Bitcoin (BTC) starts a brand new week with a few fresh expect hodlers after halting what’s been a long weekly downtrend in the history.

After battling for support through the weekend, BTC/USD ultimately found its footing to shut the week at $29,900 — $450 greater than last Sunday.

The bullish momentum didn’t hold on there, using the pair climbing during the night into June 6 to achieve multi-day highs.

The cost action provides some lengthy-anticipated relief to bulls, but Bitcoin is way from from the forest at the beginning of what offers to be a fascinating buying and selling week.

The culmination will probably be U . s . States inflation data, this itself a yardstick for that macroeconomic forces at world globally. In the future, the outcome of anti-COVID policies, geopolitical tensions and offer shortages has become even more apparent.

Risk assets remain an unlikely bet for a lot of, as central bank financial tightening is viewed to become likely to pressure stocks and crypto alike moving forward.

Bitcoin’s network fundamentals, meanwhile, continue to adjust to the nearby reality and it is effect on network participants.

Cointelegraph analyzes five factors to keep in mind when charting where BTC cost action might be headed within the future.

Tenth time’s the charm for BTC weekly

It had been a lengthy time coming, but Bitcoin has finally closed out a “green” week around the weekly chart.

BTC/USD had spent an archive nine days making progressively lower weekly closes — a pattern which started at the end of March and became a long ever in the history.

On June 5, however, bears didn’t have chance, pushing the happy couple to $29,900 prior to the new week started, this still being roughly $450 greater compared to previous week’s closing cost.

That event sparked several hrs of upside, with local highs totaling $31,327 on Bitstamp during the time of writing — Bitcoin’s best performance since June 1.

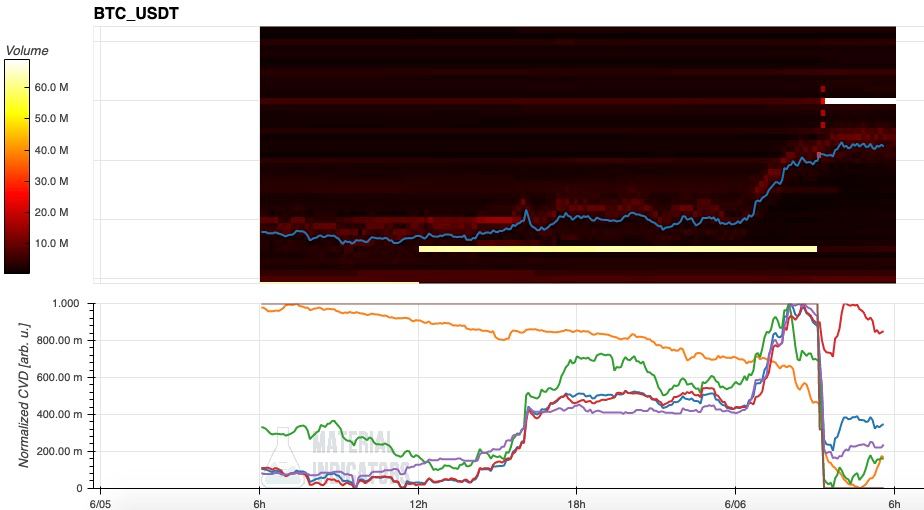

Around the Weekly candle close, Trend Precognition printed a Lengthy signal around the #Bitcoin Weekly chart. Searching for any HH around the Weekly to verify an outbreak. If #BTC rallies, key MA’s should behave as technical resistance. https://t.co/NPVL3D27C5 pic.twitter.com/GxwT5zI3gC

— Material Indicators (@MI_Algos) June 6, 2022

Although some celebrated Bitcoin’s newly found strength, others continued to be firmly awesome around the prospects of an increased rally.

Cointelegraph contributor Michaël van de Poppe eyed outdoors CME futures gap in the weekend, this supplying a lure for any go back to $29,000.

“Still expecting this to become happening on Bitcoin,” he told Twitter supporters.

“A drop for the CME Gap at $29K will make lots of sense before a brief reversal towards $31.5K.”

