A broadly adopted suite of on-chain and technical metrics are delivering bullish signs for that Bitcoin cost, with BTC/USD holding near to nine-month highs just above $28,000 as markets digest Wednesday’s US Fed policy meeting.

Bitcoin initially offered off on Wednesday inside a “sell the fact” response to the united states central bank lifting rates of interest by 25 bps not surprisingly, and softening its tone around the outlook for more rate hikes among troubles within the banking sector.

However the world’s largest cryptocurrency could get back its poise and recover back above $28,000 on Thursday as narratives around Bitcoin as being a safe place against fragility in america (and global) banking system and round the Fed’s dovish pivot tempted bulls to purchase the dip.

Even while, a collection of on-chain and technical indicators that with each other possess a strong history of predicting when Bitcoin is transitioning back to a bull market from a time period of bearishness is constantly on the flash lengthy-term bullish signals.

Indeed, seven from eight from the metrics tracked in crypto data analytics firm Glassnode’s “Recovering from the Bitcoin Bear” dashboard presently match the condition for Bitcoin being in early stages of the new bull market.

The dashboard tracks eight indicators to determine whether Bitcoin is buying and selling above key prices models, whether network utilization momentum is growing, whether market profitability is coming back and if the balance of USD-denominated Bitcoin wealth favors the lengthy-term HODLers.

When all eight are flashing eco-friendly, it has in the past been a powerful bullish sign for that Bitcoin market.

Signals 1 and a pair of: Bitcoin is Above its 200DMA and Recognized Cost

Bitcoin is buying and selling easily above its 200DMA and Recognized Cost, the very first two eight signals tracked by Glassnode. A rest above these key levels is observed by many people being an indicator that near-term cost momentum is shifting inside a positive direction.

Equally, once the Bitcoin cost mounts a effective defense of those levels, as when it retested them earlier this year, that’s also seen as an key technical validation the bull market remains in play.

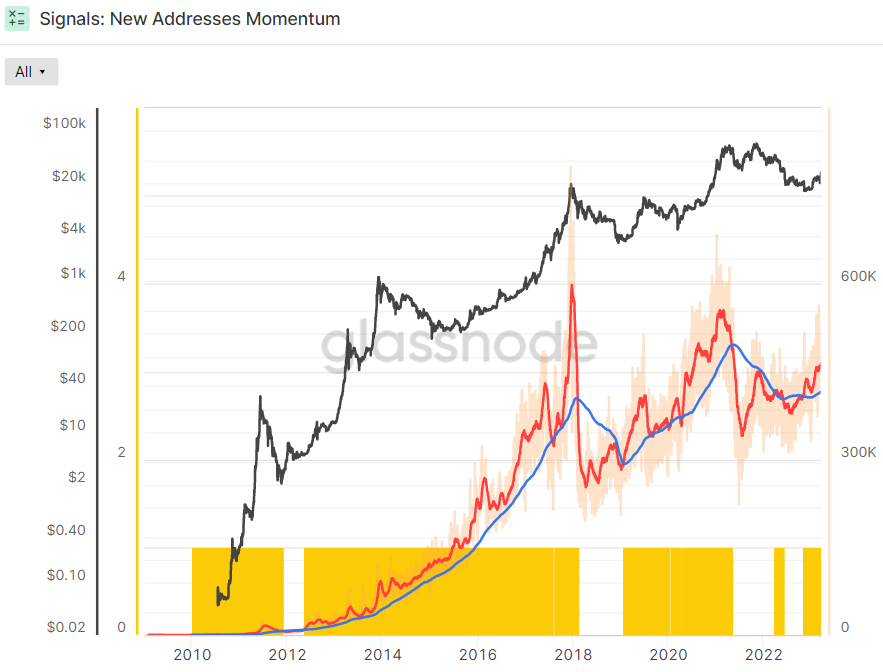

Signal 3: New Address Momentum

The 30-Day SMA of recent Bitcoin address creation moved above its 365-Day SMA a couple of several weeks ago, an indication the rate where new Bitcoin wallets are now being produced is speeding up. It has in the past happened at the beginning of bull markets.

