Senior commodity strategist at Bloomberg Intelligence, Mike McGlone, mentioned October has in the past been the very best month for Bitcoin (BTC) since 2014, averaging gains of approximately 20% for that month, which goods appearing to peak could imply Bitcoin has arrived at its bottom.

Within an March. 5 Bloomberg Crypto Outlook report, McGlone says as the rise of great interest rates globally is putting downwards pressure of all assets, Bitcoin is gaining top of the hands in comparison with goods and tech stocks like Tesla, using the report noting:

“When the ebbing economic tide turns, we have seen the tendency resuming for Bitcoin, Ethereum, and also the Bloomberg Universe Crypto Index to outshine most major assets.”

McGlone notes that Bitcoin has its own cheapest ever volatility from the Bloomberg Commodity Index, which tracks the cost movements of worldwide goods for example gold and oil, and shows that in the past Bitcoin volatility is more prone to recover when compared with goods once the crypto heads to new highs.

McGlone recommended the 2nd 1 / 2 of 2022 often see Bitcoin “shift toward being a risk-off asset, like gold and US Treasury’s,” following low volatility throughout September along with a potential peak in commodity prices.

Previously, Bitcoin continues to be highly correlated with tech stocks, using its volatility which makes it a dangerous asset that traders will probably sell within an atmosphere where investors are searching to lessen risk.

Related: 5 explanations why Bitcoin might be a better lengthy-term investment than gold

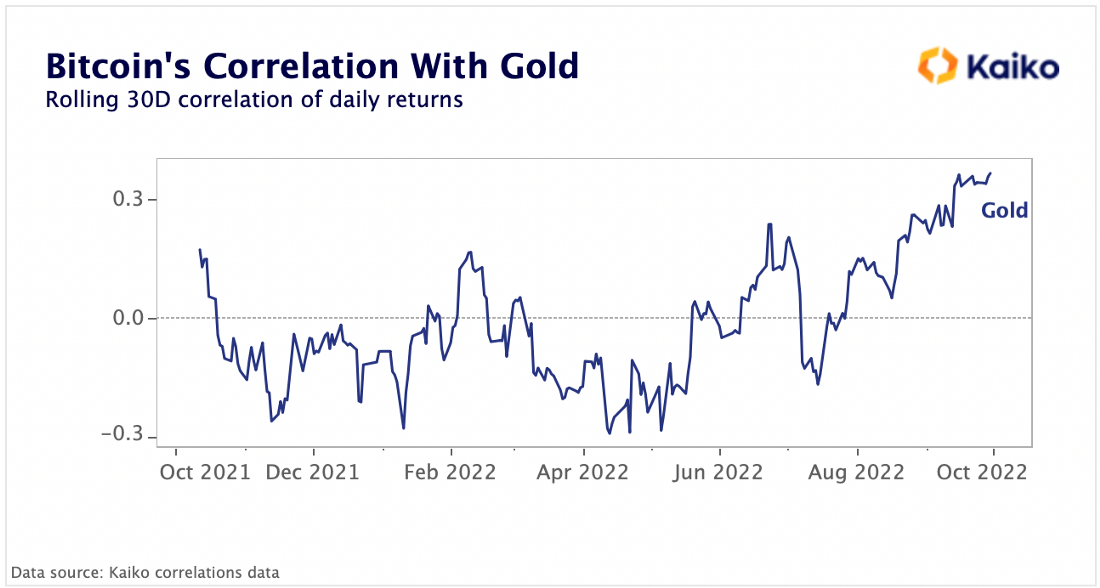

Kaiko Research data released on March. 4 supports the concept Bitcoin might be transitioning to acting a lot more like “digital gold,” with Bitcoin’s correlation to gold hitting its greatest level in at least a year at +.4 carrying out a strengthening from the U . s . States dollar as rates of interest rise.

A correlation of +1. implies that the movement between two different assets is synonymous, for instance a 10% rise in gold could be matched with a 10% rise in Bitcoin if the two assets possess a correlation of +1..