Purchasing cryptocurrencies like Bitcoin (BTC), Dogecoin (DOGE) or Ether (ETH) in Canada is with an upsurge as crypto possession increases. Furthermore, the Ontario Securities Commission, within their report, mentioned which more than 30% of Canadians intend to buy crypto assets in 2023.

So, if you’re wondering buying Bitcoin or crypto in Canada, then continue reading and understand the facts.

Could it be legal to purchase cryptocurrency in Canada?

Cryptocurrency buying and selling is legal in Canada though it may be not considered a legitimate tender. Canada Revenue Agency (CRA) specifies what virtual currencies are and offers info on all relevant taxes. It’s possible to decide to shop in cryptocurrency in Canada if retailers, coffee houses or e-commerce websites accept it.

The CRA treats cryptocurrency just like a commodity that may result in capital gains or losses. Taxed transactions include delivering, receiving and buying and selling cryptocurrencies. Canada Securities Administrators’ website details the way your crypto assets are controlled in Canada.

Do Canadian banks allow cryptocurrency?

Using the growing recognition of cryptocurrencies, Canadian banks do allow and recognize cryptocurrency buying and selling susceptible to federal and condition rules. For example, Canadian banks have installed 2600+ Bitcoin ATMs, with Toronto in the greatest with 897 ATMs. These ATMs allow individuals to convert their physical money into digital currency and purchase and sell cryptocurrency in return for cash. Canada ranks second worldwide in Bitcoin ATMs following the U . s . States.

Some popular Canadian banks which support crypto exchange one of the ways or another range from the National Bank of Canada, Canadian Imperial Bank Of Commerce, Royal Bank of Canada, Scotiabank, ATB and Coast Capital, among many more also joining in because the crypto recognition in Canada keeps rising.

Banks allow purchasing crypto using debit cards, Interac e-transfer or bank wire transfer. Clients are needed to link their accounts having a cryptocurrency exchange for purchasing cryptocurrencies while using Canadian dollar or any other popular fiat currencies.

Charge cards may also be used to buy crypto. However, this method could be costly since banks may charge greater rates of interest and extra cash loan charges on crypto charge card purchases.

Methods to buy cryptocurrency in Canada

Two common methods to buy cryptocurrency in Canada include through either an agent or directly with an exchange. However, cryptocurrency exchanges provide the account holder additional control over their crypto while brokers like Wealthsimple and Mogo may put limitations on holdings, withdrawals, transfers and storage based on their brokerage policy.

Crypto brokers in Canada are much like a conventional finance buying and selling platform. They try to simplify the procedure and lower complexities through their platforms as well as their knowledge of the cryptocurrency field. However, this convenience comes at a price, because they do charge greater charges for his or her services as compared to the crypto exchanges.

Steps to purchase cryptocurrency in Canada via a crypto broker

The below steps explain buying cryptocurrencies via brokers if a person doesn’t wish to trade utilizing a crypto exchange.

Step One: Setup a free account on the crypto buying and selling platform

Pick a crypto buying and selling platform of your liking, visit its website or download the applying and register. On line having a valid email and telephone number and complete the requisite private information details to ensure your bank account.

Step Two: Add funds for your requirements

Most crypto broker platforms have numerous choices for payment techniques to load buying and selling funds with debit cards, charge card, PayPal, wire transfer or gift certificates. Transfer charges can differ for every method and therefore are usually greater for charge card payments because they are faster (5-ten minutes usually) and occasional for wire transfers which could have a couple of days to load funds.

Step Three: Buy cryptocurrency of your liking

Choose the crypto you need to purchase, make an order and also the buying and selling platform will discover a match for the buy order. However, crypto brokers possess a limited basket of currencies to pick from and they don’t exchange every cryptocurrency unlike crypto exchanges, that offer more choices. There’s also limitations on sell orders and volume, so it’s a sensible practice to check on these before investing any funds.

Steps to purchase cryptocurrency in Canada utilizing a crypto exchange

The steps below can get the ropes for crypto exchange though each exchange may show slight variations.