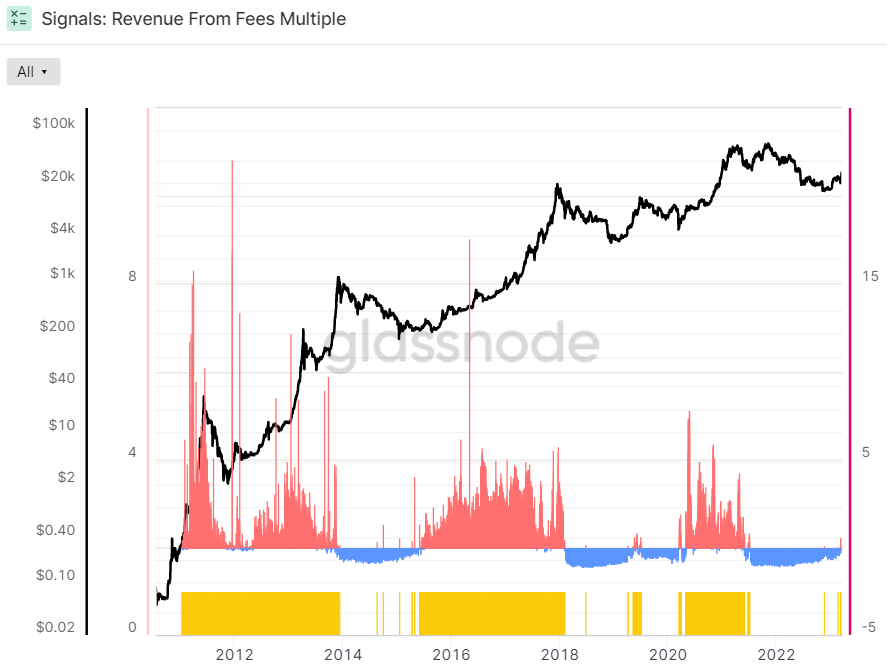

Signal 4: Revenue from Charges Multiple

Meanwhile, the 2-year Z-score from the Revenue From Charges Multiple switched decisively positive a couple of days ago. The Z-score is the amount of standard deviations below or above the mean of the data sample. In cases like this, Glassnode’s Z-score is the amount of standard deviations below or above the mean Bitcoin Fee Revenue from the last 2-years.