A glance at order book data reinforces the friction bulls will probably face in case of a ongoing breakout. During the time of writing, the region around $32,000 had greater than $60 million in sell-side liquidity arranged on Binance alone.

For Il Capo of Crypto, a Twitter analytics account well-known because of its sobering assumes approaching BTC cost action, there is likewise little to feel confident about.

Additionally for this:

-Cost is essentially varying between 29k-31k. That’s underneath the primary pivot (S/R switch)

-Every progress is corrective and knowledge implies that bulls are now being trapped.

We may visit a scam pump to $30.7k-31.5k, however the bearish primary targets continue to be most likely. https://t.co/UnmENNNK6z

— il Capo Of Crypto (@CryptoCapo_) June 5, 2022

Nevertheless, the marketplace wasn’t without its optimism.

“Having an agenda is much more important than guessing the right direction,” popular Twitter account IncomeSharks contended.

“I think we drop go up, so I will be longing should this happen. If stocks open eco-friendly we’re able to rally and I’ll pivot to alts to ride them up. TP level reaches $34,000 for the time being.”

Countdown to U.S. CPI reado

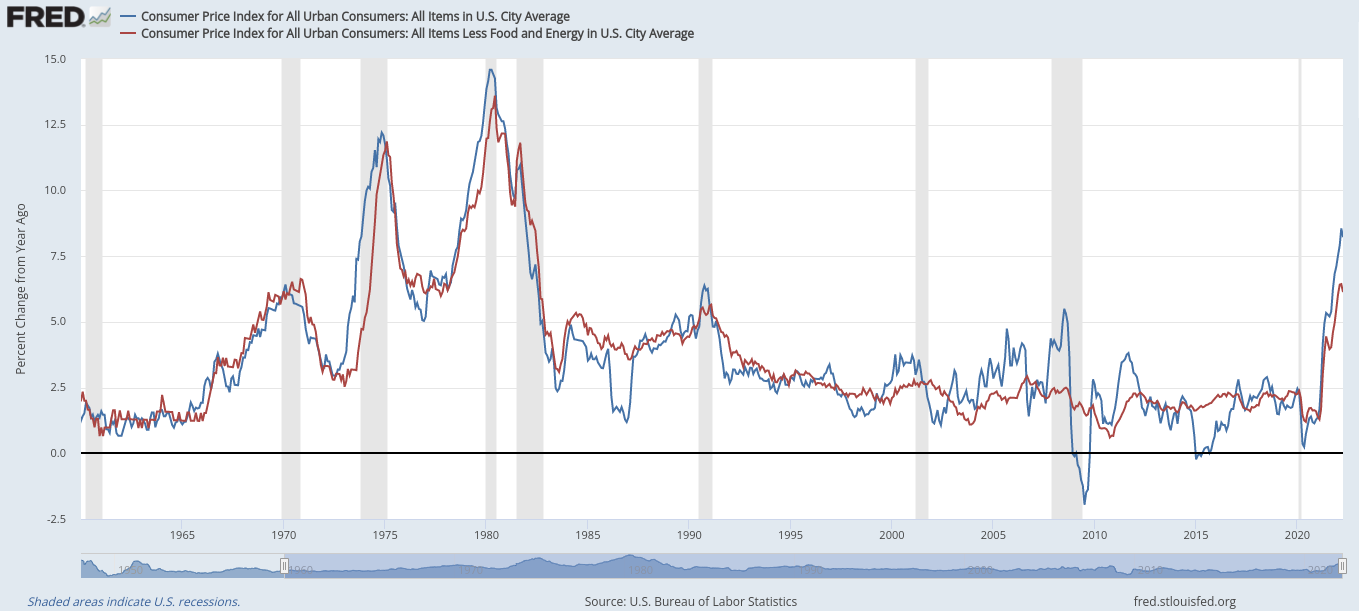

U.S. inflation reaches its greatest because the early 1980s, and can it continue?

The marketplace will discover now as June 10 sees the discharge of Consumer Cost Index (CPI) data for May.

Among the benchmarks for gauging how inflation is progressing, CPI prints have typically been supported by market volatility both within crypto and beyond.

