Bitcoin (BTC) starts a brand new week inside a precarious place as global macro instability dictates the atmosphere.

After sealing an every week close just inches above $19,000, the biggest cryptocurrency still lacks direction as nerves heighten within the resilience from the global economic climate.

A week ago demonstrated a testing here we are at risk asset investors, with gloomy economic data flowing in the U . s . States and, furthermore, Europe.

The eurozone thus offers the backdrop towards the latest concerns of market participants, who’re watching because the financial buoyancy of major banks is known as into question.

Using the war in Ukraine only escalating and winter approaching, it’s possibly understandable that hardly anybody is positive — what is the impact perform Bitcoin and crypto?

BTC/USD remains below its prior halving cycle’s all-time high, so that as comparisons towards the 2018 bear market flow in, also is talk of the new multi-year low.

Cointelegraph analyzes five BTC cost factors to look at within the future, with Bitcoin still firmly below $20,000.

Place cost avoids multi-year low weekly close

Regardless of the bearish mood, Bitcoin’s weekly close might have been worse — just above $19,000, the biggest cryptocurrency were able to give a modest $250 to last week’s closing cost, data from Cointelegraph Markets Pro and TradingView shows.

That prior close had nevertheless been the cheapest since November 2020 on weekly timeframes, and therefore, traders still fear the worst is yet in the future.

“The bears continued to be under way yesterday throughout the Asian, as the bulls unsuccessful to provide us worthwhile rallies to operate off on,” popular trader Crypto Tony authored partly of the Twitter at the time.

Others agreed having a summary that figured that BTC/USD is at a “low volatility” zone, which may necessitate an outbreak eventually. Everything remained was to select the direction.

“Next big move expires,” Credible Crypto responded:

“Typically just before these major moves after capitulation we have seen a time period of low volatility prior to the newest move begins.”

As Cointelegraph reported, the weekend had been tipped to give a boost of volatility as recommended by Bollinger Bands data. This came hands in hands with rising volume, a vital component in sustaining a possible move.

“Weekly chart BTC shows an enormous elevated volume forever from the third quarter + weekly bullish divergence on probably the most reliable periods,” fellow buying and selling account Physician Profit concluded:

“Bitcoin cost increase is only a matter of time.”

Not everybody eyed an impending comeback, however. In predictions over the past weekend, meanwhile, trader Il Capo of Crypto gave the region between $14,000 and $16,000 like a longer-term target.

“If it was the actual bottom… bitcoin ought to be buying and selling near to 25k- 26k right now,” buying and selling account Profit Blue contended, showing a chart having a double bottom structure potentially within the making around the 2-day chart.

Credit Suisse unnerves as dollar strength goes nowhere

Beyond crypto, attention is coalescing round the fate of major global banks, particularly Credit Suisse and Deutsche Bank.

Worries over liquidity led to emergency public reassurances in the Chief executive officer from the former, with executives apparently spending the weekend calming major investors.

Bank failures really are a sore place for underwater hodlers — it had been government bailouts of lenders in 2008 which initially spawned Bitcoin’s creation.

With history more and more searching to rhyme nearly 15 years later, the loan Suisse saga isn’t going undetected.

“We can’t see inside CeFi firm Credit Suisse JUST LIKE we’re able to avoid seeing within CeFi firms Celsius, 3AC, etc.,” entrepreneur Mark Jeffery tweeted at the time, evaluating the problem towards the crypto fund meltdowns captured.

For Samson Mow, Chief executive officer of Bitcoin startup JAN3, the present atmosphere could yet give Bitcoin it is time to shine inside a crisis rather of remaining correlated with other risk assets.

“Bitcoin cost has already been pressed lower towards the limit, well below 200 WMA,” he contended, talking about the 200-week moving average lengthy lost as bear market support.

“We’ve had contagion from UST/3AC and leverage flushed already. BTC is massively shorted like a hedge. Even when Credit Suisse / Deutsche Bank collapse & trigger an economic crisis, can’t see us going reduced.Inches

Nevertheless, with instability already rampant through the global economy and geopolitical tensions only growing, Bitcoin financial markets are voting using their ft.