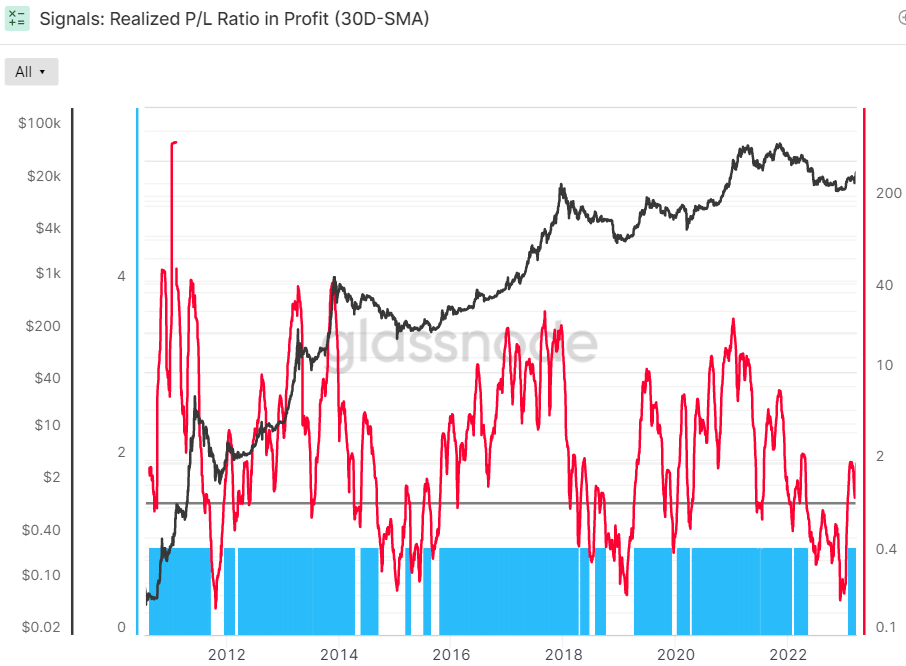

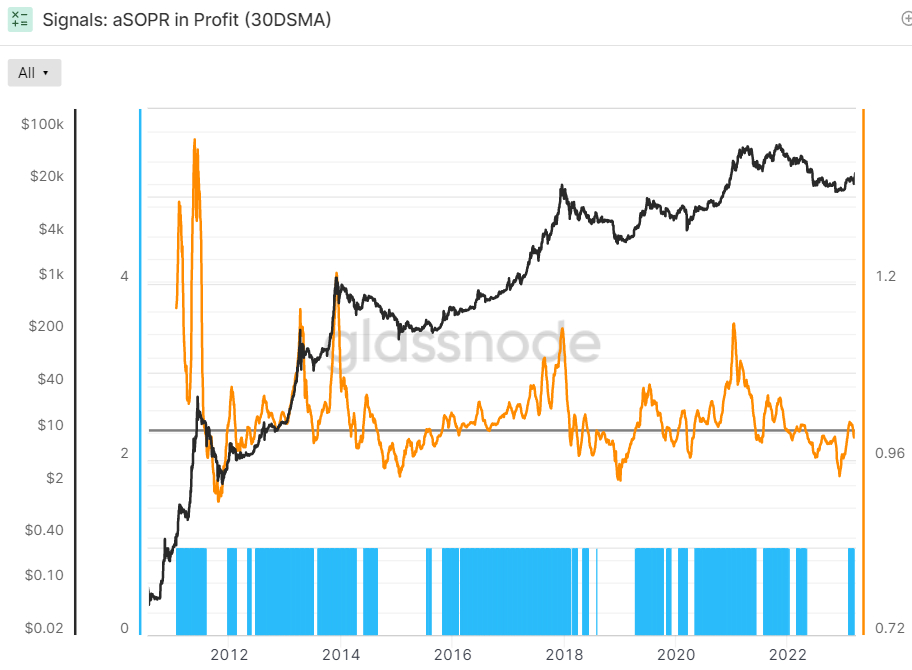

Signal 5 and 6: Recognized P/L Ratio and aSOPR in Profit

Getting to the 5th and sixth indicators associated with market profitability the market’s recovery from earlier monthly lows helped keep your 30-Day Simple Moving Average (SMA) from the Bitcoin Recognized Profit-Loss Ratio (RPLR) indicator above one.

Once the RPLR is above one, which means that Bitcoin marketplace is realizing a larger proportion of profits (denominated in USD) than losses. Based on Glassnode, “this generally ensures that sellers with unrealized losses happen to be exhausted, along with a healthier inflow of demand exists to soak up profit taking”. Hence, this indicator is constantly on the send a bullish signal.

The 30-day SMA of Bitcoin’s Adjusted Spent Output Profit Ration (aSOPR) indicator, an indication that reflects the quality of recognized profit and loss for those coins managed to move on-chain, lately dipped below one (meaning it’s no longer delivering a bull signal). That basically implies that typically in the last thirty days, the marketplace is not in profit.

However, among the recovery within the Bitcoin cost from earlier monthly lows to new nine-month highs above $28,000, this indicator should soon recover back above one. That will mean all eight of Glassnode’s indicators are flashing eco-friendly. Searching back during the last eight many years of Bitcoin history, the aSOPR rising above 1 following a prolonged spell below it’s been an incredible buy signal.

