Crypto mining companies have experienced their stock values increase around 120% during the last month, among rebounding crypto asset prices, greater mining profitability and sharp increases in Bitcoin (BTC) production.

Crypto mining companies Marathon Digital Holdings at 124.12%, Core Scientific at 110.39%, Hut 8 at 98.95% and Riot Blockchain at 96.69% have experienced their stock values rocketing upward during the last 30-days, based on data from Yahoo Finance — considerably outperforming BTC with 18.% and Ether (ETH) with 67.8% asset prices.

Inside a Q2 results filing on Thursday, Core Scientific reported an astounding 1601% rise in self-found Bitcoin year-to-date, reaching 6,567 BTC. Q2 revenue rose 118% year-on-year to $164 million, driven by increases in digital mining revenue and hosting revenue.

Hut 8 Mining Corp. also saw its found Bitcoin increase within the quarter, up 71% when compared to prior-year period to as many as 946 found BTC because of “an rise in hash rate from additional highly efficient miners” and ramping of activities at its Ontario mining site. Its revenue also elevated in Q2, rising 30.7% year-on-year to $43.8 million.

Marathon Digital, which shared its Q2 results the 2009 week, also stated it’d elevated its Bitcoin production year-on-year, producing 707 BTC within the quarter despite a “challenging macro atmosphere,” by having an 8% rise in Bitcoin production activity.

The 3 companies, however, published widened losses, driven by impairment losses on their own crypto holdings.

The stock cost surge has additionally coincided with climbing crypto prices because the June and This summer slump, with key crypto assets including BTC and ETH gaining 18.% and 67.8%, correspondingly.

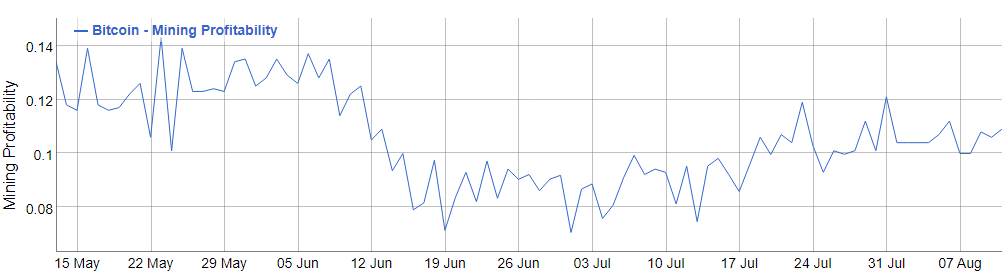

Bitcoin mining profitability has additionally rebounded from year-lows on June 19, according to Bitinfocharts.

Bitcoin mining companies have experienced to handle a quantity of factors in recent several weeks which have impacted BTC production and profitability, including lower asset prices and greater energy costs, that have been partly related to heat wave in Texas and also the Russia-Ukraine conflict.