The issue for a lot of is when much greater sometimes it can go because the aftermath from the Russia-Ukraine conflict and it is effect on global trade and offer chains is constantly on the engage in.

Within the U.S., the government Reserve’s rate of interest hikes will also be under scrutiny because of prices surging.

The finish from the “easy money” era is really a difficult one for stocks and correlated crypto assets more generally, which discomfort trend is anticipated to not finish in the near future, no matter inflation performance.

“Liquidity is losing sight of the marketplace and just what which means could it be will have an affect on the equity markets,” Charu Chanana, market strategist at Saxo Capital Markets, told Bloomberg.

“We do expect the drawdown within the equity markets continues to have some room to visit.”

Chanana was speaking as Asian markets rallied at the begining of week’s buying and selling, brought by China loosening its latest round of COVID-19 lockdown measures.

The Shanghai Composite Index was up 1.1% during the time of writing, while Hong Kong’s Hang Seng traded up greater than 1.5%.

Past the intraday data, however, the atmosphere with regards to macro versus crypto is extremely certainly one of cold ft.

For buying and selling firm QCP Capital, the most recent contraction in U.S. M2 money supply — only its third in around two decades — is yet another need to require a chance.

“This contraction in M2 is a consequence of Given hikes and forward guidance which drove an outburst backwards repos (RRP) to any or all-time record levels. Banks and cash market funds withdrew money in the economic climate to be able to park it using the Given to benefit from high overnight rates of interest,” it authored within the latest edition of their Crypto Circular research series.

“This draining of liquidity are only exacerbated through the approaching QT balance sheet unwind too, beginning 1 June. We predict these 4 elements to weigh on crypto prices.”

Miner capitulation “very close”

Despite days of affordable prices endangering their cost basis, Bitcoin miners have to date held removed from significant distribution of coins.

This might soon change, new analysis argues, sparking what’s in the past supported generational BTC cost bottoms.

