Cathie Wood’s investment firm, ARK Invest, has offered 700,000 shares from the Grayscale Bitcoin Trust (GBTC) in the last month, even while Bitcoin (BTC) hit 17-month highs over excitement for any possible place Bitcoin exchange-traded fund (ETF).

The ARK Next-gen Internet ETF (ARKW) offered 36,168 GBTC shares on November. 22, offloading as many as 697,768 GBTC since March. 23, based on ARK’s daily buying and selling data seen by Cointelegraph.

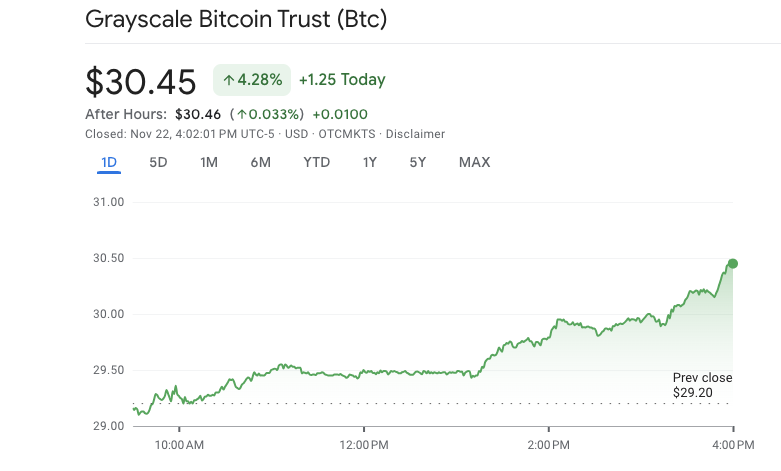

ARKW offloaded roughly $a million in GBTC as Grayscale’s trust traded around $30 on November. 22, closing at $30.50, per Google Finance data. U . s . States markets closed on November. 23 for Thanksgiving.

ARK began selling Grayscale Bitcoin Trust shares on March. 23, 2023, as Bitcoin was heading toward $34,000. Before that, ARK’s previous reported GBTC transaction is at November 2022, once the firm offered 450,272 GBTC shares.

Related: Grayscale met with SEC to go over place Bitcoin ETF details

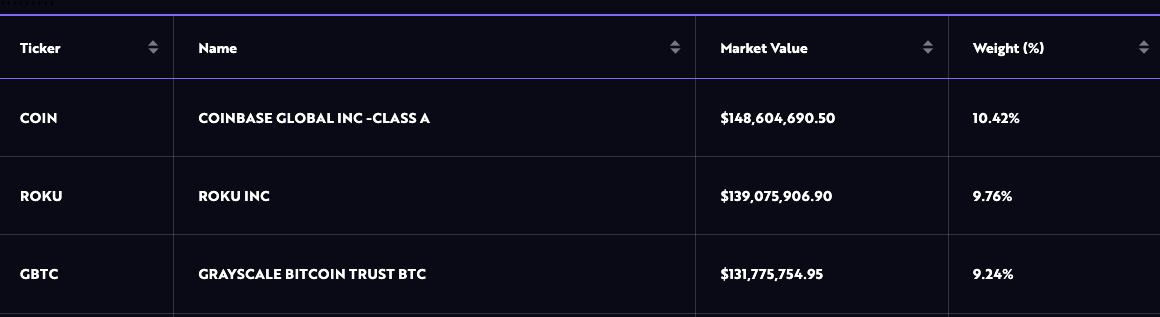

After selling nearly 700,000 GBTC shares in the last month, ARK’s ARKW still holds $131.8 million price of GBTC, or even more than 4.3 million GBTC shares. By November. 24, Grayscale Bitcoin Trust makes up about 9.2% of ARKW’s portfolio, rated third after Coinbase and Roku, according towards the official ARKW data.

The ARK ETF that offloaded the funds expires over 68% year-to-date when compared to over-271% published by Grayscale’s trust, per Google Finance data.

Meanwhile, Bitcoin expires 125% YTD and neared $38,000 on November. 16, the greatest since May 2022, per Cointelegraph Markets Pro.

Additional reporting by Helen Partz.

Magazine: Asia Express: HTX hacked again for $30M, 100K Koreans test CBDC, Binance 2.