Bitcoin (BTC) sellers are nursing their largest overall losses since March 2020, one on-chain metric suggests.

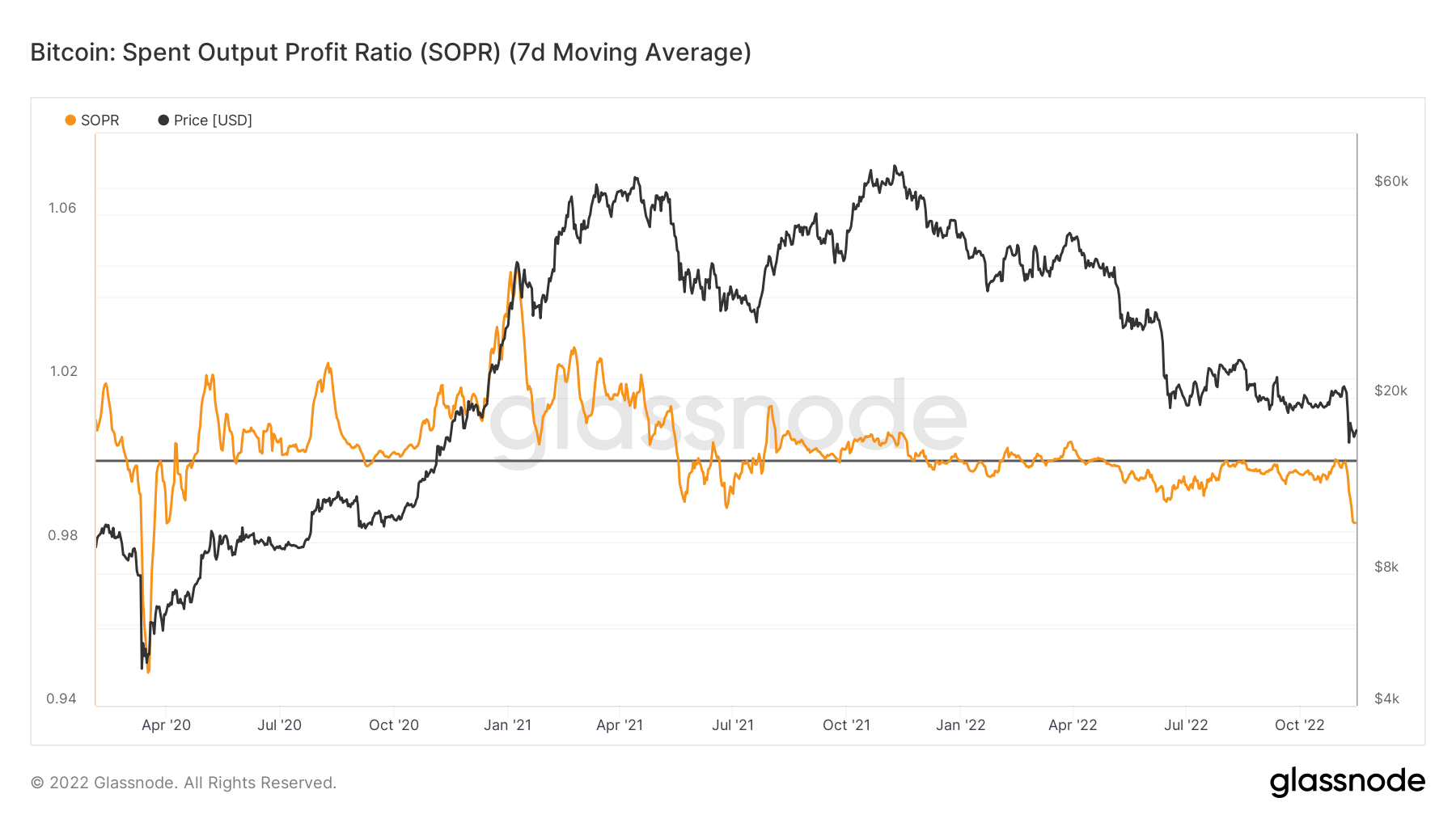

Data from on-chain analytics firm Glassnode confirms that Bitcoin’s spent output profit ratio (SOPR) has fallen to 2-year lows.

BTC on-chain losses mount

As Bitcoin holders make an effort to pull funds from exchanges into non-custodial wallets, individuals moving coins around do so at multi-year high losses.

SOPR divides the recognized worth of coins inside a spent output by their value at creation. Quite simply, as Glassnode summarizes, “price offered / cost compensated.”