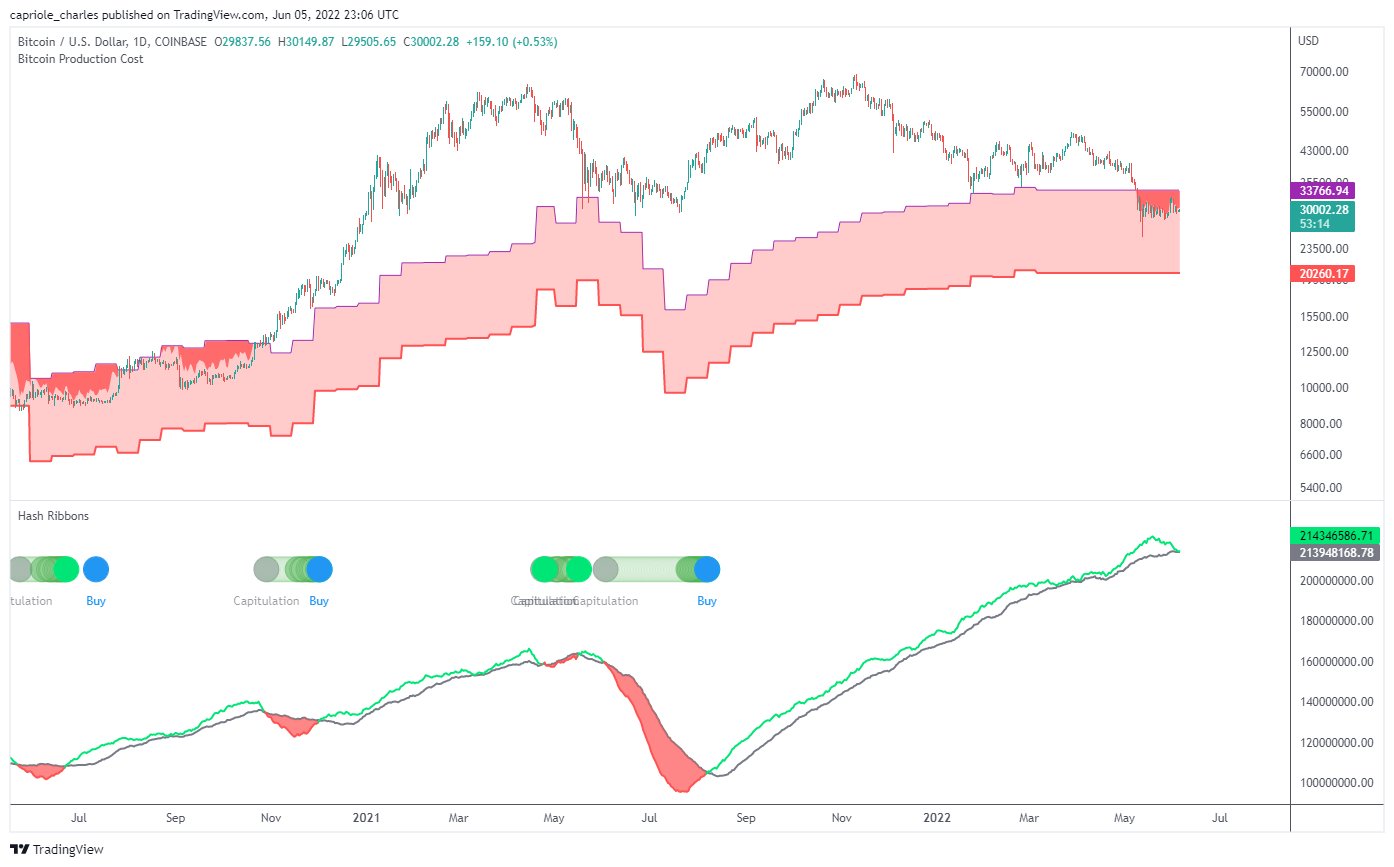

Inside a tweet on June 6, Charles Edwards, founding father of crypto asset manager Capriole, highlighted a vintage bottom signal in Bitcoin’s hash ribbons metric.

Hash ribbons measures miner profitability and it has been in the past accurate in correlating with cost phases. Presently, the “capitulation” phase much like March 2020 is going ahead, he described, but hodlers must do not sell consequently.

“Hash Ribbon miner capitulation is extremely close. Bitcoin mining income are becoming squeezed,” Edwards commented.

“Reminder: this isn’t a sell signal. The finish of the capitulation period has in the past setup the best lengthy-term buys for Bitcoin.”

Formerly, Cointelegraph reported on miners’ ongoing challenges, which now includes a ban the practice through the Condition of recent You are able to this month.

Fundamentals echo miner calm

Fluctuations in miner participation have a palpable impact on Bitcoin’s hash rate and network difficulty.

To date, hash rate has continued to be stable above 200 exahashes per second (EH/s), based on estimates, indicating that miners typically remain active and also have not decreased activity over cost concerns.

Data covering Bitcoin’s network difficulty likewise presents a relaxed short-term picture.

At its approaching automated readjustment now, difficulty will decrease by under 1%, again reflecting a family member insufficient upheaval within the mining sphere.

By comparison, the prior readjustment two days ago saw a 4.3% reduction, marking the greatest reversal since This summer 2021.

Beyond short term, a feeling of optimism prevails among a number of Bitcoin’s best-known commentators.

“As we have seen within the development of its hash rate, today bitcoin is roughly 50% cheaper yet 20% more powerful than last year,” podcast host Robert Breedlove noted partly of the Twitter debate on June 5, quarrelling this demonstrated “mobilization” of entrepreneurs thinking about fueling Bitcoin’s growth.

