Bitcoin (BTC) fell around the 12 ,. 9 Wall Street open as U . s . States economic data made an appearance to dissatisfy markets.

Attention turns to Bitcoin versus. CPI “big trigger”

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD dipping in the future nearer to $17,000 after passing the amount overnight.

The happy couple reacted badly to U.S. Producer Cost Index (PPI) data, which despite being above expectations still beat the readout in the month prior.

“Bit of the over reaction towards PPI, that has been shedding considerably from recently, but under expected,” Michaël van de Poppe, founder and Chief executive officer of buying and selling firm Eight, responded.

Van de Poppe, like others, noted the crux of macro cues will come in a few days by means of Consumer Cost Index (CPI) print for November.

“CPI in a few days may be the big trigger, much like it had been earlier this year,” he added.

CPI might be a seminal point, buying and selling firm QCP Capital ongoing, as though it would continue its downward trend, markets could get a level more powerful conviction over lower inflation greeting 2012.

The Government Reserve’s Federal Open Market Committee (FOMC) meeting days later, where policymakers choose rate of interest hikes, should add fuel towards the fire.

“Tuesday’s CPI will all over again be ‘the most significant CPI release ever’, this time around since the market has arrange it to get along with its epic 2-month short squeeze rally,” QCP authored inside a market update at the time.

“At the FOMC, Given people will release their updated projections of inflation and rates of interest. Markets will concentrate on where they forecast inflation the coming year, in addition to where they see rates in 2023 and 2024. These two occasions would be the last remaining hurdles for that rally into year-finish.”

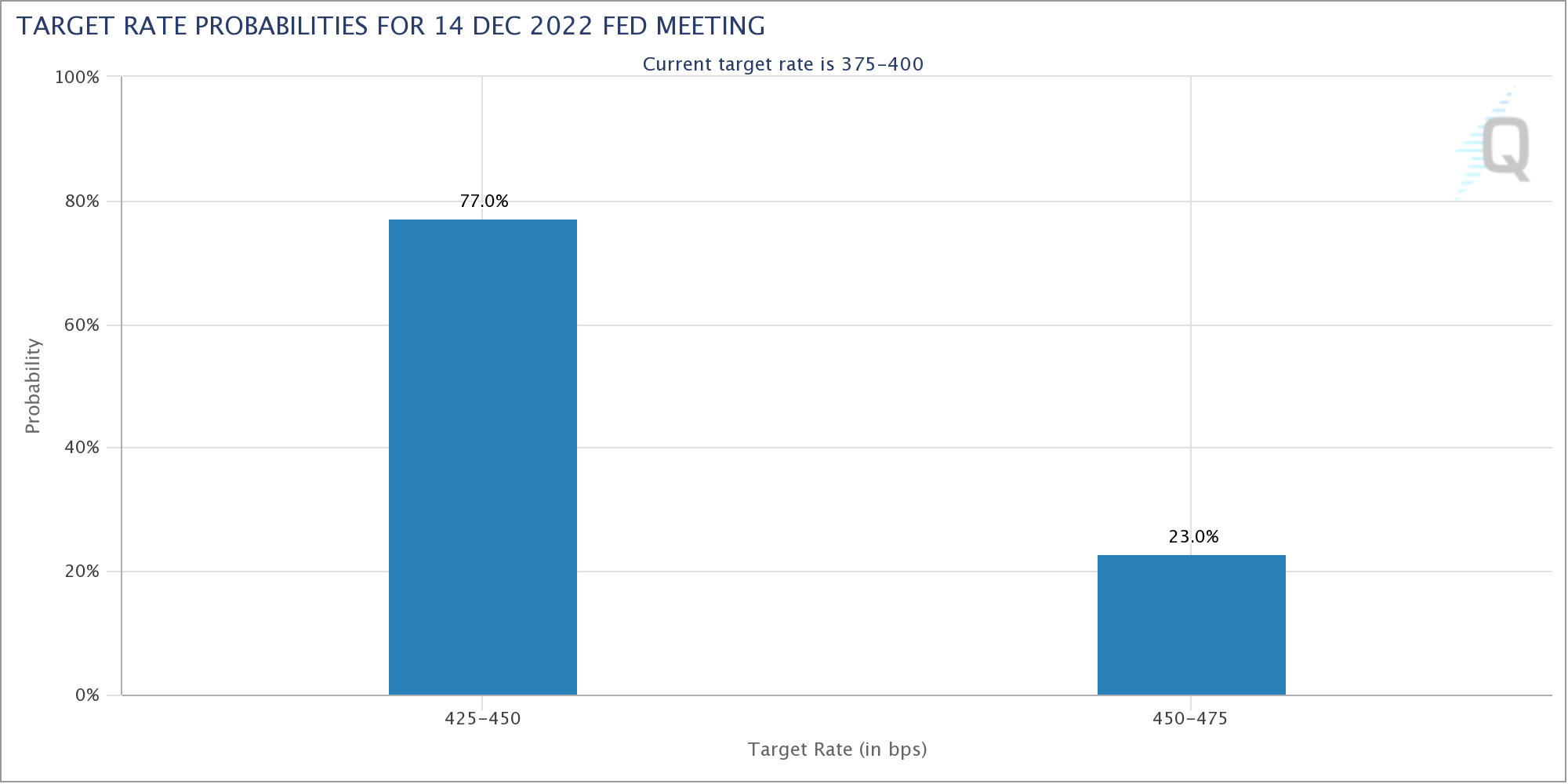

Analysts acknowledged when CPI would dissatisfy, it might potentially “invalidate” the stocks rally to date. A 50-basis-point rate hike were built with a 77% possibility of occurring, based on CME Group’s FedWatch Tool.

U.S. dollar catches a rest

U.S. equities were flat following the first hour’s buying and selling, with PPI failing to create a significant dent in performance.

Related: GBTC ‘elevator to hell’ sees Bitcoin place cost approach 100% premium

For macro economist and stocks analyst James Choi, ps3 slim be anticipated, since Given had been thinking about reducing the pace of their rate hikes.

“The Given already pivoted its course. Today’s PPI will not create a dent to Powell’s plan. It’s 50bp in a few days, then there you have it,” he forecast, also stating that his calculations predicted a “much, reduced” CPI studying than many believed.

Meanwhile, U.S. dollar strength also simmered, the U.S. dollar index (DXY) working to make up for that previous day’s lost ground on the rear of PPI.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.