Bitcoin (BTC) made probably the most of weekend volatility on June 26 like a squeeze saw BTC/USD achieve its greatest in more than a week.

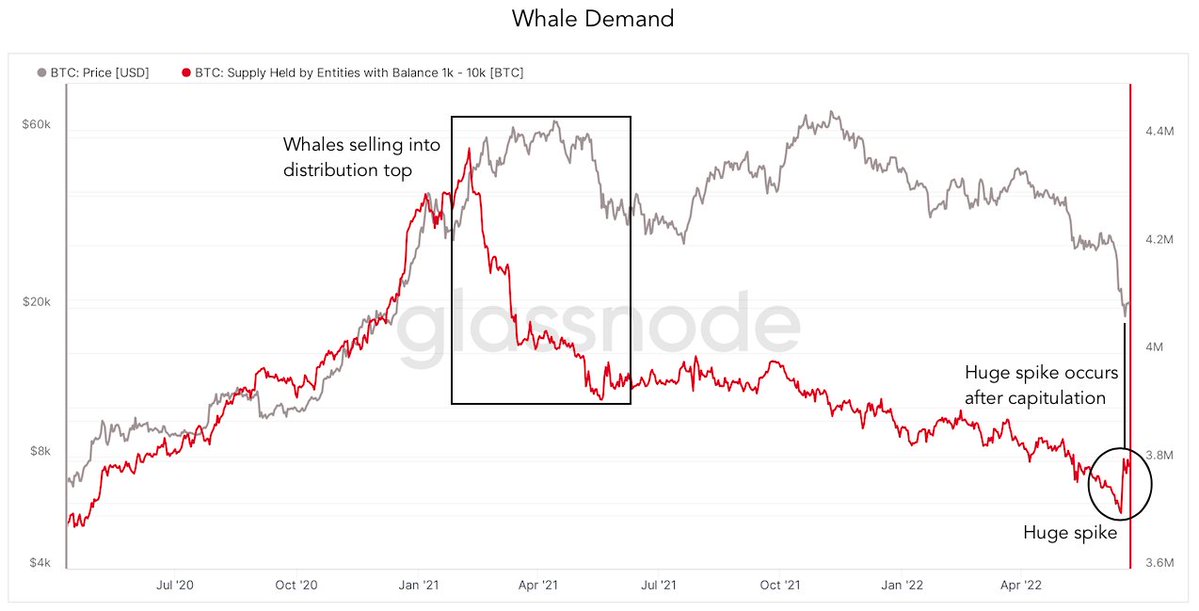

“Unusual whale activity” flagged

Data from Cointelegraph Markets Pro and TradingView followed the biggest cryptocurrency because it hit $21,868 on Bitstamp.

Just hrs in the weekly close, a reversal then occur under $21,500, Bitcoin still lined up to close its first “eco-friendly” weekly candle since May.

The big event adopted warnings that volatile conditions both up and lower could return during low-liquidity weekend buying and selling. On-chain data nevertheless fixed what made an appearance to become buying by Bitcoin’s largest-volume investor cohort before the uptick.

“Unusual whale activity detected in Bitcoin,” popular analytics resource Bet on Trades observed.

“The availability held by entities with balance 1k-10k BTC just saw an enormous spike sought after. Let’s watch when the trend confirms.”

An associated chart from on-chain analytics firm Glassnode demonstrated shifting up markedly from at about the time BTC/USD hit lows of $17,600 this month.

As Cointelegraph reported, whales had eagerly purchased BTC below $20,000, developing new support clusters along the way.

CME futures gap looms large

For other people, however, conservative thoughts about cost action continued to be standard.

Related: Bitcoin gives ‘encouraging signs’ — Watch these BTC cost levels next

Cointelegraph contributor Michaël van de Poppe eyed the necessity to crack $21,600 for sure to be able to secure the likelihood of further upside. Furthermore, last week’s closing cost of $21,100 on CME Group’s Bitcoin futures could give a short-term target.

“Standard weekend fake-outs happening and most likely ending at CME close at $21.1K for Bitcoin,” he forecast at the time.

“No obvious breakout above $21.6K at this time, yet.”

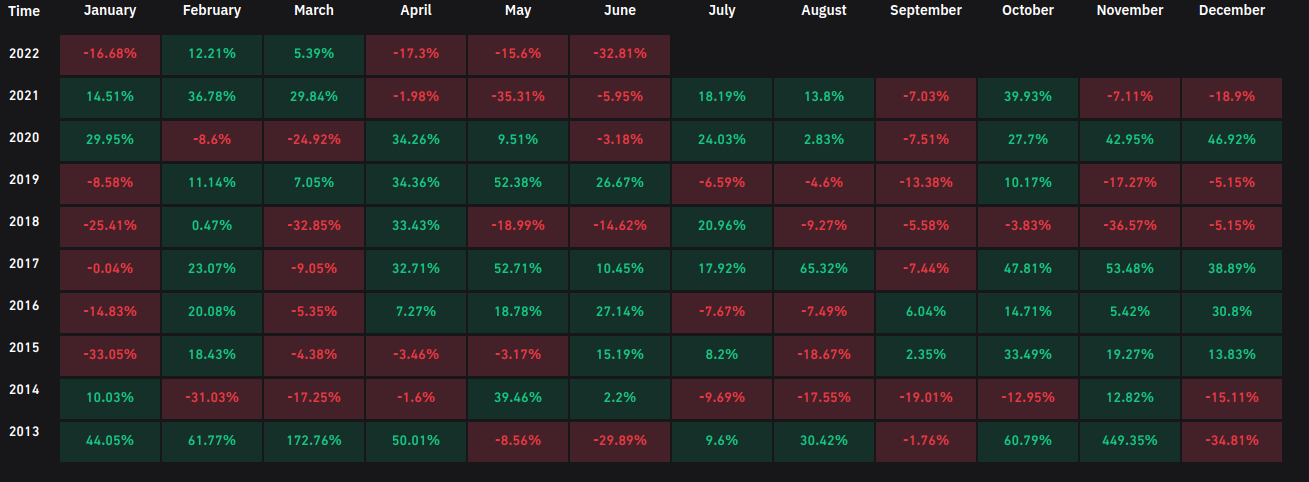

The monthly close was still being on target to cement Bitcoin’s worst June on record with monthly losses of just about 33%.

Together with May 2021, this could be also the worst-performing month since prior to the 2018 bear market bottom, data from on-chain monitoring resource Coinglass confirms.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.