Step One: Pick your exchange

A crypto exchange is really a digital marketplace where consumers can meet and trade various kinds of cryptocurrencies. Many exchanges allows buying and selling the Canadian dollar for crypto or exchanging one sort of crypto for an additional. The exchanges that support cryptocurrency buying and selling in Canada are Coinbase, Binance, Crypto.com, Kraken, KuKoin, Bitbuy and Coinberry.

Step Two: On line

After selecting an exchange, join a legitimate email and telephone number to spread out a free account. Verification documents including license and passport will have to be submitted. Most exchanges will request a selfie to look into the face complement the documents posted for verifying an individual’s identity.

Step Three: Deposit cash and purchase cryptocurrency

When the account is activated, link a financial institution account and deposit funds into this recently opened up crypto account. Using the funds ready, convey a crypto buy order and buy any cryptocurrency in the ones on the exchange. Many people buy BTC in Canada however the marketplace is also flooded with altcoins like Binance Gold coin (BNB) or Solana (SOL).

Similarly, you can also sell crypto on these exchanges and become fiat and withdraw within the linked banking account. Bitcoin ATMs are a different way to convert cryptocurrency to money in Canada. However, not every ATMs have this facility and lots of charge high service charges.

How you can store cryptocurrency in Canada?

You should store and secure crypto assets because unlike fiat, they aren’t guarded by insurance protections such as the Canada Deposit Insurance Corp. Perils of thefts, hacking, scams or cyberattacks are high and therefore you should secure safe storage for the crypto. A number of ways for storing crypto in Canada include:

Around the exchange

Leave the crypto around the exchange and earn passive earnings from staking and farming. Staking helps earn crypto interest by locking the cryptocurrency holdings around the exchange, while farming helps you to earn more cryptocurrencies using existing crypto assets around the exchange.

Switch on the 2-factor authentication, or 2FA, within the security settings from the account login to supply that extra layer of security. Risk may also be reduced by distributing the crypto assets across multiple exchanges. Nevertheless, as centralized exchanges happen to be recognized to change policies, rules or cease operations, storing on multiple exchanges may spread the chance of losing all assets in case of a hack, seizure or closure of the exchange.

Crypto wallets

Crypto wallets contain the ‘private keys,’ or perhaps a password for accessibility cryptocurrency assets. So, crypto wallets don’t really store your crypto, however they contain the keys that offer use of your digital money living around the blockchain. You’ll be able to hold multiple coins in a single wallet like BTC, ETH, DOGE or other altcoins, as based on that wallet.

However, securing the seed or recovery phrase is important since it helps you to recover private keys in case you can forget. Losing or failing to remember the seed phrase means permanent lack of the stored crypto assets.

