Bitcoin (BTC) starts a brand new week fresh from the new multi-week low among coming back of highly nervous sentiment.

After dipping below $21,000 over the past weekend, the biggest cryptocurrency is consolidating around 10% less than the other day, and also the fear across crypto markets is clearly visible.

As some demand new lows yet others warns of the difficult couple of several weeks ahead, there’s plenty for bulls to deal with on lengthy and short timeframes

The U . s . States Federal Reserve’s annual Jackson Hole symposium arrives now, while September has already been because of form something of the showdown with regards to inflation and connected macro cost triggers.

That may mean fresh volatility across risk assets both during and prior, something weary investors won’ doubt not welcome after last week’s escapades on BTC/USD.

Related: three reasons why the Bitcoin cost bottom isn’t in

Simultaneously, miners are giving strong signals the worst has ended, using the hash rate beginning to rebound from the rare “capitulation” phase.

Knowing that, Cointelegraph takes a closer inspection at five market-moving topics pertinent to Bitcoin traders within the future and beyond.

All eyes on Jackson Hole

The U . s . States Fed is once more within the driving seat now with regards to potential macro cost triggers for risk assets.

Fresh from last week’s Federal Open Markets Committee (FOMC) meeting, Given officials, along with banking figures from around the globe, will meet for that annual Jackson Hole symposium on August. 25-27.

2010 gathering comes in a critical here we are at markets within the U.S. and additional afield. Inflation underneath the Fed’s jurisdiction seems to possess begun cooling, while elsewhere, the alternative story remains true.

The most recent U.S. inflation information is still days away, however that may not stop Given Chair Jerome Powell from giving strong hints regarding the way the Given will react, in addition to positioning expectations regarding future economic policy.

Knowing that, volatility could easily get both during and before the big event, making Jackson Hole a vital item to look at on traders’ radar.

“They are extremely centered on carrying this out partially simply because they messed up this past year using the whole ‘transitory’ factor, plus they understand that the main one factor they are able to do now’s tighten policy, which will slow inflation,” Kevin Cummins, chief U.S. economist at NatWest Markets in Stamford, Connecticut, told Bloomberg.

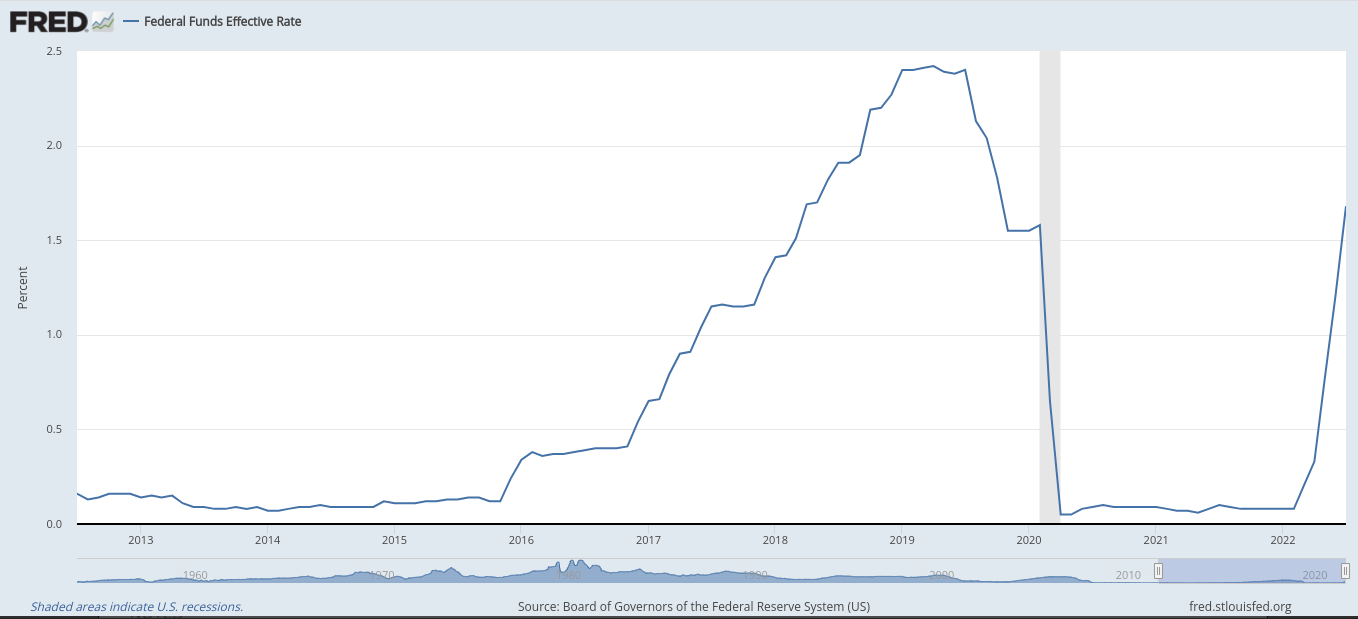

With this, it remains seen if the market will shift to favor another 75-basis-point funds rate hike in September or gravitate toward a lesser 50-point raise.