The U.S. dollar index (DXY), still just three points off its latest twenty-year highs, is constantly on the circle around for any potential rematch after restricting corrective moves in recent days.

Searching further out, macroeconomist Henrik Zeberg repeated an idea that sees DXY temporarily losing ground inside a major boost for equities. This, however, wouldn’t last.

“In early 2023 DXY will once more rally with target of ~120. This is Deflationary Bust – and Equities will crash inside a bigger bust than during 2007-09,” he authored partly of the tweet:

“Largest Deflationary Bust since 1929.”

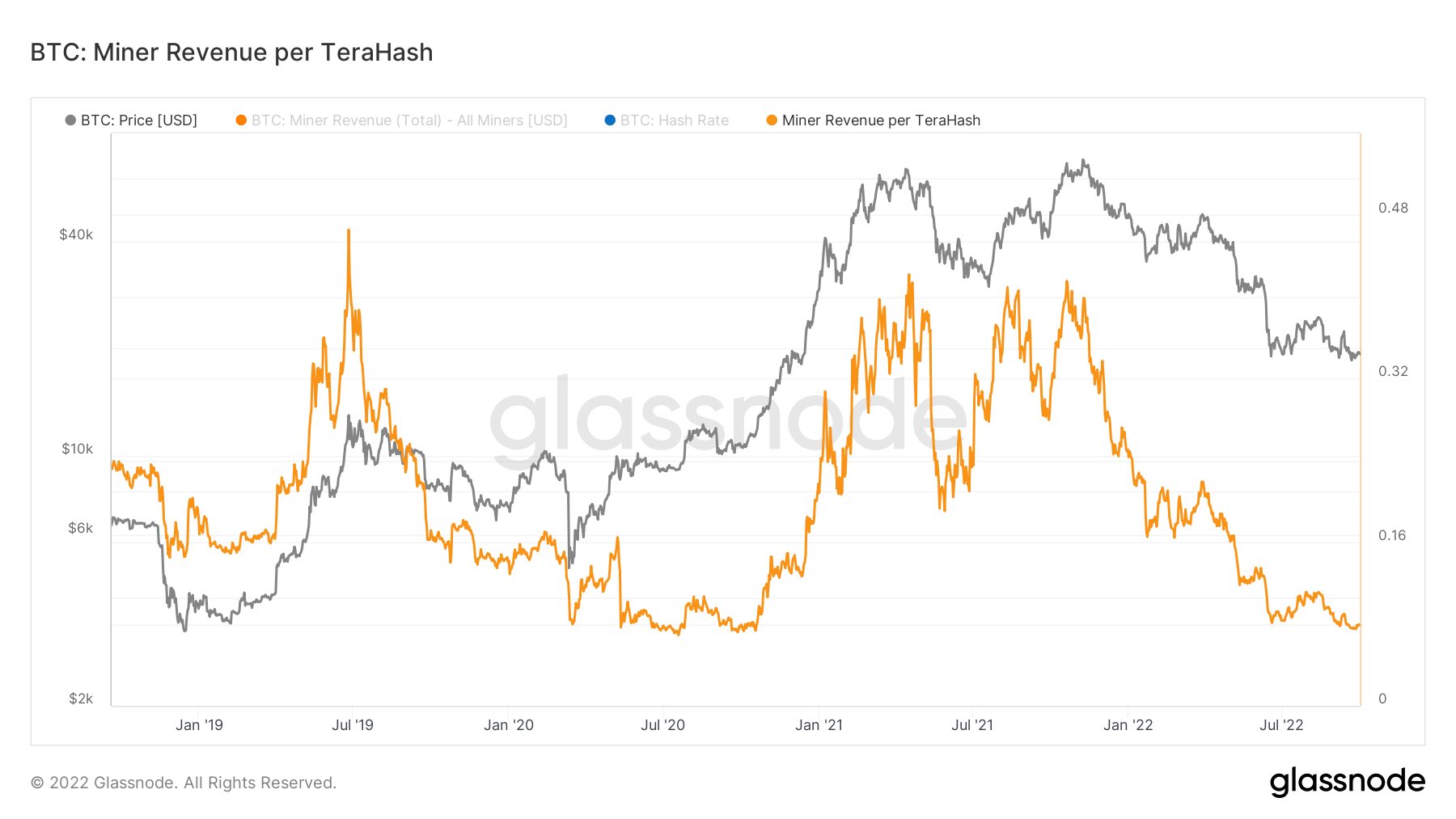

Miner revenue measure gets near all-time low

With Bitcoin cost suppression grinding on, it’s under surprising to determine miners find it difficult to maintain profitability.