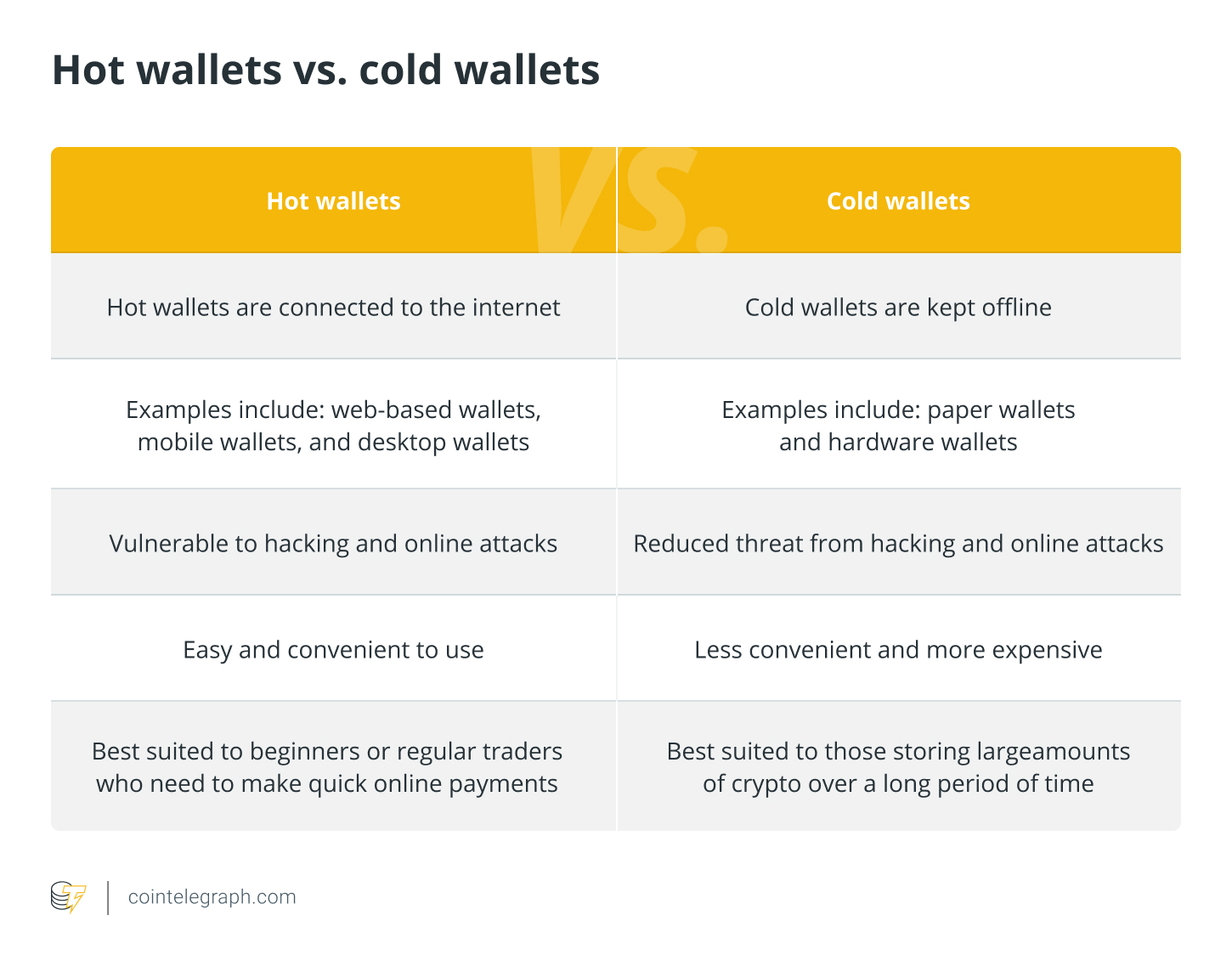

Two kinds of cryptocurrency wallets in Canada or any country are cold and hot wallets.

MetaMask, Binance Trust Wallet, Coinbase Wallet and CoinSmart are types of crypto hot wallets in Canada, while cold wallets being used are Ledger and Trezor. It’s possible to also strike an account balance by storing in a mix of cold and hot wallets as storing vast amounts of coins in one wallet can be very dangerous.

Where and how to invest cryptocurrency in Canada?

Purchases can be created with BTC along with other crypto in Canada at retailers who directly accept crypto payments or through debit or prepaid credit cards. A 2022 Capterra survey of just one,000 Canadian respondents revealed that 62% from the participants are curious about being compensated in crypto within the next 5 years.

CoinGate accepts an array of cryptocurrencies to buy gift certificates for eBay, Amazon . com, Ps, BestBuy, Airbnb and much more. Other retailers that accept crypto payments in Canada include Newegg (gaming products), Travala (travel bookings) and Overstock (furniture).

Coincards is yet another webshop to buy gift certificates for a lot of top brands including BestBuy, Amazon . com, Air Canada and much more. They accept BTC along with other cryptocurrencies and provide prepaid credit cards for shopping online.The prepaid credit card is reloadable and could be capped track of crypto according to customer requirement.

Positive provisions and clearly defined rules set Canada apart and supply a benchmark for other nations to promote a crypto-friendly atmosphere for the exact purpose of speeding up cryptocurrency adoption proactively. However, investors must do their very own extensive research and become well-experienced using the crypto landscape before committing any funds.