Governments around the world also have be conscious of the crypto market and also the various ways that it may be controlled.

Despite an increasing adoption rate and participation of mainstream financial giants, however, naysayers still portray crypto like a tool for miscreants and crooks. Several crypto platforms and decentralized finance (DeFi) protocols happen to be compromised through the years, because of various code vulnerabilities or centralization problems. However, stealing of cash may be the easiest part, while moving that cash and cashing it is almost impossible.

This really is mainly since most crypto transactions are documented on an open ledger, which functions like a permanent trail, and whether or not the hacker uses various gold coin mixing services to cover its origins, effective transaction monitoring tools can eventually identify such illicit trails.

Even gold coin mixing services themselves have began to bar transactions connected or flagged as illicit.

Through rigorous study, crypto forensic firms for example Chainalysis and Elliptic have further debunked the concept cryptocurrency offers an ideal tool for financial crimes and masking illicit activity.

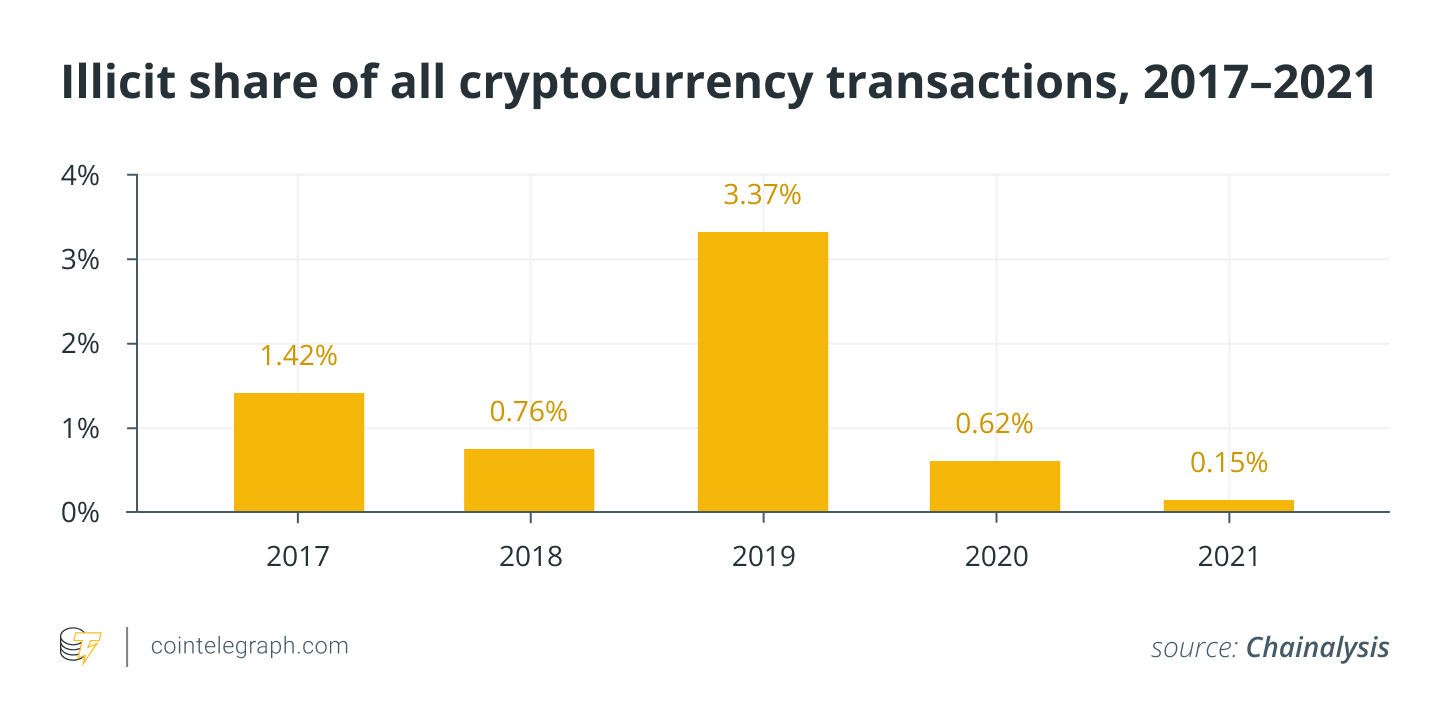

A current report by Chainalysis implies that the proportion of crypto transactions connected with illicit activities in 2021 would be a mere .15%.

Cryptocurrencies have grown to be more mainstream in the last few years, using the public prescription from the crypto market evolving from your internet bubble a few years ago to some reliable investment option today.

