The price of mining one Bitcoin (BTC) has fallen to 10-month lows as mining hardware gets to be more efficient, and difficulty has dropped 6.7% since its May peak.

On Wednesday, strategists from JPMorgan brought by Nikolaos Panigirtzoglou told investors that Bitcoin production costs have fallen close to $13,000 from $24,000 at the outset of June.

This is actually the cheapest it’s been since September 2021, based on the analysts citing a chart from Bitinfocharts, and may come as mining difficulty has fallen from the May highs of 31.25T to 29.15T.

Lower Bitcoin production costs could possibly ease miner selling pressure and improve profitability. However, the strategists remained as bearish, stating “the loss of the development cost may be regarded as negative for that Bitcoin cost outlook moving forward,” according to Bloomberg.

They added the production price is perceived by a few analysts because the lower bound for the BTC cost range inside a bear market. Several analysts have predicted BTC prices to fall close to $13,000, which may align using the 80%+ drawdowns in the last two bear markets. Bitcoin is presently buying and selling lower 70% from the November all-time high.

Bitcoin production cost peaked soon after the cost peaks in April and November 2021 and it has fallen back as markets did, so it’s correlated but lags cost movements.

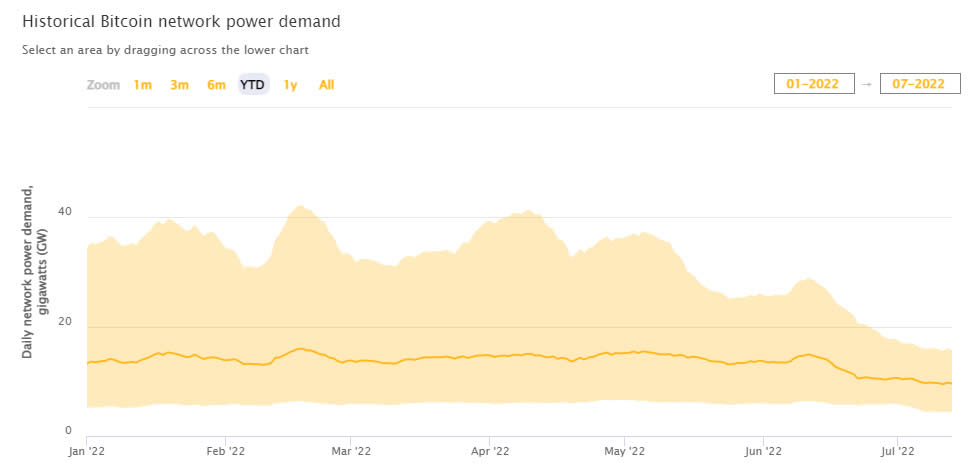

The stop by production cost continues to be associated with a loss of electricity consumption.

Cambridge University’s Bitcoin energy consumption index presently reports the network’s believed daily power demand is 9.59 Gigawatts. This can be a decline of 33% in the last month and it is lower 40% in the 2022 peak need for almost 16 GW in Feb.

Furthermore, a substantial quantity of miners have powered lower older and much more inefficient mining rigs because they have grown to be unprofitable to function because of surging energy prices along with a collapse in BTC prices.

Based on Asicminervalue, the Bitmain Antminer E9, just released this month, is among the most effective units available on the market, having a maximum hash rate of two.4Gh/s for any power use of 1,920 watts.

Related: Bitcoin miners sell their hodlings, and ASIC prices keep shedding — What’s next for that industry?

Around the switch side, miners happen to be hit using the double whammy of growing global energy prices and tanking BTC prices. It has caused mining profitability to slump by 63% forever of the season. Bitinfocharts reports that mining profitability is presently at its cheapest levels since October 2020 at $.095 each day per terahashes per second.

However, the autumn being produced cost prevents an additional fall in profitability and may even reverse that trend within the coming several weeks.