To navigate the entire process of buying Bitcoin effectively, it is important to explore secure options. Within the Uk, obtaining cryptocurrencies is legal, yet it may pose challenges, because the government underscores the necessity to know the connected risks.

To have an effective traversal from the crypto landscape, investors should follow key steps, including selecting the best crypto exchange or broker, establishing a secure wallet and making informed decisions regarding payments and orders.

This short article examines how you can purchase Bitcoin (BTC) and Ether (ETH) within the U.K. and will be offering info on legal factors, secure storage options, cryptocurrency exchanges and brokers for easy market navigation.

Could it be legal to purchase Bitcoin and Ether within the U.K.?

As the legal status of cryptocurrencies differs from one country to a different, buying Bitcoin (BTC) and Ether (ETH) is entirely legal within the U.K., having a well-defined regulatory framework in position. Cryptocurrencies are classified as taxed assets by His Majesty’s Revenue and Customs (HMRC), and they’re susceptible to taxation.

Obtaining Bitcoin and Ether within the U.K. triggers the tax reporting and payment obligations connected with cryptocurrency transactions. As a result, maintaining accurate records is vital for people intending to purchase BTC and ETH within the Uk. This ensures compliance with tax rules for crypto gains and crypto losses.

It’s worth noting that within the U.K., cryptocurrencies aren’t acknowledged as legal tender such as the British pound. This regulatory method of cryptocurrencies helps you to promote innovation and promote understanding of connected risks, developing a transparent, legal atmosphere for purchasing, selling and holding Bitcoin and Ether.

In October 2023, the Financial Conduct Authority (FCA) expanded its regulatory oversight to incorporate crypto asset promotions within the U.K., emphasizing compliance with accurate information and risk warnings. Furthermore, beginning in September 2023, the Travel Rule mandates that U.K.-based crypto asset companies are needed to gather, verify and share info on transfers, which impacts the pseudonymous nature of cryptocurrencies.

Despite industry engagement, some market players have exited the U.K., highlighting the significance of sticking to rules and rules when utilizing exchanges to purchase cryptocurrencies.

Secure wallet practices to guard Bitcoin and Ether holdings

Just before delving into Bitcoin and Ether investments, it’s essential to possess a secure crypto wallet, obtainable in many forms. While departing holdings with an exchange account works for small quantities, transitioning to some more secure storage solution is definitely an choice for individuals investors who wish to store bigger levels of tokens.

Furthermore, it’s crucial to understand that retaining funds with an exchange means missing control of the keys and, consequently, forfeiting control of the coins, emphasizing the significance of securing private keys for that full control and possession of digital assets.

Bitcoin wallets, including hardware, software and paper options, are utilized to safely manage and store Bitcoin holdings, while Ethereum wallets behave as secure repositories for ETH, supplying control of assets and facilitating transactions.

Cryptocurrency users depend on Bitcoin and Ether wallets to guard and control their digital assets, making certain the secure control over private keys required for being able to access and managing their holdings.

Related: A beginner’s help guide to filing cryptocurrency taxes in america, United kingdom and Germany

To lessen risk, a trader can enhance security by transferring their cryptocurrency from your exchange’s default wallet to their personal cold wallet, which isn’t on the internet and thus less prone to hacking.

It’s important to note these wallets don’t store investor’s cryptocurrencies by itself rather, they safeguard the non-public keys essential for being able to access the wallet’s address and authorizing transactions. Losing these digital keys means forfeiting use of Bitcoin and Ether holdings.

Buying Bitcoin and Ether within the U.K. through crypto exchanges

Investors have to select a broker or cryptocurrency exchange before they are able to purchase cryptocurrencies. Although both enable cryptocurrency purchases within the U.K., it’s worth noting some significant distinctions together. Because of the growing chance of hacks within the cryptocurrency space, selecting the very best cryptocurrency exchange or broker could be a challenging process, with security to be the primary priority.

Select a crypto exchange

Within the U.K., crypto assets and crypto exchanges operate without formal regulation, however the Financial Conduct Authority (FCA) mandates registration for crypto exchanges inside the country. Particularly, some crypto exchanges for example Gemini, Bitpanda, Kraken and Crypto.com are effectively registered using the FCA.

Because of the extreme volatility and lack of government-backed protection for cryptocurrency investments, exercising caution and acknowledging the speculative nature of cryptocurrencies is essential, even when confronted with FCA-approved and controlled providers. To boost security, a trader may also diversify their digital currency holdings across multiple exchanges to mitigate the chance of just one exchange failure.

