Bitcoin (BTC) hit new weekly lows into Sept. 28 as risk asset drawdown ongoing overnight.

Trader: “First new lows” before Q4 recovery

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD falling to $18,461 on Bitstamp, lower almost $2,000 in comparison to the previous day’s high.

The modification of direction arrived lockstep with stocks, which switched red after initially heading marginally greater in the Wall Street open.

The S&P 500 and Nasdaq Composite Index ultimately finished your day lower .25% or more .25%, correspondingly.

Crypto, however, unsuccessful to extract its losses, even though hopes were for Q4 to create a far more solid recovery, traders were betting around the discomfort ongoing first.

Popular Twitter account Il Capo of Crypto made an appearance to confirm he favored October copying last year’s performance — a thing that earned it the nickname “Uptober.”

In comments, he added he was “expecting bullish Q4. However new lows.”

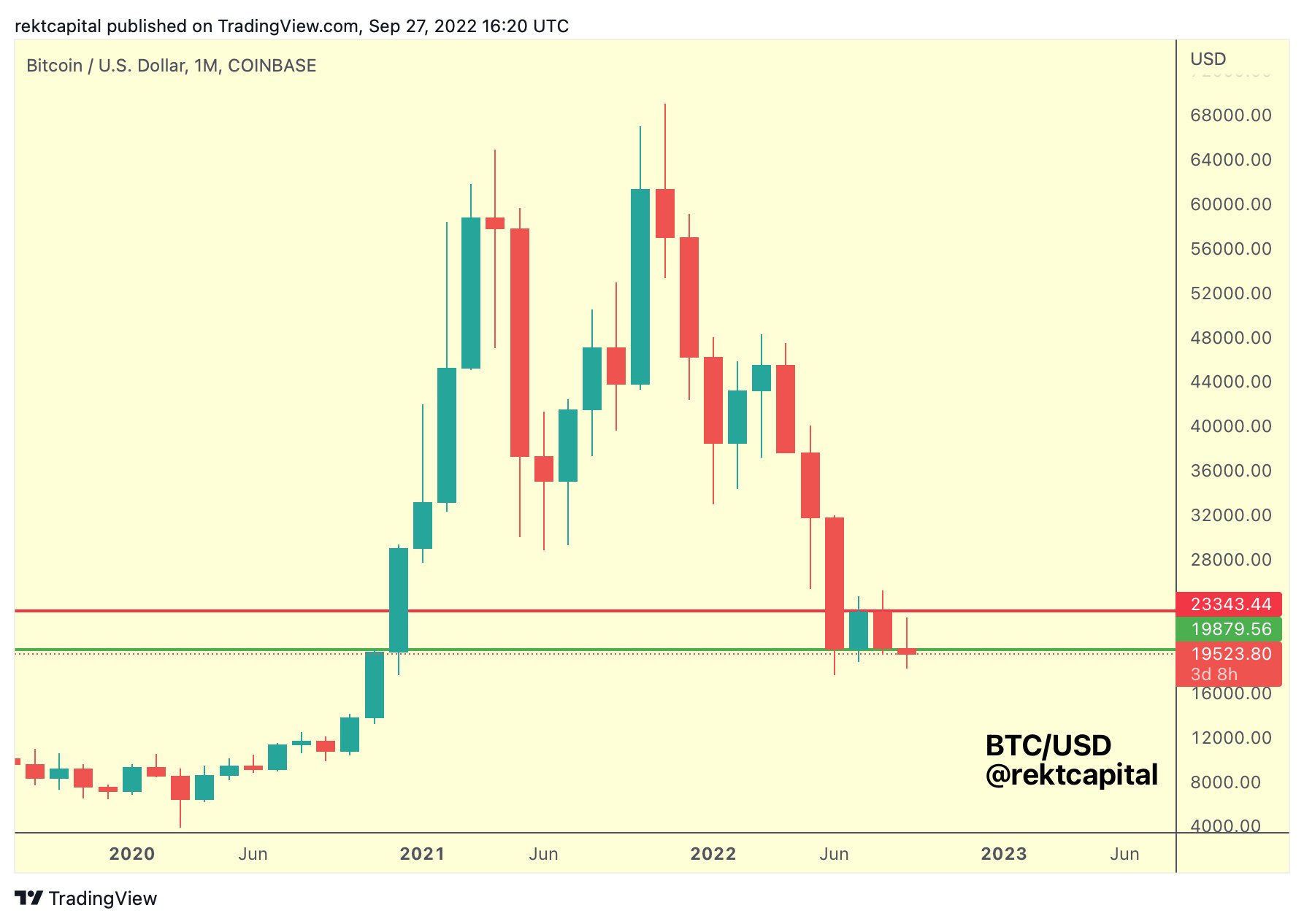

Fellow trader and analyst Rekt Capital, meanwhile, came focus on the hurdles Bitcoin required to overcome on monthly timeframes.

