Bitcoin (BTC) cooled volatility above $17,000 in to the 12 ,. 5 Wall Street open as traders confirmed upside targets.

Bitcoin traders warm to close-term upside

Data from Cointelegraph Markets Pro and TradingView adopted BTC/USD because it held overnight gains, getting hit three-week highs.

The weekly close itself was encouraging for many, developing Bitcoin’s greatest because the FTX scandal broke.

Now, traders were wishing that upside would continue toward $20,000, with assorted resistance zones in play.

“Slowly, but surely, Bitcoin is grinding upwards. Must crack $17.4-17.6K, however we probably continue quite fastly towards $19K,” Michaël van de Poppe, founder and Chief executive officer of buying and selling firm Eight, authored within an update at the time.

A further publish offered a BTC/USD chart with relevant cost amounts of interest.

Fellow trader Titan of Crypto flagged $18,500 like a formidable resistance zone to look at, while a regular close above $17,167 could be “encouraging.”

“Are we departing the number now?” trader DoopieCash queried alongside a chart showing $17,552 as clinch level on daily timeframes.

A still-positive Moustache meanwhile pointed to some classic bottoming pattern, the inverse mind and shoulders, “in full swing” around the 12-hour chart.

Dollar strength faces tense week

Eyes were meanwhile on U . s . States equities as Asian markets had another strong day’s buying and selling.

Related: ‘Imminent’ crash for stocks? 5 items to know in Bitcoin now

Hong Kong’s Hang Seng was up 4.5% at the time, as the Shanghai Composite Index managed nearly 1.8%.

The U.S. dollar continued to be an emphasis inside the macro picture, using the U.S. dollar index (DXY) near five-month lows with what could yet be considered a boon for Bitcoin.

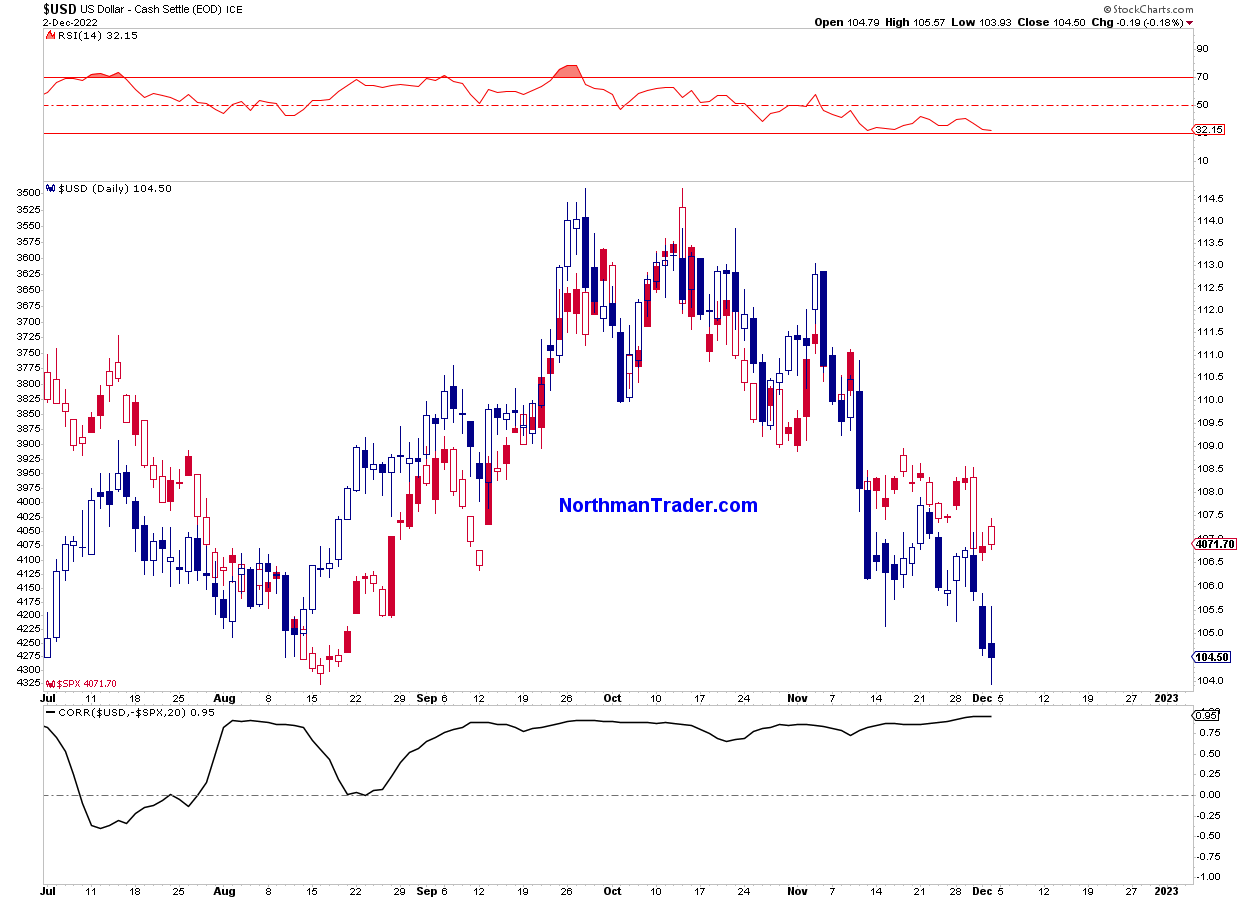

Sven Henrich, founding father of NorthmanTrader, meanwhile noted the continuing inverse correlation between DXY and also the S&P 500.

“A vital chart to navigating markets in past couple of several weeks: The United States dollar $SPX directional correlation. Still sitting at 95%,” a part of Twitter comments pointed out at the time.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.