Inside a preview of their Jackson Hole comments circulating online, Bank of the usa stated it would “continue to consider 50bp rate hikes in September and November, along with an additional 25bp rate hike in December.”

Rate hikes by themselves present headwinds for risk assets and, consequently, give a challenge for Bitcoin and it is bid to flee strong correlation to asset classes for example U.S. equities.

BTC set for “ugly” six several weeks

Bitcoin were able to prevent major volatility over the past weekend, but nonetheless saw a brand new low for August as low-volume weekend buying and selling conditions highlighted market moves.

Following the sudden drawdown on August. 19, BTC/USD spent subsequent days eking out a minimal within an overall consolidation pattern, this ongoing during the time of writing.

The reduced came by means of a vacation to $20,770 on Bitstamp, with Bitcoin then adding $1,000 before coming back to trade roughly in the center of the 2 values.

The weekly close at $21,500 was difficult, marking the cheapest because the week of This summer 18 after last week’s candle cost bulls almost $3,000 or 11.6%.

Seems like $BTC getting ready to mind back below $20k soon.

Don’t get caught unawares.

— Ben Lance armstrong (@Bitboy_Crypto) August 21, 2022

With anxiety about a brand new low palpable among commentators, others contended that conditions weren’t positively pointing to help misery.

For Cointelegraph contributor Michaël van de Poppe, BTC/USD may cap any dip in the CME futures close from August. 19, this laying around $21,200. Harder for almost all the marketplace, he implied, could be gains, because of the overall bias for disadvantage to enter.

“Probably around CME open, i will be seeing markets drop to $21.2K as this is the close of Friday, after which things are fine,” he told Twitter supporters over the past weekend:

“Still not inclined i will be seeing new lows. The general duration of accumulation and high correction on Friday causes panic. Discomfort is around the upside.”

Zooming out, however, John Beamish, founding father of education suite The Rational Trader, left social networking without any illusions over how the remainder of 2022 should shape up for Bitcoin.

“Next 12-19 wks are destined to be ugly,” a part of a tweet read.

“Once done, the ground with this cycle needs to be in – then let us start it once again.”

Beamish came on experience with two prior crypto bear markets, having a comparative cost action chart suggesting the real macro low was not even close to set for BTC/USD.

Equally positive about a recovery over a longer time, however, was analyst Matthew Hyland, who contended that traders shouldn’t lose belief.

“The Bitcoin structure within the coming days/several weeks should not scare you. Whether greater low, double bottom, or cycle low is going to be created,” he summarized.

“The finish is near.”

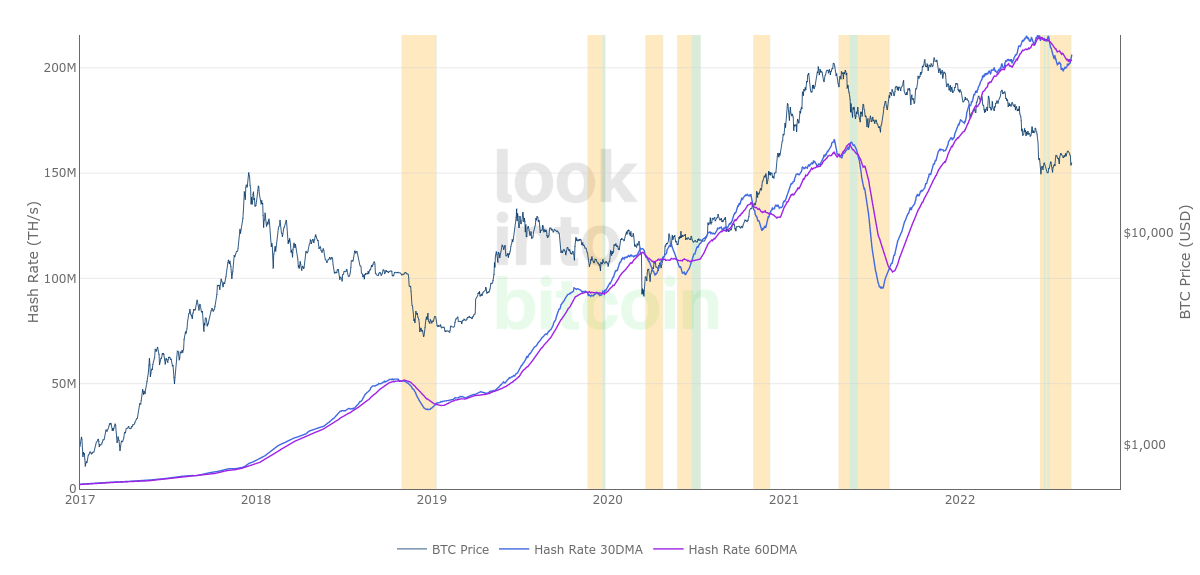

Hash ribbons show miners from capitulation phase

One number of Bitcoin network participants that an finish to hard occasions appears demonstrably near is miners.

