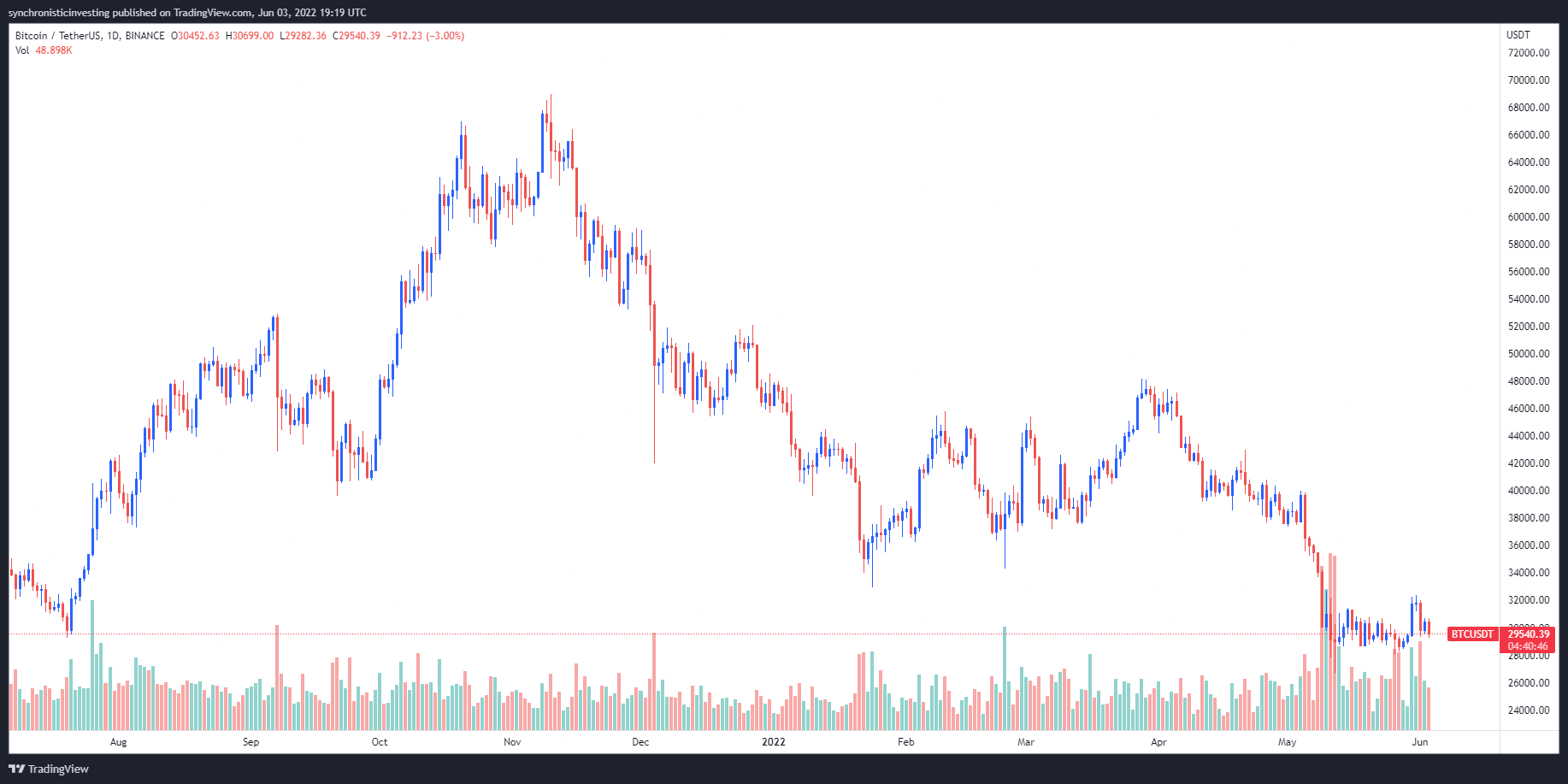

The finish from the first week in June introduced more discomfort to global markets because the tech-heavy Nasdaq composite closed your day on June 3 lower 2.3%, as the S&P 500 shed 1.4% of their value.

The cryptocurrency market hasn’t faired much better and knowledge from Cointelegraph Markets Pro and TradingView implies that an earlier morning make an effort to push Bitcoin (BTC) above $30,000 was hit having a wave of promoting that dropped it to some daily low of $29,286.

Here’s a glance at what several market analysts say concerning the outlook for BTC because it remains pinned in the narrow buying and selling range.

Cost is stuck within the lower range

Bitcoins’ slide back to its current range was “expected,” based on crypto trader and pseudonymous Twitter user Altcoin Sherpa, who published the next chart highlighting the cost pullback into the center of its recent buying and selling range.

Altcoin Sherpa stated,

“A bit lower is probably a much better spot to lengthy however this entire area is choppy and never very obvious in my experience for levels. Would prefer to watch for 28.4k first. #Bitcoin”

Fellow trader and pseudonymous Twitter user ShardiB2 likewise lamented the cost pullback in to the buying and selling range, noting that “Elon, Dimon, Goldman, etc., saying [the] economy will probably be shit for some time will weigh on markets.”

ShardiB2 stated,

“Not awesome, in our lower funnel…must hold here or perhaps a visit to [$]28.6[K] might be so as, crack might we’ll have that [$]25[K]–[$]26K me thinks…”

Bitcoin’s rally to $32,400 only agreed to be a fakeout

Further understanding of what levels to keep close track of for any good entry was provided by EmperorBTC, who published the next chart highlighting the “previous range high serving as the resistance.”

EmperorBTC stated,

“Looks such as the go to [$]32K was just a deviation. Wasn’t expecting the prior range high to do something as a result strong a resistance. Expecting support at PoC [reason for control] now and can Spots there.”

Related: The crypto market dropped in May, but June includes a silver lining

Bulls will win within the lengthy-run

A quote about how lengthy crypto traders can get the present market find it difficult to persist was supplied by Twitter user Crypto Rover, who published the next chart outlining the development of the bullish reversal pattern.

Crypto Rover stated,

“It can always take another 3 several weeks before #Bitcoin finally starts upgrading in a significant pace. Only one factor is certain, we’re developing a typical bullish buyers reversal pattern. Time is great now.”

The general cryptocurrency market cap now is $1.217 trillion and Bitcoin’s dominance rates are 46.3%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.