Bitcoin (BTC) holders searching to prevent Central Bank Digital Currencies (CBDCs) might have acquired an unexpected ally — banks.

In the latest blog publish, “Pure Evil,” Arthur Hayes, ex-Chief executive officer of crypto derivatives platform BitMEX, contended that banks may limit the outcome from the CBDC “horror story.”

Hayes: Bitcoiners and banks stand against CBDC “dystopia”

CBDCs are presently in a variety of stages of development worldwide.

Fans of monetary sovereignty naturally fear as well as dislike them, because they imply total government control of everyone’s money and getting power — “a full-frontal assault on the capability to have sovereignty over honest transactions between ourselves,” states Hayes.

Among opponents of CBDCs are not only seen Bitcoiners, however. Discussing the reason will probably be the commercial banks they’ve searched for to oust from power with BTC.

“I think that the indifference from the majority allows governments to simply remove our physical cash and change it with CBDCs, ushering inside a utopia (or dystopia) of monetary surveillance,” your blog publish explains.

“But, there’s an unlikely ally which i believe will hamper the government’s capability to implement the very best CBDC architecture for manipulating the general populace — which ally may be the domestic commercial banks.”

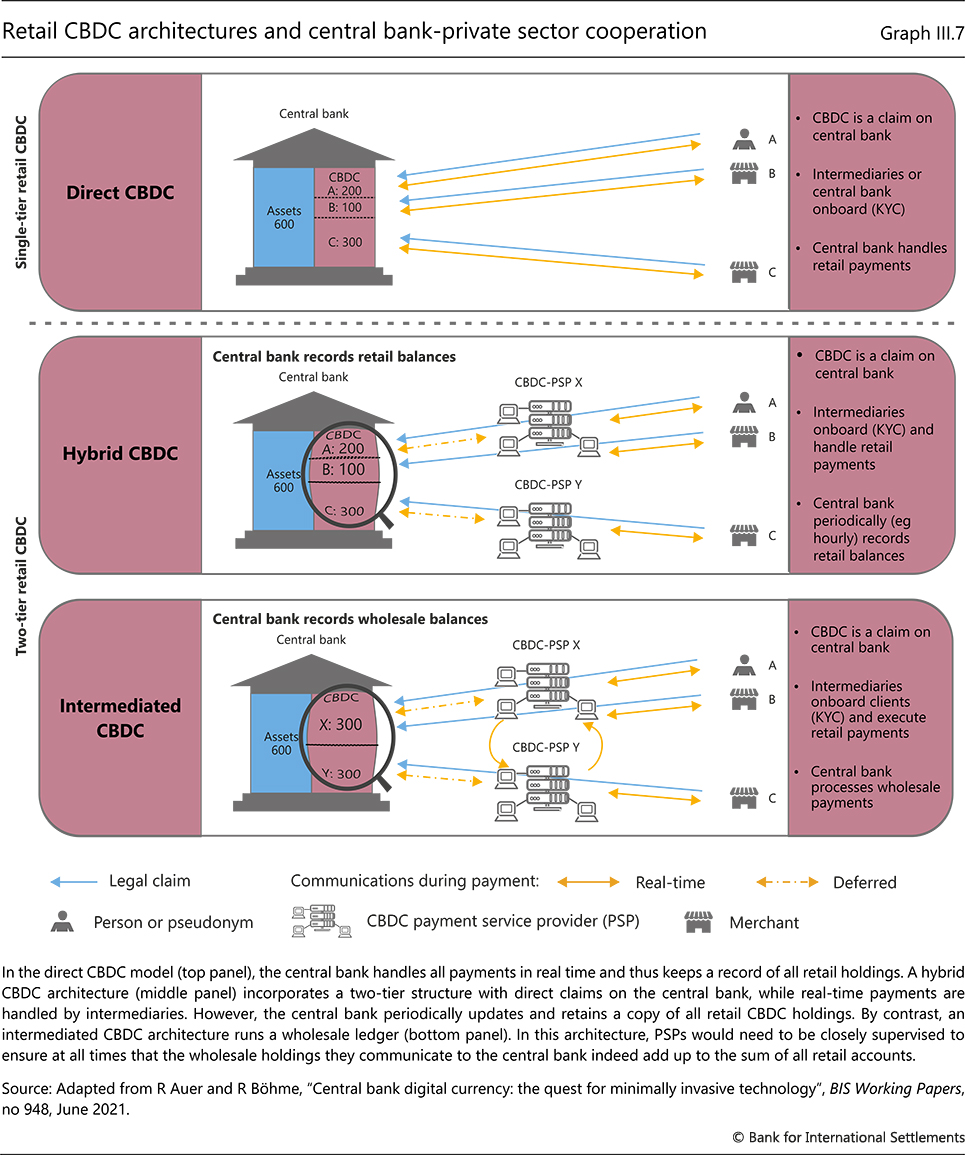

In applying a CBDC, a government could either result in the central bank the only real “node” within the digital network, or use commercial banks as nodes inside a less radical overhaul from the economic climate. Scalping strategies Hayes calls the Direct Model and Wholesale Model, correspondingly.

“Given that each country which has a minimum of arrived at the ‘choosing a CBDC model’ stage has chosen the Wholesale Model, it’s obvious that no central bank really wants to bankrupt their domestic commercial banks,” he reasons.

As a result, to “placate” banks to some extent but nonetheless achieve benefits for example eradicating cash, governments could eventually be stored under control by the type of entities noted for restricting crypto exchange transactions and banning hodlers’ accounts.

“For politicians who care more for power than profits, this really is their opportunity to completely destroy the influence of Too Large to Fail banks — but, they appear to stay politically not able to do this,” Hayes adds.

“Capital controls are coming”

The subject of CBDCs receives extensive attention, even past the crypto industry, because they represent a significant transfer of both money and politics.

Related: CBDCs aren’t any threat to crypto — Binance Chief executive officer

Within an interview with Cointelegraph a week ago, Richard Werner — development economist and professor at De Montfort College — described them like a “declaration of war.”

“In short, the financial institution regulator is all of a sudden saying we’re likely to compete from the banks now since the banks don’t have any chance. You cannot compete from the regulator,” he stated.

Hayes meanwhile flagged Bitcoin like a safe place still readily available for individuals already against any kind of zero-cash economy — although not for lengthy.

Buying BTC will end up more and more difficult, or possibly outright impossible, once CBDCs are implemented.

“This window won’t last forever. Capital controls are coming, so when all cash is digital and certain transactions aren’t permitted, the opportunity to purchase Bitcoin will rapidly vanish,” he cautioned.

“If any one of this disaster porn resonates with only you don’t own a minimum of a really small % of the liquid internet worth in Bitcoin, the very best day-to have purchased Bitcoin was yesterday.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.