At some point in September, monthly selling from miners was more than 8,500 BTC, even though the dpi subsequently cooled, data implies that for a lot of, everything is precarious.

“Bitcoin miner revenue per TeraHash around the edge ever lows,” Dylan LeClair, senior analyst at digital asset fund UTXO Management, revealed in the weekend:

“Margin squeeze.”

The scenario is definitely an interesting one for that mining ecosystem, which presently deploys more hash rate than at just about any amount of time in history.

Estimates from monitoring resource MiningPoolStats place the current Bitcoin network hash rate at 261 exahashes per second (EH/s), only marginally underneath the all-time a lot of 298 EH/s observed in September.

Competition among miners also remains healthy, as evidenced by difficulty adjustments. While seeing its first decrease since This summer a week ago, difficulty is placed to include an believed 3.7% in seven days’ time, taking it to new all-time highs of their own.

Nevertheless, for economist, trader and entrepreneur Alex Krueger, it might yet be premature to breathe a sigh of relief.

“Bitcoin hash rate hitting in history highs while cost goes lower is really a occur as opposed to a reason for celebration,” he authored inside a thread concerning the miner data recently:

“As miner profitability will get squeezed, likelihood of another round of miner capitulation increase in case of a downmove. But hopium never dies.”

GBTC “discount” hits new all-time low

Echoing the institutional exodus from BTC exposure this season, the space’s largest institutional investment vehicle has not been this type of bargain.

The Grayscale Bitcoin Trust (GBTC), which within the good occasions traded far beyond the Bitcoin place cost, has become on offer at its greatest-ever discount to BTC/USD.

Based on data from Coinglass, on Sep. 30, the GBTC “Premium” — now, actually, a price reduction — hit -36.38%, implying a BTC cost of just $11,330.

The Premium has been negative since Feb 2021.

Analyzing the information, Venturefounder, a cause of on-chain analytics platform CryptoQuant, described the GBTC drop as “absolutely wild.”

“Yet still no manifestation of GBTC discount bottoming or reversing,” he commented:

“Institutions aren’t even biting for $12K BTC (locked for six several weeks).”

Cointelegraph has lengthy tracked GBTC, with owner Grayscale trying to get legal permission to transform and launch it as being a place exchange-traded fund (ETF) — something still forbidden by U.S. regulators.

For that meantime, however, the possible lack of institutional appetite for BTC exposure is one thing of the elephant within the room.

“Objectively, I’d say there isn’t much curiosity about $BTC from U.S. based institutional investors until $GBTC starts getting bid nearer to internet asset value,” LeClair authored a week ago.

Charting Bitcoin’s “max pain” scenario

Even though it is reliable advice that the fresh Bitcoin cost drop would cause many a hodler to question their investment strategy, it remains seen whether this bear market will copy individuals that have gone before.

Related: Analyst on $17.6K BTC cost bottom: Bitcoin ‘not there yet’