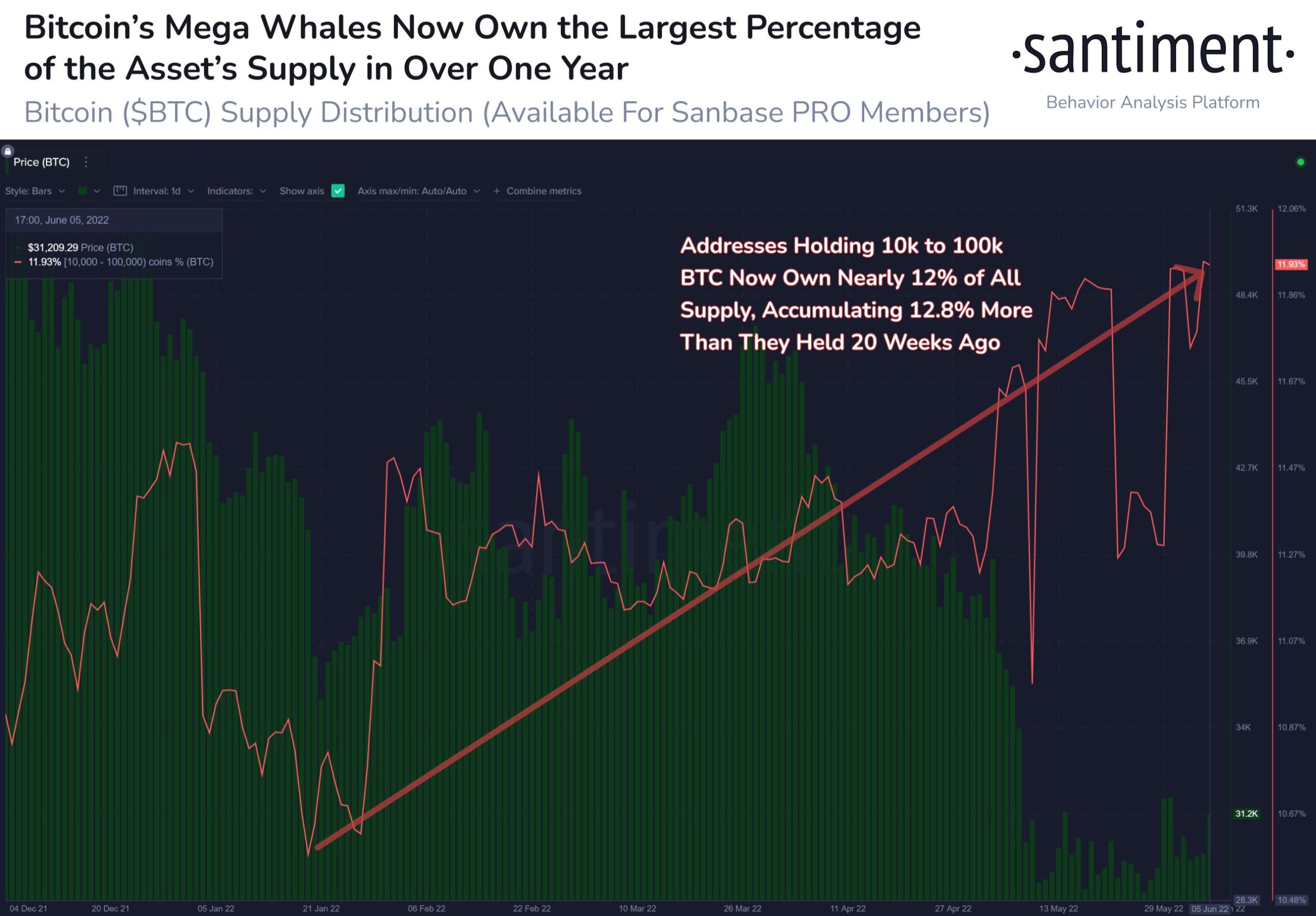

Megawhales show “promising sign”

When it comes to putting their cash where their mouth is, Bitcoin’s greatest investors might be showing the way in which this month.

Related: 5 Best cryptocurrencies to look at now: BTC, ADA, XLM, XMR, MANA

As noted by sentiment monitoring firm Santiment, entities controlling 1,000 BTC or even more now own a lot of BTC supply than at any time previously year.

“The mega whale addresses of Bitcoin, comprised partly of exchange addresses, own their greatest way to obtain $BTC each year,” Santiment summarized on June 6.

“We frequently evaluate the 100 to 10k $BTC addresses for alpha, but accumulation out of this high tier can nonetheless be an encouraging sign.”