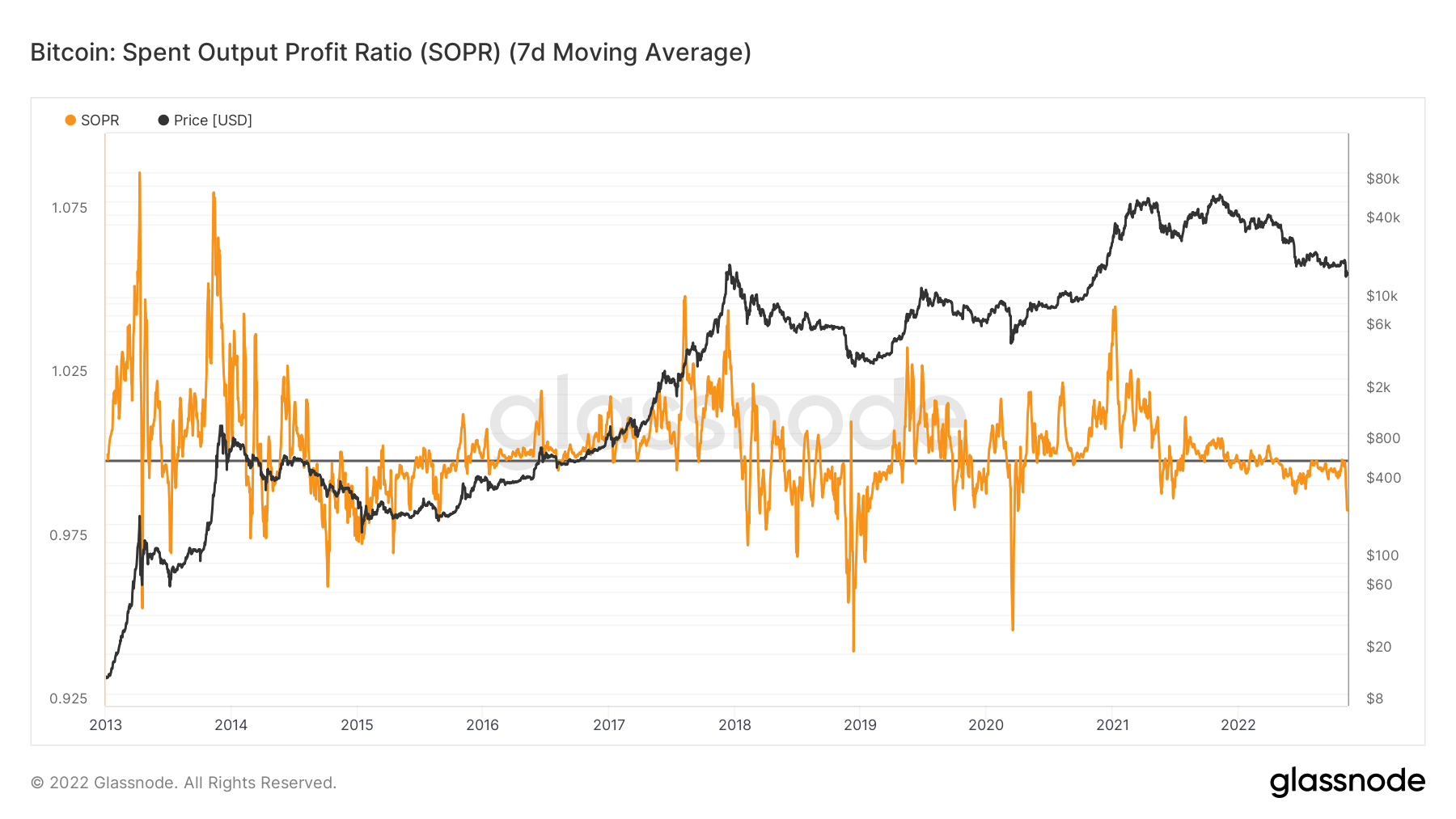

As Cointelegraph reported, SOPR fluctuates around 1, and is commonly below that much cla during Bitcoin bear markets and above it in bull markets.

This really is logical, as unrealized losses increase with the bear market phase, resulting in relatively bigger overall recognized losses once coins are offered.

As a result, the finish of bear markets has a tendency to see lower SOPR. By November. 14, the metric’s 7-day moving averag what food was in .9847 — its cheapest because the March 2020 COVID-19 mix-market crash.

SOPR has further implications for BTC cost action.

Should BTC/USD start gaining, hodlers may have a motivation to market at cost cost or slightly above to prevent losses. This can lead to a supply glut, which without buyers logically forces the cost lower again.

SOPR thus functions like a helpful forecasting tool for potential cost trends, with 1 once more to be the important line within the sand with regards to hodlers embracing sellers.

“Due towards the fundamental nature of underlying metrics which the SOPR depends on, it might be fair to take a position the Spent Output Profit Ratio is influencing cost changes,” Renatio Shirakashi, the metric’s creator, mentioned within an introduction into it in 2019.

