Bitcoin (BTC) continues to be not able to shut above $32,000 within the last 4 weeks, frustrating bulls and pushing the Fear and Avarice index to bearish levels below 10. Despite today’s small boost, the tech-heavy Nasdaq stock exchange index is lower 24% year-to-date.

Investors who keep an eye on regulatory development were possibly scared following the U.S. condition of recent You are able to Condition made obvious its intention to manage the crypto industry, including Bitcoin mining.

On June 2, New You are able to Attorney General Attorney Letitia James issued an investor alert against “dangerous cryptocurrency investments,” citing the assets’ volatility. Based on Cointelegraph, the lawyer general thinks that crypto investments create “more discomfort than gain” for investors.

The New You are able to Condition Senate approved an evidence-of-work (Bang) mining ban on June 2 and also the suggested questionable bill aims to stop any new mining operations within the condition for the following 2 yrs and it is now going to the governor’s desk.

Interestingly, as all this happens, Bitcoin derivatives traders haven’t been so bullish based on one metric.

Margin traders are very bullish

Margin buying and selling enables investors to leverage their positions by borrowing stablecoins and taking advantage of the proceeds to purchase more cryptocurrency. When individuals savvy traders borrow Bitcoin, they will use the coins as collateral for shorts, meaning they’re betting on the cost decrease.

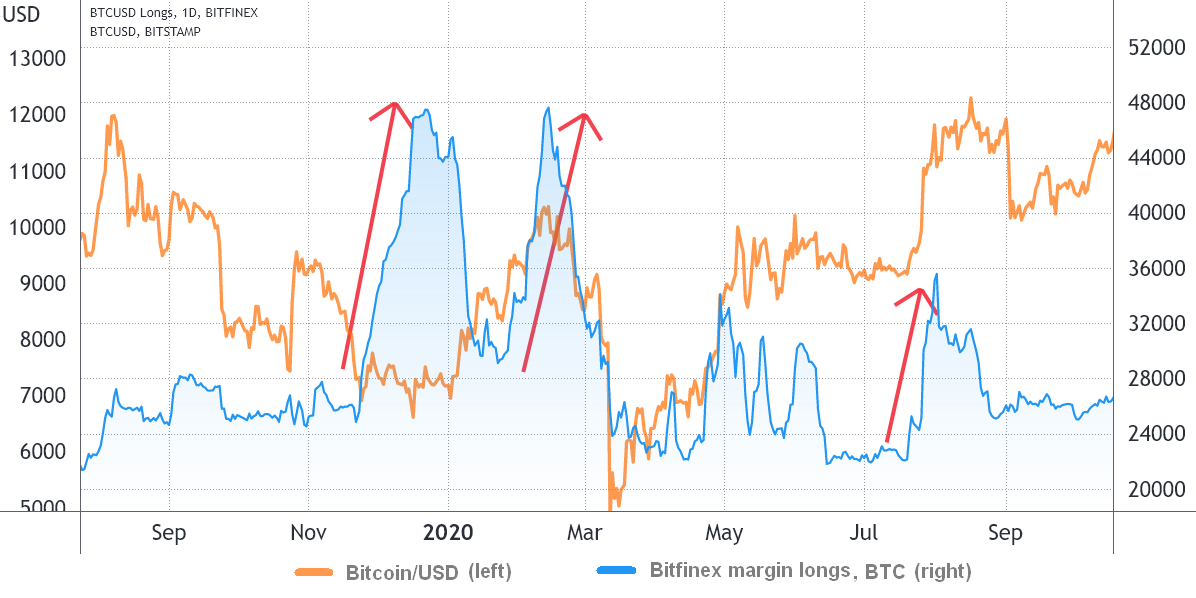

That’s the reason some analysts monitor the entire lending levels of Bitcoin and stablecoins to achieve understanding of whether investors are leaning bullish or bearish. Interestingly, Bitfinex margin traders joined their greatest ever leverage lengthy (bull) position on June 6.

Bitfinex margin traders are recognized for creating position contracts of 20,000 BTC or greater in an exceedingly small amount of time, indicating the participation of whales and enormous arbitrage desks.

Observe that the longs (bull) indicator vastly elevated in mid-May and presently is 90,090 BTC contracts, its greatest-ever registry. To know how severe this movement was, one might compare it towards the June-This summer 2021 previous all-time a lot of 54,500 BTC contracts in longs.

These traders hit the bullseye his or her bullish positions peaked right as Bitcoin cost bottomed. Within the subsequent several weeks, they might sell individuals lengthy (bull) contracts in a profit, reducing the amount of open lengthy positions (blue line).

Often even whales go wrong

One might think that these whales and arbitrage desks buying and selling at Bitfinex margin markets have better timing (or understanding), and therefore it seems sensible to follow along with their steps. However, when we evaluate exactly the same metric for 2019 and 2020, a totally different scenario emerges.

There have been three hikes in the amount of Bitfinex BTC margin longs now. The very first instance happened between mid-November and mid-December 2019 following the indicator leaped from 25,200 BTC to 47,600 BTC longs. However, within the the following month, the Bitcoin cost unsuccessful to interrupt above $8,300 which traders closed their positions with minimal gains.

The following wave of BTC longs required devote early-Feb 2020, but individuals traders were caught unexpectedly following the Bitcoin cost unsuccessful to interrupt $10,500, forcing these to close their margin positions in a considerable loss.

Bitfinex BTC margin longs elevated from 22,100 to 35,700 contracts at the end of-This summer 2020. The movement coincided using the cost rally to $47,000, therefore the early entrants may have scored some profit, but the majority of the investors exited their margin longs without any gains.

Clever margin longs may be right 75% time, there is however a catch

To place things in perspective, within the previous four instances where BTC margin longs (bulls) considerably elevated, investors had 1 lucrative trade, 2 mostly neutral, and 1 considerable loss.

Some might say odds still favor individuals tracking the indicator, only one must keep in mind that whales and arbitrage desks could easily crash the marketplace when closing their positions. In such instances, individuals following a strategy might arrive late towards the party and are available out baffled.

Will the present Bitfinex margin longs increase lead to extreme profits? It could rely on how traditional markets, mainly tech stocks, perform within the next handful of days.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.