Bitcoin (BTC) left both lengthy and short traders behind in May and June, but data suggests buying and selling it might be “easier” than many imagine.

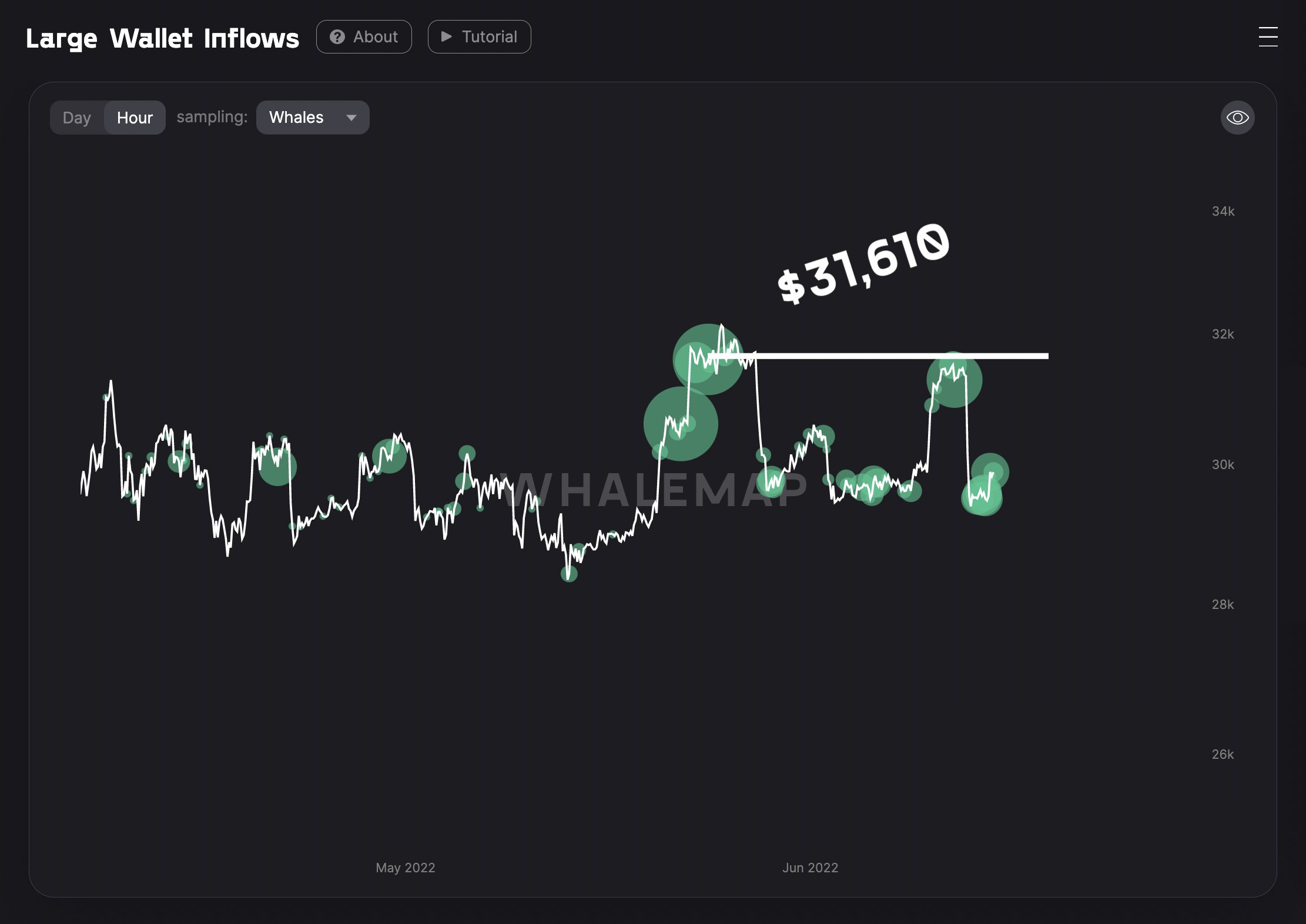

Based on on-chain analytics resource Whalemap, Bitcoin whales have basically determined market performance in recent days.

Whales help pin Bitcoin at $30,000

In fresh analysis printed on June 7, Whalemap researchers demonstrated that BTC/USD local tops and bottoms have coincided with regions of increased whale activity.

When Bitcoin’s largest wallet entities decide to purchase or sell, cost reacts accordingly. For individuals searching to lessen risk buying and selling short timeframes, it might thus suffice to do something based on where popular whale levels lie.

“Can it get simpler than this?” Whalemap summarized partly of the Twitter publish.

As Cointelegraph reported, some whales have more interest than the others. In the last week, one particular entity on Binance continues to be adding to Bitcoin’s narrow buying and selling range with a number of buys and sells.

“This binance whale has marked every local top/bottom during the last two days,” popular analyst Credible Crypto added in new Twitter comments on June 21.

“Been watching him appear and disappear. Accumulating in the lows, capping cost in the highs. Most lately filled 2,000 BTC (60 million) in the local lows at 29.2k before pump there has been now.”

That “pump,” much like that from earlier within the week, continues to be short resided, with BTC/USD plateauing then reversing, losing pretty much all increases from the initial upward trend, data from Cointelegraph Markets Pro and TradingView shows.

“Annoying” stocks correlation keeps pressure on BTC

Zooming out beyond internal factors, meanwhile, optimism remains thin for inflationary macro conditions favoring crypto strength moving forward.

Related: BTC cost snaps its longest losing streak ever — 5 items to know in Bitcoin now

While whales keep prices rangebound, Bitcoin’s correlation to stock markets can also be frustrating traders.

The correlation using the stock markets is annoying.

— Michaël van de Poppe (@CryptoMichNL) June 7, 2022

Stocks are further unlikely to feel relief for the short term, commentator Bob Loukas accepted on June 7, as financial tightening worldwide gathers pace.

“Still aren’t seeing macro catalyst (yet) for bottom in equities. As mentioned before has appearance of a cyclical bear market that requires additional time,” he stated.

“Cost action on Cycle front confirms, move lower into summer time several weeks. Been underweight some time, pleased to be wrong. Wont fomo a ripping rally.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.