When selecting a crypto exchange, look for BTC and ETH availability, but additionally ensure there’s substantial daily buying and selling volume to ensure sufficient liquidity for smooth transactions both in cryptocurrencies and fiat currency. Also, look out for charges that may affect returns, specifically for high-frequency traders, and make sure the exchange offers preferred buying and selling types for example limit orders and margins.

As a result of updated regulatory guidelines in the FCA and also the expanded parameters from the Regime of monetary Promotions, CEX.IO and Binance announced in 2023 that they suspended onboarding new U.K.-based consumers. Therefore, verifying an exchange’s availability within the U.K. and compliance with regulatory changes is important for informed decision-making.

Select a cryptocurrency broker

Cryptocurrency brokers, for example interactive brokers and eToro, simplify the crypto shopping process with user-friendly interfaces that communicate with exchanges for investors. Although some cryptocurrency brokers charge greater charges, others offer their professional services free of charge but gain selling traders’ data or executing user trades at suboptimal market prices.

While brokers offer convenience, they might limit the change in cryptocurrency holdings using their buying and selling platforms. This restriction could be a concern for investors seeking enhanced security through crypto wallets, including hardware wallets disconnected from the web. However, brokers can restrict investors motionless their crypto holdings to exterior wallets.

Pick a payment option

After picking out a cryptocurrency broker or exchange, investors can join open a free account and fund it through options like linking a financial institution account or using credit or debit cards, although the latter may incur high charges.

Upon creating a free account deciding on a repayment method, identity verification is required. For instance, the submission of the identity document and evidence of address is a very common requirement within the Uk. Investors might also encounter a crypto risk awareness quiz. With respect to the broker or exchange, there can be a wait of the couple of days prior to the deposited funds may be used to buy cryptocurrency.