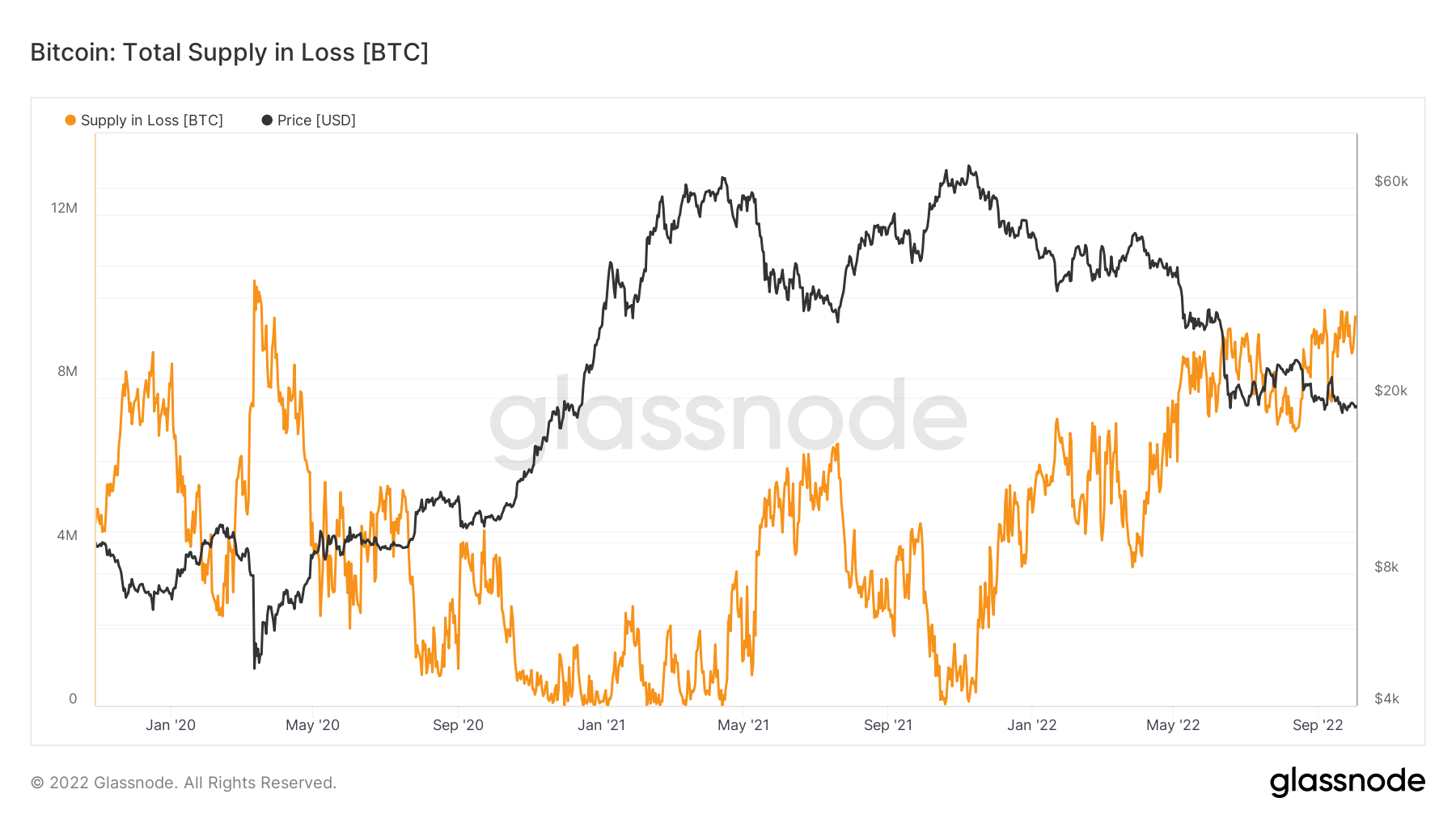

For analyst and statistician Willy Woo, creator of information resource Woobull, the following bottom will have a close relationship with hodler capitulation.

Formerly in Bitcoin’s history, bear market bottoms were supported by a minimum of 60% from the BTC supply being traded baffled.

To date, the marketplace has almost, although not quite, copied that trend, leading Woo to summarize that “max pain” can always be nearby.

“This is an excellent method of visualising maximum discomfort,” he authored alongside certainly one of his charts showing underwater supply:

“Past cycles bottomed when approximately 60% from the coins traded below their purchase cost. Can we hit it can? I do not know. The dwelling of the market now is extremely different.”

According to on-chain analytics firm Glassnode, by March. 2, 9.52 million BTC had been held baffled. Recently, the metric in BTC terms hit its greatest since March 2020.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.