Everybody expects another Bitcoin (BTC) capitulation event, but data shows that mass buying has began.

Inside a Twitter thread on June 29, Checkmate, add-chain analyst at data firm Glassnode, came focus on who in Bitcoin is actually stacking sats.

Shrimp or whale, Bitcoin hodlers are stacking sats

Bitcoin selling makes the headlines for days, and it has even started to include lengthy-term holders (LTHs) — individuals who’ve been guarding their coins for 155 days or even more.

Speculators aren’t using the blame for current BTC cost weakness, but unlike popular opinion, many market participants are actually contributing to their BTC allocations.

Dissecting Glassnode data, Checkmate says the tiniest and largest players are generally in buy-mode around $20,000.

Spitting the hodler base into four sections: “shrimps,” “crabs (also known as classic hodlers),” “sharks” and whales, the figures alllow for surprising studying.

Both shrimps and crabs, the tiniest retail investors with 10 BTC or fewer within their wallets, are not only seen stacking, but doing this more intensely than anytime since the very first time that BTC/USD hit $20,000 in 2017.

“Can’t stop and will not stop,” Checkmate authored describing the buildup action.

“Shrimp are contributing to the $BTC balance in the finest rate because the 2017 ATH. Same cost, different trend direction. I don’t underestimate the smarts not conviction from the little guy in Bitcoin.”

In the other finish from the spectrum, whales are similarly removing coins from exchanges to personal wallets in a pace Checkmate calls “full Pork.”

Whales with 1k+ $BTC ‘re going Pork.

Plus the Shrimp and Crabs, thsi appears like the right mid-wit meme.

Shrimp = stackers

Middle wealth = scared and margin known as

Whales = stackers pic.twitter.com/zyakmicxGG— _Checkɱate ⚡ (@_Checkmatey_) June 29, 2022

The primary exception lies in the centre: the sharks or institutional, high internet worth entities with between 10 and 1,000 BTC for their name.

Although this comprises a sizable swathe from the network, hodlers have borne the brunt of macro changes, Checkmate claims, either getting liquidated on positions or seeing their wealth erased in DeFi bets.

Even here, however, the general trend expires.

“Balances are growing, but nothing special. Because of the TradFi and crypto shitshow –> I believe this option are heavily impacted by deleveraging, and margin calls,” he authored.

Analyst $25 billion exchange stablecoin reserves

The 2009 week, Glassnode likewise demonstrated that 30-day cumulative BTC outflows from exchanges had arrived at a brand new peak.

Related: 80,000 Bitcoin millionaires easily wiped in the truly amazing crypto crash of 2022

For Ki Youthful Ju, Chief executive officer of fellow analytics firm CryptoQuant, signs that capital delays around the sidelines to deploy back to crypto will also be obvious.

Ki eyed the mere 11% decrease in the combined stablecoin market cap when compared with Bitcoin’s 70% all-time highs.

“Stablecoins relaxing in exchanges are actually worth 1 / 2 of Bitcoin reserve,” he added on June 30.

“We’ve $25B loaded bullets that make crypto asset prices increase. Now you ask , when, not how.”

Stablecoins relaxing in exchanges are actually worth 1 / 2 of #Bitcoin reserve.

We’ve $25B loaded bullets that make crypto asset prices increase. Now you ask , when, not how. pic.twitter.com/SQ0ZvBnAMt

— Ki Youthful Ju (@ki_youthful_ju) June 30, 2022

Everything is complicated because the stablecoin market cap ratio on exchanges has remained practically constant for 2 years, as the market cap itself has ballooned for the reason that period.

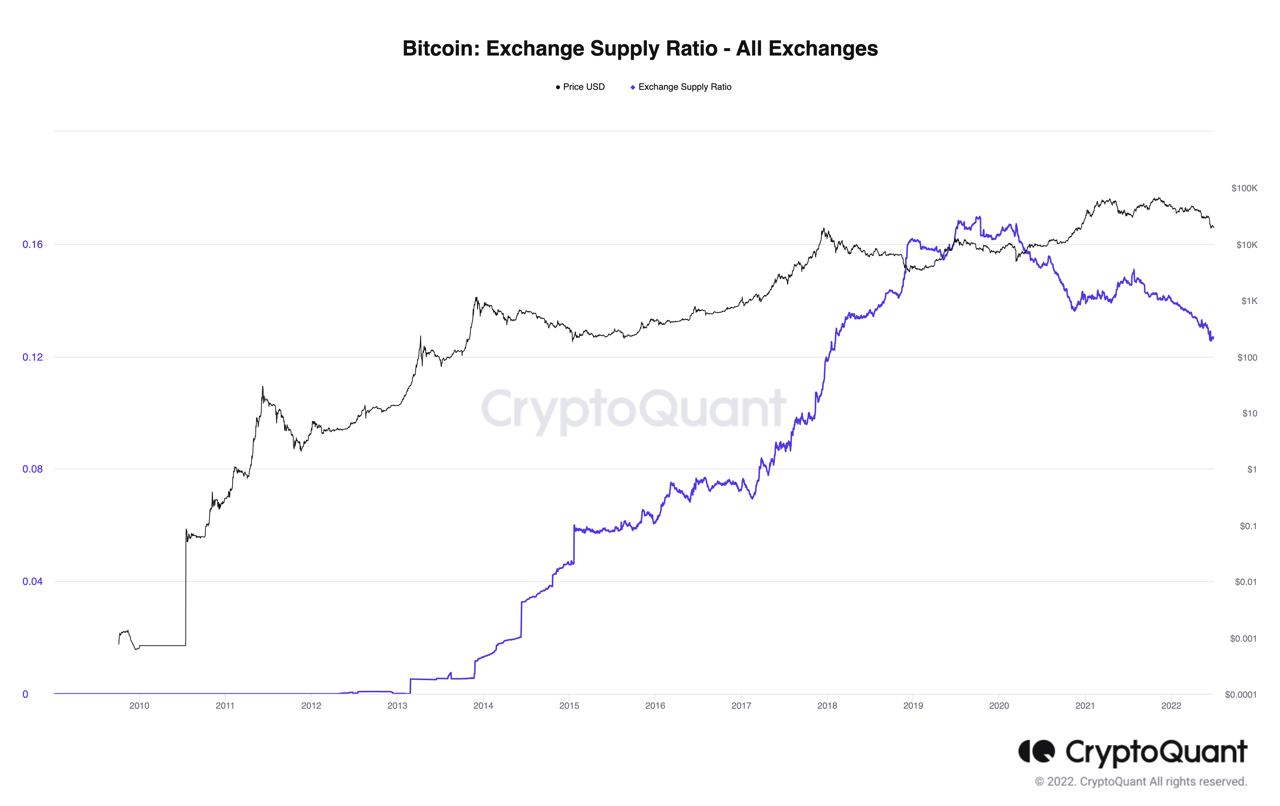

The Bitcoin exchange supply ratio meanwhile continues to be a lot more volatile.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.