“Already a clear, crisp BTC rejection in the eco-friendly ~$19800 level,” he authored inside a tweet concerning the approaching monthly candle close:

“Continued see-sawing around this level isn’t surprising as $BTC approaches its Monthly Close. Most significant is going to be the way the Monthly Candle really closes in accordance with the eco-friendly Range Low.”

Rekt Capital added that the close below that eco-friendly line means an exit in the monthly range in position since late 2020.

Betting on bears bowing out

Discussing once the bear market of 2022 could finish, opinions differed over using data from previous halving cycles.

Related: More ancient Bitcoin leaves its wallet after 10-year hibernation

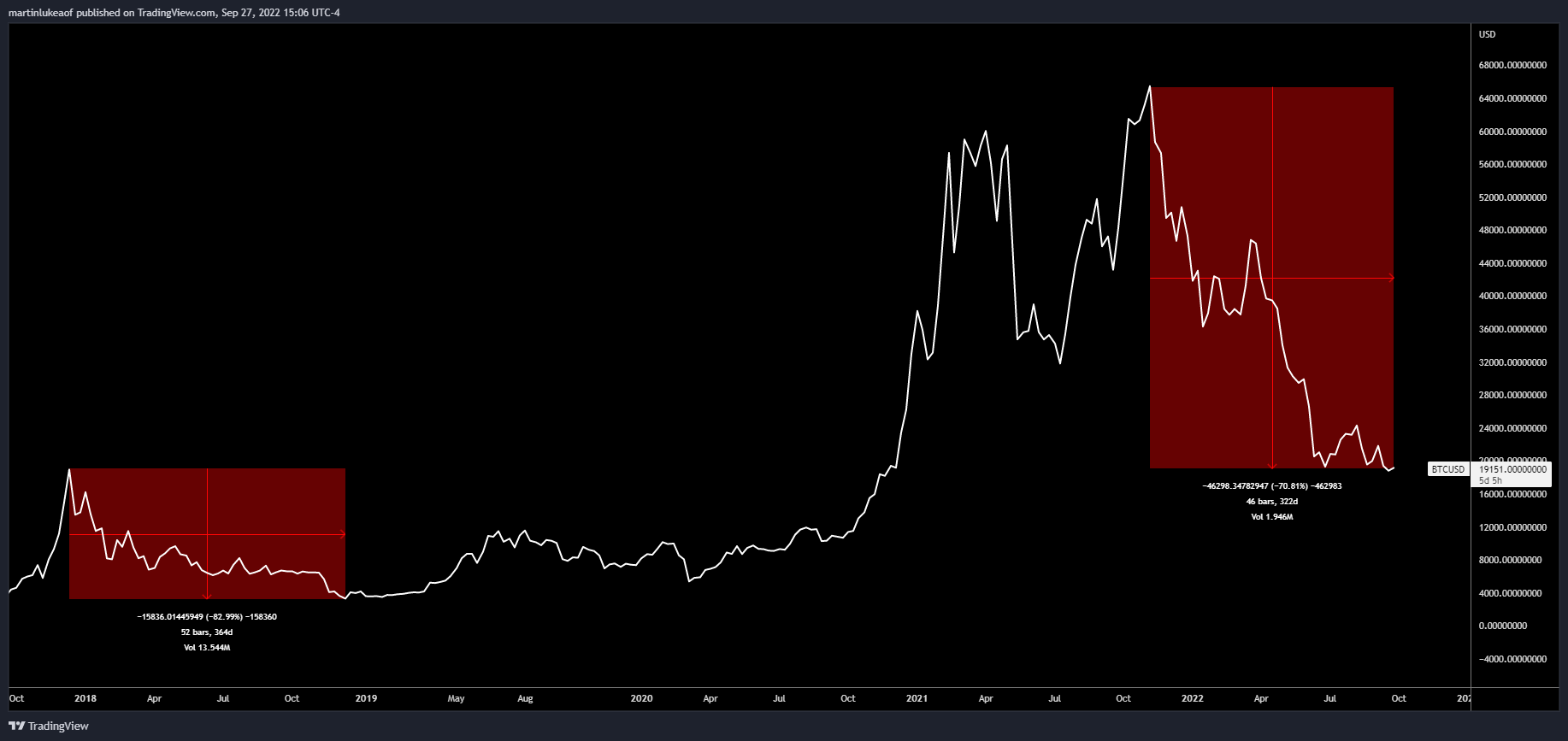

Uploading a comparative chart, Luke Martin, host from the STACKS Podcast, noted that it absolutely was 322 days since Bitcoin’s last all-time a lot of $69,000.

Following the 2017 prior all-time high, BTC/USD spent 364 days inside a bear market, suggesting the finish might be due if history would repeat itself.

“Cycle timing here’s optimal,” Charles Edwards, creator of crypto asset manager Capriole, reacted.

Others were less convinced, with tedtalksmacro drawing attention that the macro atmosphere was nothing beats it had been in 2018, something Martin acknowledged.

As Cointelegraph reported, the U . s . States Fed has provided no dedication to halting the eye rate hikes pressuring risk assets, including crypto, this season.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.