Make an order

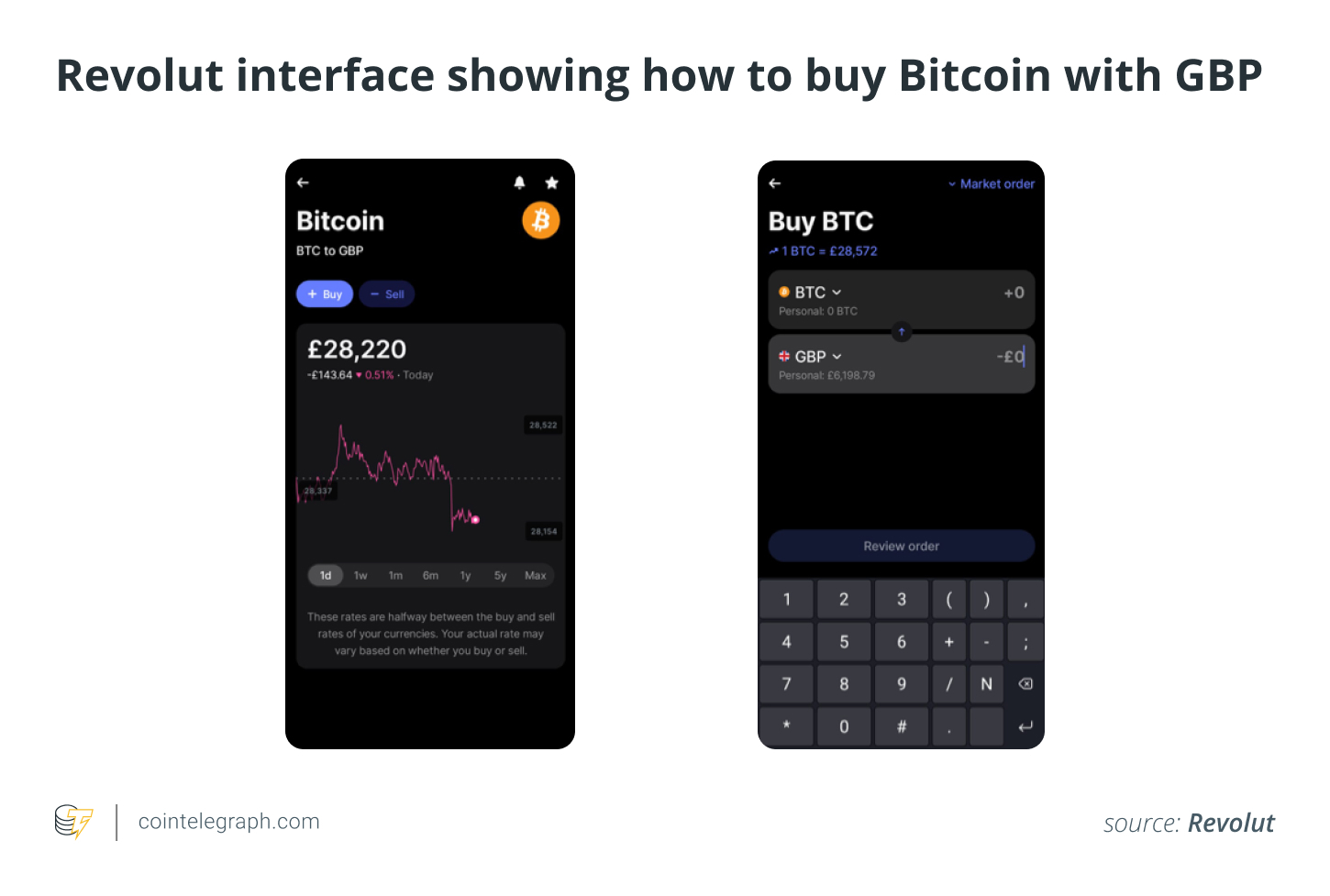

After funding their account, investors can go to placed their order for getting Bitcoin or Ether simply by entering the preferred amount in pounds. The procedure varies by exchange some possess a straightforward “Buy” button for BTC and ETH, which prompts users to go in the preferred amount.

Most exchanges enable purchasing fractional cryptocurrency shares, which makes it achievable to possess servings of greater-priced tokens like Bitcoin or Ethereum that will typically require significant investment.

Store Bitcoin and Ether

As formerly noted, cryptocurrency exchanges run the extra chance of thievery or hacking and aren’t paid by the Financial Services Compensation Plan from the Uk. If cryptocurrency proprietors misplace or forget their private keys or recovery phrases, they might forfeit all of their investment.

When choosing cryptocurrency on the crypto exchange, it is normally retained inside a wallet attached to the exchange. If preferred, investors can store or withdraw Bitcoin and Ether to some selected exterior wallet for additional security. However, investors purchasing cryptocurrency via a broker might possibly not have much control of where it’s stored.

If the investor has an interest in transferring their digital currency to some securer place or doesn’t such as the provider the exchange collaborates with, they might move them back the exchange and into a completely independent cold or hot wallet. With respect to the exchange and the quantity of the transfer, investors might be needed to pay for a little charge to be able to make this happen.

Cryptocurrency ATMs

Crypto ATMs happen to be appearing in metropolitan areas around the globe however, in Feb 2023, the FCA enforced a ban on cryptocurrency ATMs and advised operators to seal lower their machines or face enforcement actions.

The FCA warns that with such machines is dangerous, because they operate unlawfully and supply no protection in situation of issues, and communication with operators is frequently challenging. The FCA aims to help keep cautioning the general public and taking enforcement measures against unregistered crypto ATM operators.

Crypto exchange-traded funds (ETFs): An alternative choice to directly holding Bitcoin and Ether

Exchange-traded funds (ETFs) provide diversified contact with multiple holdings inside a single investment, including cryptocurrencies like Bitcoin and Ether. Investment trusts pool investors’ funds with the purchase of the set quantity of shares, who have some initial trust-related challenges upon launch. This structure provides instant diversification and reduces risk when compared with picking individual investments.

Investors are now able to access multiple cryptocurrencies concurrently through various firms. ETF providers for example Purpose Investments and VanEck offer possibilities for investors to take part in the crypto market.

Other techniques to buy Bitcoin and Ether within the U.K.

Several U.K. banking and financial apps, for example PayPal, Revolut, Skrill and MoonPay, have introduced the power for purchasers to buy Bitcoin and Ether on their platforms. To buy shares in firms that are openly listed, they’ll require a web-based account.

However, it’s important to note that JPMorgan’s U.K. bank, Chase, required another stance in October 2023 by prohibiting cryptocurrency transactions because of its British customers as a result of notable rise in fraud and scams, including fake investments and deceitful celebrity endorsements.

Furthermore, payment processors, for example BitPay, may be used to buy BTC and ETH. Once connected, users can initiate transactions with the payment processor, converting fiat currency into Bitcoin or Ether.

Furthermore, within the U.K., traders can utilize peer-to-peer (P2P) crypto platforms, for example Cash Application and Paxful, to trade digital assets, even though the government emphasizes the potential risks connected using these assets. P2P platforms enable direct cryptocurrency transactions between individuals and therefore are a prevalent way of obtaining digital currencies within the Uk. However, it’s important to keep yourself informed that U.K. investors have limited legal protections in case of platform insolvency.