Bitcoin (BTC) briefly broke above $24,000 on This summer 20, however the excitement lasted under two hrs following the level of resistance demonstrated tougher than expected. An optimistic would be that the $24,280 high represents a 28.5% increase in the This summer 13 swing low at $18,900.

Based on Yahoo Finance, on This summer 19, the financial institution of the usa printed its latest fund managers survey, and also the headline was “I am so bearish, I am bullish.” The report reported investors’ pessimism, expectations of weak corporate earnings and equity allocations staying at the cheapest level since September 2008.

Some.6% advance around the tech-heavy Nasdaq Composite Index between This summer 18 and 20 also provided the required expect bulls to learn in the approaching This summer 22 weekly options expiry.

Global macroeconomic tensions eased on This summer 20 after Russian President Vladimir Putin confirmed intends to improve the Nord Stream gas pipeline flow following the current maintenance period. However, throughout the final couple of several weeks, data implies that Germany has reduced its reliance upon Russian gas from 55% to 35% of their demand.

Bears placed their bets at $21,000 or lower

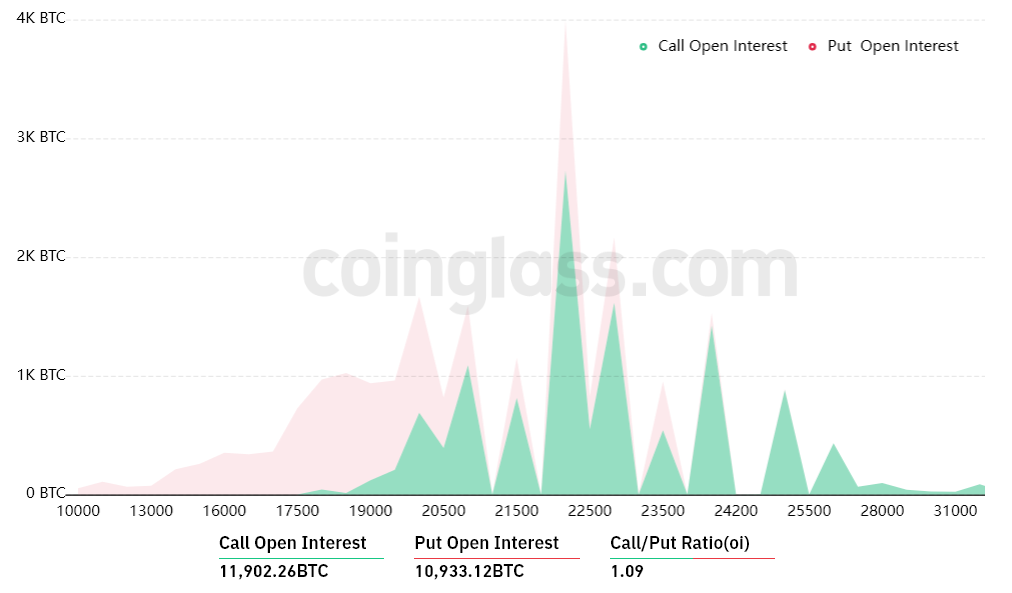

Outdoors interest for that This summer 22 options expiry is $540 million, however the actual figure is going to be lower since bears happen to be caught unexpectedly. These traders didn’t expect a 23% rally from This summer 13 to Ju20 as their bets targeted $22,000 minimizing.

The Fir.09 call-to-put ratio shows the total amount between your $280 million call (buy) open interest and also the $260 million put (sell) options. Presently, Bitcoin stands near $23,500, meaning most bearish bets will probably become useless.

If Bitcoin’s cost remains above $22,000 at 8:00 am UTC on This summer 22, only $$ 30 million price of these put (sell) options is going to be available. This difference is really because the authority to sell Bitcoin at $22,000 is useless if BTC trades above that much cla on expiry.

Bears strive for $24,000 to have a $235 million profit

Here are the 4 probably scenarios in line with the current cost action. The amount of options contracts on This summer 22 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $20,000 and $21,000: 900 calls versus. 3,000 puts. The internet result favors the put (bear) instruments by $60 million.

- Between $21,000 and $22,000: 2,400 calls versus. 3,000 puts. The internet outcome is balanced between bulls and bears.

- Between $22,000 and $24,000: 6,600 calls versus. 500 puts. The internet result favors the phone call (bull) instruments by $140 million.

- Between $24,000 and $26,000: 9,400 calls versus. puts. Bulls take total control, profiting $235 million.

This crude estimate views the put options utilized in bearish bets and also the call options solely in neutral-to-bullish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

For instance, an investor might have offered a put option, effectively gaining positive contact with Bitcoin over a specific cost, but regrettably, there is no good way to estimate this effect.

Related: Bitcoin may hit $120K in 2023, states trader as BTC cost gains 25% per week

Bears have until Friday to show things around

Bitcoin bears have to pressure the cost below $22,000 on This summer 22 to prevent a $140 million loss. However, the bulls’ best-situation scenario needs a slight push above $24,000 to maximise their gains.

Bitcoin bears just had $222 million leverage lengthy positions liquidated from This summer 17 to twenty, so that they must have less margin needed they are driving the cost greater. Quite simply, bulls possess a jump to sustain BTC above $22,000 in front of the This summer 22 options expiry.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.