“This could be of considerable significance, because most current indicators are lagging indicators.”

March 2020 briefly saw SOPR dip to simply .9486, still not as little as the finish from the 2018 bear market, which created a score of .9416.

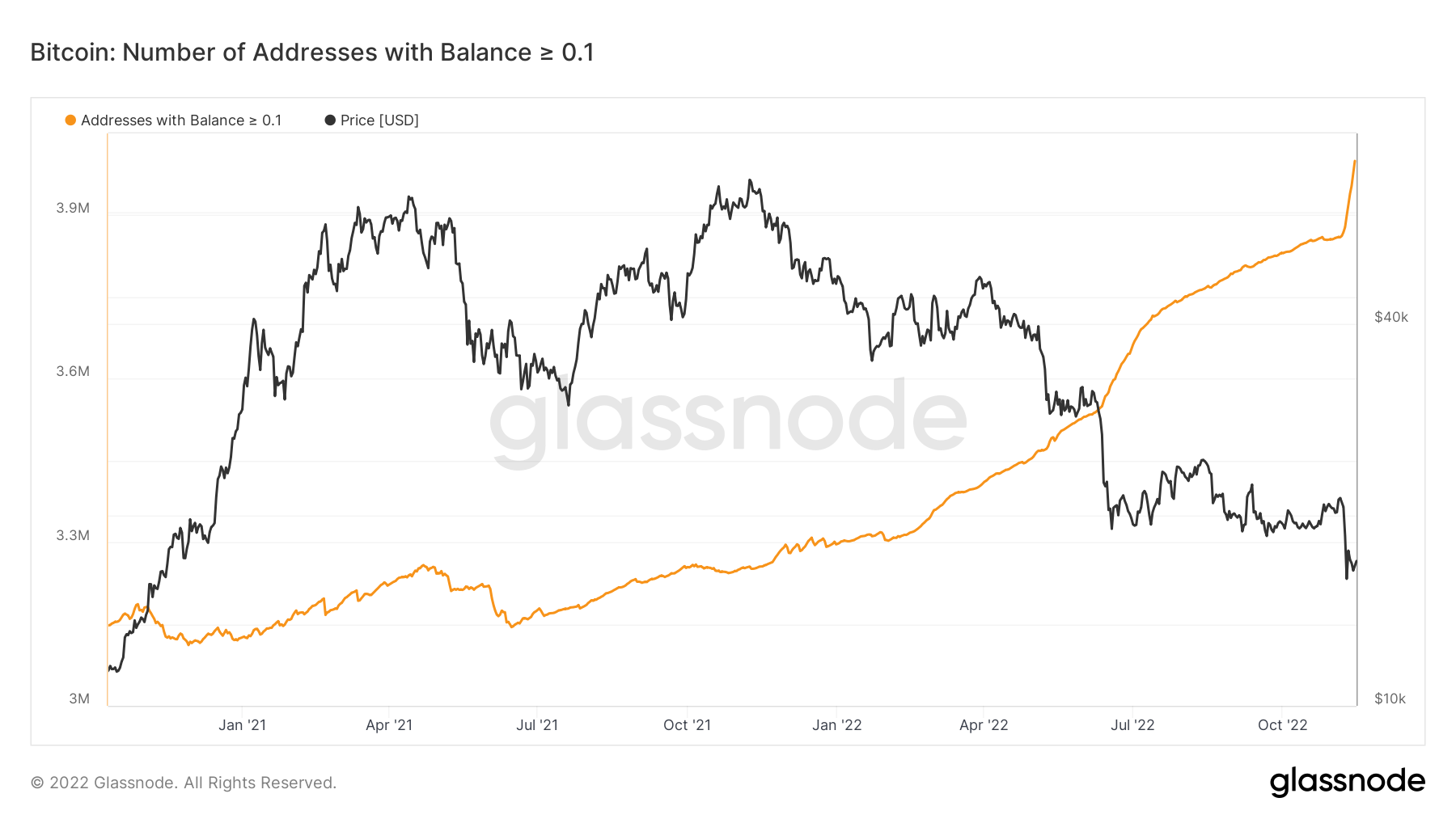

4 million wallets now hodl a minimum of .1 BTC

Meanwhile, individuals involved in “purchasing the dip” do so even in the tiniest level.

Related: Elon Musk states BTC ‘will make it’ — 5 items to know in Bitcoin now

Further Glassnode data implies that the amount of wallets that contains a minimum of .1 BTC ($1,700) has passed 4 million.

While almost constantly rising this season, the popularity saw reasonable acceleration as BTC/USD fell because of the FTX scandal.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.