A comparative chart demonstrated BTC/USD presently dealing with the cheapest a part of its four-year cycle, showing a powerful correlation between 2014 and 2018.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.