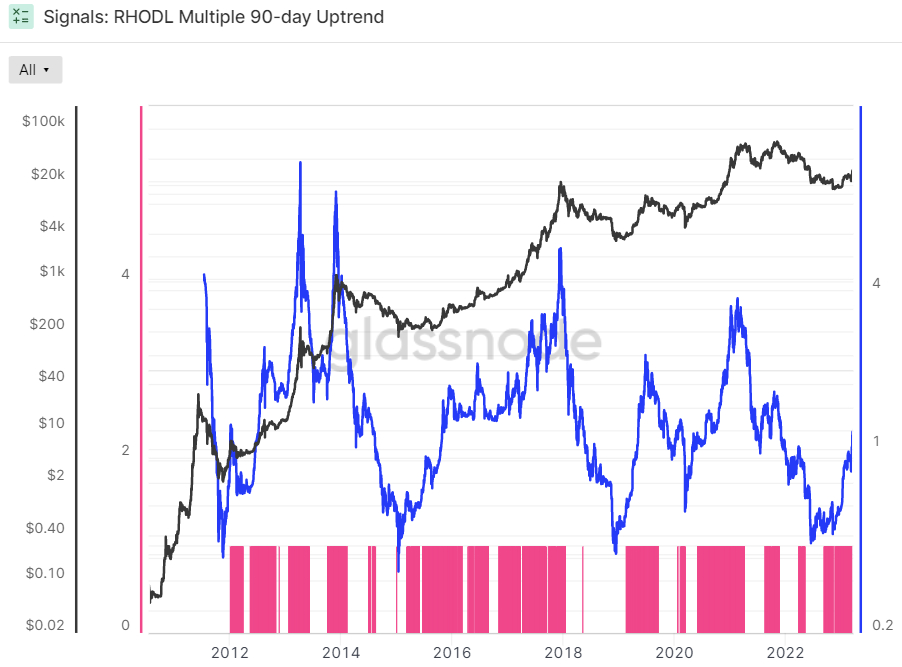

Signal 7 and eight: RHODL Multiple and offer in Profit

Finally, you will find the ultimate two indicators that report as to whether the total amount of USD wealth had sufficiently thrown back in support of the HODLers to signal weak-hands seller exhaustion.

The Bitcoin Recognized HODL Multiple has been around an upward trend during the last 3 months, a bullish sign based on Glassnode. The crypto analytics firm claims that “when the RHODL Multiple transitions into an upward trend more than a 90-day window, it signifies that USD-denominated wealth is beginning to shift back towards new demand inflows”.

It “indicates earnings are being taken, the marketplace is capable of doing absorbing them… (and) that longer-term holders are beginning to invest coins” Glassnode states.

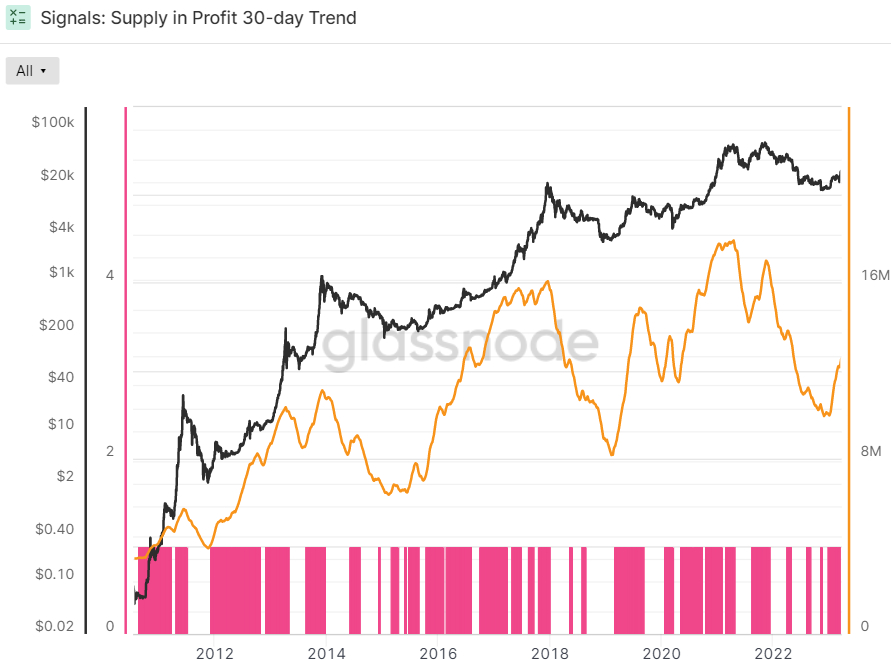

Glassnode’s final indicator in the Dealing with a Bitcoin Bear dashboard is if the 90-day Exponential Moving Average (EMA) of Bitcoin Supply in Profit has been around an upward trend during the last thirty days or otherwise. Supply in Profit is the amount of Bitcoins that last moved when USD-denominated prices were less than they’re at this time, implying these were bought for any lower cost and also the wallet is possessing a paper profit. This indicator can also be flashing eco-friendly.

Where Next for BTC?

Many analysts believe that Bitcoin’s next stop is a test from the $30,000 level, however, many have expressed doubts about BTC’s capability to muster a sustained break above this level even without the new bullish catalysts.

These catalysts might be further contagion and crisis concerns in america banking sector, that could spur fresh safe-haven interest in Bitcoin. Alternatively, if Given communications give markets need to extend their rate of interest cut bets for that year ahead, that may boost Bitcoin among easing financial conditions.

But even without the these catalysts, ongoing positive trends in Bitcoin market fundamentals among growing adoption along with a growing narrative that 2022’s bear marketplace is lengthy previously imply that Bitcoin’s outlook through out the entire year still looks excellent.