Regardless of the latest cost drop, on-chain data now implies that Bitcoin miners en masse have exited a “capitulation” period lasting over two several weeks.

Based on the hash ribbons metric, which utilizes two moving averages of hash rate to find out miner participation trends, a rebound has become materializing.

The move continues to be lengthy anticipated. Earlier in August, mining firm Blockware forecast the hash ribbons capitulation phase to finish either this month or next.

The most recent shift was noted by Charles Edwards, Chief executive officer of asset manager Capriole, who compared 2010 capitulation with other people in Bitcoin’s history.

“The Bitcoin miner capitulation has formally ended today, which makes it the next longest capitulation ever at 71 days,” he authored inside a Twitter thread:

“This capitulation zone was more than 2021, and merely 2 days shorter than 2018’s where cost touched $3.1K.”

A glance at hash rate estimates from monitoring resource MiningPoolStats shows that the uptick above 200 exahashes per second (EH/s) likely started in recent days.

“Historically, Bitcoin’s miner capitulations have taken major cost lows and been great buy-signals,” Edwards ongoing, echoing the classic Bitcoin market mantra, “price follows hash rate:”

“Miner capitulations that occur late cycle (a minimum of 24 months after halving) after cycle tops happen to be probably the most lucrative lengthy-term signals (eg. 2012, 2015, 2018).”

