Bitcoin (BTC) remained steady near $17,000 in the 12 ,. 12 Wall Street open as news involving Binance unsuccessful to spark BTC cost downside.

Factors fall into line to “scare” Bitcoin trade

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD staying away from fresh volatility as U . s . States markets opened up.

Getting traded sideways through the weekend, the happy couple offered couple of cues to analysts, who have been awaiting U.S. macroeconomic data to change the established order.

This, by means of the November Consumer Cost Index (CPI) print, would nevertheless be considered a pivotal moment for crypto assets, they agreed, with the opportunity of significant upside and downside hinging around the figures, due 12 ,. 13.

Subsequent occasions relating to the Fed would equally shape cost performance, they stated.

Meanwhile, however, Bitcoin made an appearance to shrug off news that largest global exchange Binance was apparently the prospective of the U.S. money washing suit.

Appearing in Reuters, a study mentioned the Department of Justice (DoJ) was undecided over whether or not to bring charges against Binance and it is Chief executive officer, Changpeng Zhao, after an analysis so it started in 2018.

This adopted fresh concerns within the exchange’s evidence of reserves, which various commentators nevertheless labeled “FUD” because it spread with the media.

“Bitcoin remains stable, altcoins losing value, $BTC dominance bouncing upwards and presently rallying,” Michaël van de Poppe, founder and Chief executive officer of buying and selling firm Eight, authored partly of the summary at the time.

Van de Poppe noted that market participants remained as “scared” because of approaching macro data and legal occasions associated with the FTX scandal.

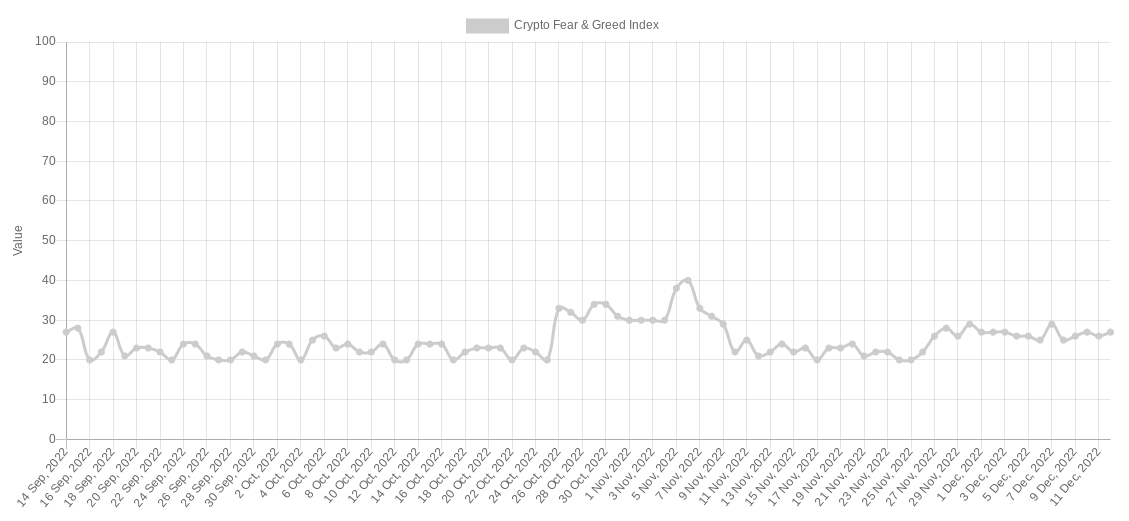

Crypto sentiment more broadly continued to be more powerful compared to worst situation scenario, as reported by the Crypto Fear & Avarice Index, which measured 27/100 at the time — still above its lowes “extreme fear” zone.

Risk-asset bottom could come after Given pivot

Around the subject of near-term market action, there have been fresh bearish warnings for crypto and risk assets.

Related: ‘Biggest week from the year’ — 5 items to know in Bitcoin now

Popular trader Moustache switched to U.S. stocks to help remind supporters that regardless of the Given potentially pivoting on rate hikes, in the past, this didn’t mark a level for performance.

“Don’t forget that the stock exchange has crashed very difficult each time ever Following the FED’s Pivot,” he commented alongside a chart.

“Possible the market creates a rally, due to the expectations of the pivot. Following the official announcement: Sell this news.”

He added the result might be a “final bottom for $BTC.”

Analyst Toni Ghinea was similarly wary, telling supporters the BTC/USD bottom could be between $11,000 and $14,000 and are available in Q1 the coming year.

“Bottom is 11-14k. Capitulation is within Q1 2023,” he authored, also together with a bounce target as high as $30,000.

“Ignore the noise.”

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.