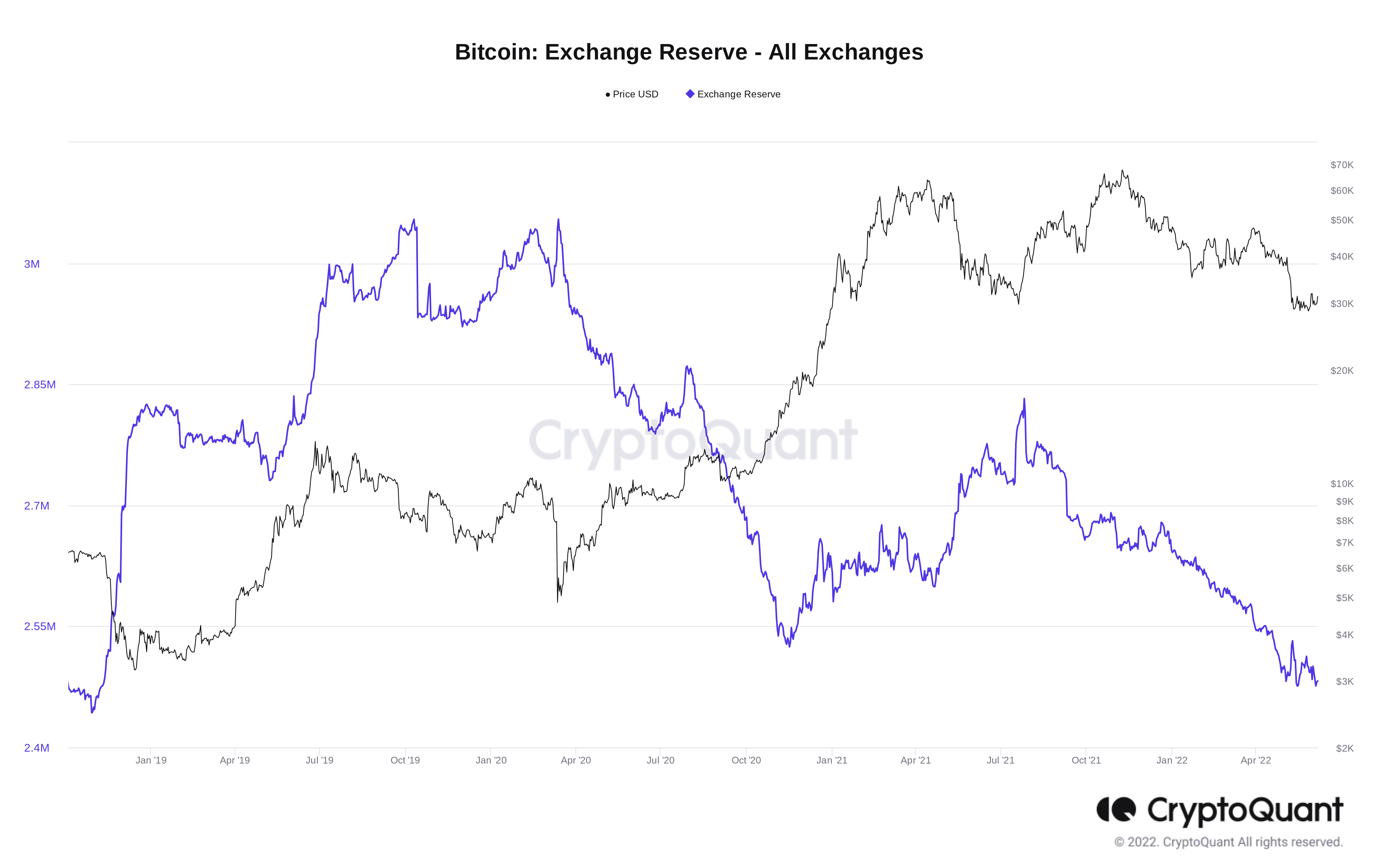

Data from on-chain analytics firm CryptoQuant meanwhile allays fears that users are delivering BTC en masse to exchanges for purchase. The general trend in decreasing exchange reserves continues, and it is at levels last observed in October 2018.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.