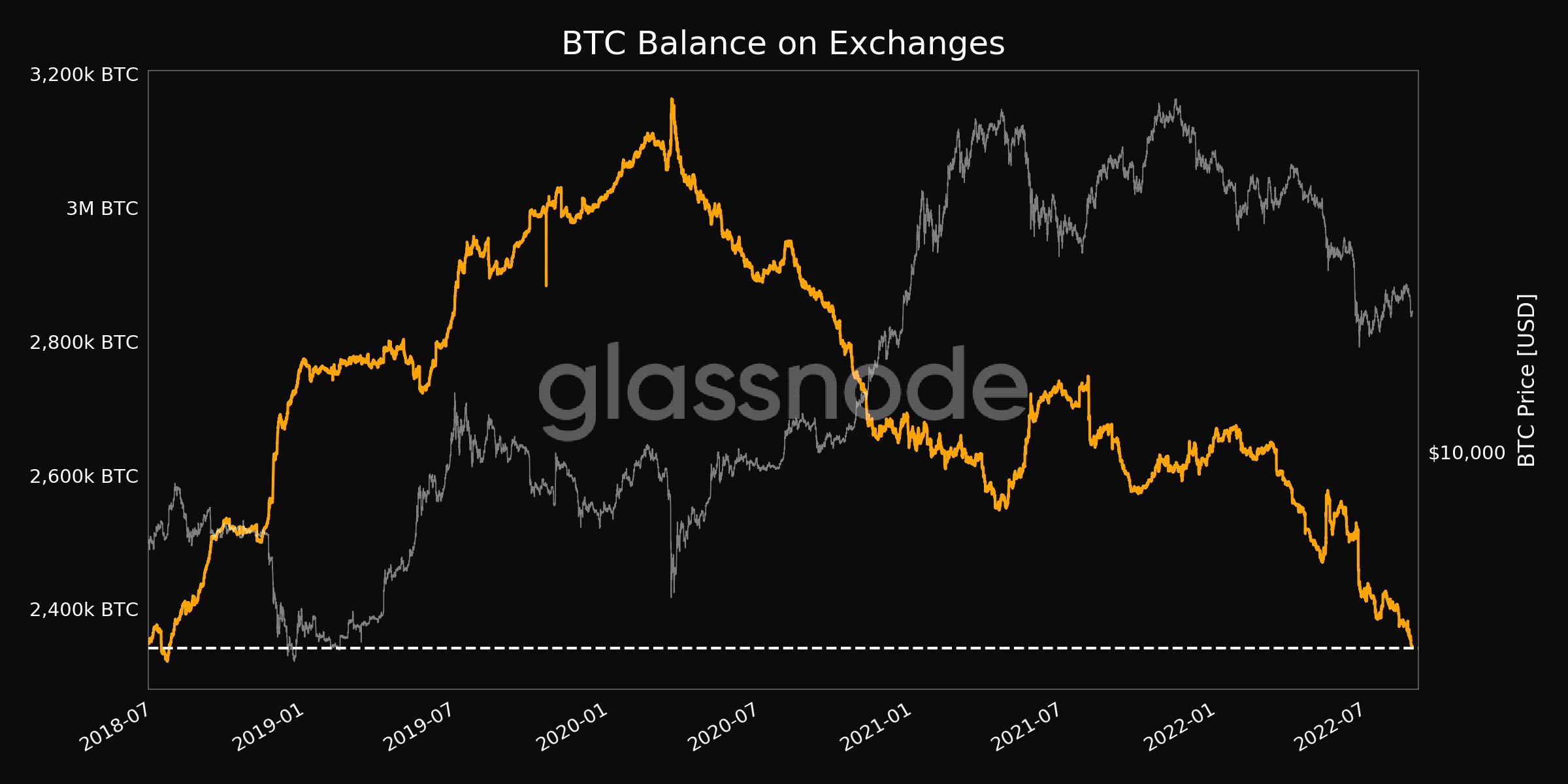

Exchange balances hit new 4-year lows

Cost struggles on short timeframes are actually something of the non-problem for buyers now.

Behind the curtain, investors, rather of fleeing BTC exposure, happen to be piling in to the market in a noticeable pace in recent days.

According to data from on-chain analytics platform CryptoQuant, from August. 18, available Bitcoin on 21 major exchanges dropped from 2,342,662 BTC to two,309,727 BTC on August. 22.

In four days, exchange users thus removed over 30,000 BTC using their accounts.

Fellow data firm Glassnode, meanwhile, added the current combined balance over the exchanges it monitors hit a brand new four-year have less August. 22.

To compare, in August 2018, BTC/USD was climbing toward $7,000, but nonetheless several several weeks from its bear market bottom of $3,100.

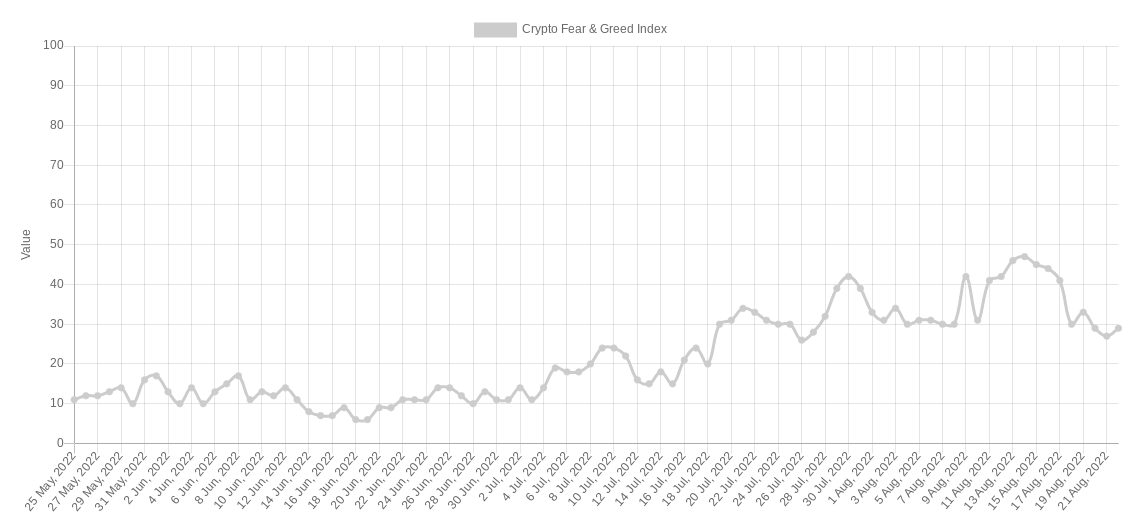

Sentiment gauge drops 40% per week

When compared with prior to the cost drop, meanwhile, sentiment isn’t what it really was on crypto.

Related: Here’s 5 cryptocurrencies with bullish setups which are near an outbreak

Even while exchanges see an acceleration in BTC departing their books, the general picture has become firmly certainly one of “fear” with regards to Bitcoin and altcoin investors.

Based on the Crypto Fear & Avarice Index, which utilizes a gift basket of things to provide a normalized score for market sentiment, “extreme fear” is simply a step away.

At 29/100, the Index is four points off coming back to the extreme fear bracket, getting hit 27/100 over the past weekend.

The second represents a small amount of 40% in one week — 7 days prior, the Index what food was in 45/100, recording its most positive levels since April.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.