Dmytro Volkov, chief technology officer at crypto exchange CEX.IO, told Cointelegraph why the idea of crypto being mainly utilized by crooks is outdated:

“The misconception that crypto is predominantly utilized by crooks most likely has roots in the era of the Silk Road. The fact is that the immutable part of the blockchain makes hiding transactions very hard. Within the situation of Bitcoin, whose blockchain ledger is openly available, a significant exchange having a competent analytics team can certainly monitor and thwart online hackers and launderers prior to the damage is performed.”

He added that “As lengthy because the security team stays positive and in front of the curve on blockchain technology, we are able to continue protecting our customers. Because this industry keeps growing, I have faith that this myth of crypto getting used largely by crooks will fade.”

Volkov noted that there’s an “arms race happening between cybercriminals and also the security groups of cryptocurrency environments,” as ne’er-do-wells still try to look for instruments to facilitate illicit activities. However, “This isn’t only at digital asset industry,” Volkov claimed.

A “paper” trail

There has been several instances by which crooks were discovered to be attempting to launder stolen cryptocurrencies years afterwards, the newest example being Bitfinex.

Police force agents could stick to the stolen Bitcoin (BTC) — believed to be with $4 billion in the current value — with the blockchain to eventually detain influencer Louise Morgan and her husband Ilya Lichtenstein, a cybersecurity specialist.

Related: Making feeling of the Bitfinex Bitcoin billions

Derek Muhney, executive v . p . at Coinsource — a Bitcoin ATM provider — told Cointelegraph:

“Look in the results of the 2016 Bitfinex hack. People involved tried to launder roughly $4.5 billion in cryptocurrency by using several systematic washing techniques. Still, police force could stick to the money with the blockchain, find out the perpetrators and recover a substantial area of the stolen money. Cases such as this prove that crooks may try to benefit from crypto however they won’t succeed. Crypto was produced for anyone and will still be for that good guys.”

From your outdoors perspective, using cryptocurrency for criminal activities might appear ideal. Online transactions can be achieved rapidly and without getting to physically move sums of cash across far distances. But, individuals within the crypto world know you will find robust protocols in position that permit police force to help keep records and verify the identity of consumers if necessary.

Crypto exchanges play a vital role

Crypto exchanges play a vital role in identifying and blocking or freezing stolen funds, because they effectively function as off-ramps for crypto to fiat.

Lately, Binance blocked $six million price of stolen funds connected using the Ronin bridge hack. The crypto exchange says the hacker attempted to spend $5.8 million from the total $600 million via 86 accounts in small batches.

As washing via centralized exchanges with heavy Know Your Customer (KYC) policies is becoming difficult, online hackers have then switched to decentralized exchanges (DEX) hoping anonymizing their movements.

More often than not, however, these online hackers convert their stolen crypto into stablecoins, which, once flagged, can be simply frozen through the issuer. Thus, washing via DEX platforms is becoming more and more difficult too.

Tigran Gambaryan, v . p . of worldwide intelligence and investigations at Binance, told Cointelegraph that although crooks continuously use crypto for washing, exchanges are the initial type of defense against them:

“Criminals will launder money regardless of what form it’s available in. With regards to cryptocurrency, exchanges are the initial type of defense and need to be ready for that. What exchanges have to do is to possess a sufficient number of individuals with the proper expertise and also the necessary tooling to prevent and identify suspicious transactions. Proper KYC and transaction monitoring tools are crucial.”

Binance has additionally helped take lower a cybercriminal ring washing $500 million in digital assets received through ransomware attacks. The exchange has additionally labored with local governments and police force agencies to tackle ransomware risks.

Fiat currencies tend to be more susceptible to illicit activities

A few of the greatest naysayers that propagate the narrative of crypto like a tool for criminality are traditional bankers, who are not innocent of ill financial deeds.

Despite governments flowing vast amounts of dollars into stringent banking rules, including Anti-Money Washing (AML) measures, major financial institutions have compensated over $300 billion in fines since 2000 for any slew of numerous conduct violations including although not restricted to insider buying and selling and AML deficiencies.

A few of the greatest naysayers that propagate the narrative of crypto like a tool for criminality are traditional bankers, who are innocent of ill financial deeds.

Despite governments flowing vast amounts of dollars into stringent banking rules, including Anti-Money Washing (AML) measures, major financial institutions have compensated over $300 billion in fines since 2000 for any slew of numerous conduct violations including although not restricted to insider buying and selling and AML deficiencies.