Establishing a yield on crypto is more and more tricky. The Terra ecosystem implosion — where as much as $50 billion was easily wiped out — brought to some loss of decentralized finance (DeFi) protocols offering interest.

In the other finish on the table, centralized finance, or CeFi, where all processes are rooted via a central body, has suffered a somewhat peaceful bear market, yet rates of interest are trending lower.

Around the to begin the month, investors who’ve a free account having a CeFi provider for example Ledn, Celsius, BlockFi or Nexo generally receive emails detailing the eye rate for an additional month.

A blow for individuals searching for passive earnings, the eye compensated from CeFi providers has ground lower because the 2021 bull market. Quitting child custody of the crypto asset for any tightfisted interest payment has encouraged some crypto enthusiasts to seize control of the private keys, even drawing comparisons to legacy banking.

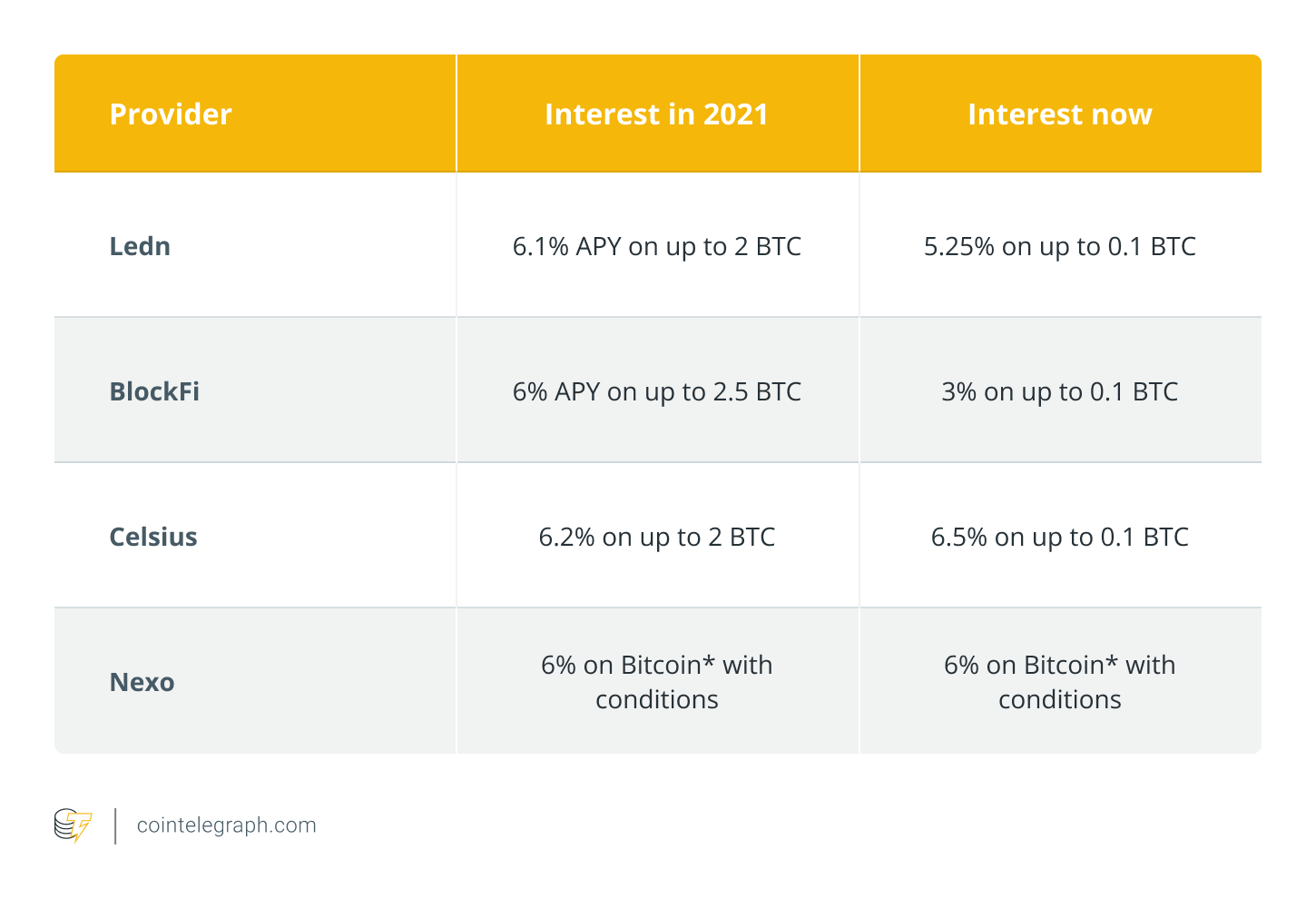

Within the table below, three from the largest custodians of Bitcoin (BTC) and crypto assets have fallen, considering both rate of interest and the quantity of interest compensated on every asset.

Cointelegraph spoke to 3 from the largest lenders of Bitcoin along with other crypto assets to know whether rates of interest from CeFi providers may eventually hit very cheap, also known as .01% interest — like at banks — and the lenders and interest providers exist.

Rates of interest will still be attractive

Representatives from Ledn, Nexo and BlockFi agreed that although curiosity about crypto is gloomier, it outcompetes legacy lending. Mauricio Di Bartolomeo, co-founding father of Canada-based Ledn, told Cointelegraph, ”We continue to be five to ten years from Bitcoin rates coming anywhere near to individuals of fiat accounts.Inches

“Most legacy bank savings accounts are having to pay out mere basis points (between .01% and .05%). Rates of interest for the Bitcoin Checking Account product continue to be 5.25% APY for that first .1 BTC and a pair ofPercent APY for balances above .1 BTC currently.Inches

Inside a tweet thread, Di Bartolomeo shared that “changing market conditions” have obliged lenders to decrease their rates, because the difficulty degree of turning an income on arbitrage possibilities and also the futures basis trade has risen.

Basically – which means that market makers will also be seeing their average returns get compressed.

Which forces them to need to lower their borrowing costs.

— Mauricio (@cryptonomista) May 4, 2022

Jonathan Haspel, senior institutional buying and selling affiliate at BlockFi, agreed, proclaiming that “yield associated with crypto interest-bearing accounts is impacted by a few factors, including market sentiment, funding rates, demand and supply, and balance sheet optimization.”

It is true that crypto market sentiment has plummeted because the March 2020 crash, while funding rates, designed for altcoins, have dropped to “worrying levels.” Haspel described:

“Ultimately, compressed rates and volatility are an indication of the asset class’s maturation. Where yield used to be rampant and liquidity once sparse, there are other players within the crypto game feeding its competitive financing and prevalent access.”

Bullish on CeFi: The long run remains vibrant

Zac Prince, Chief executive officer of BlockFi, told Cointelegraph that he’s still “bulllish on […] clients’ need to earn crypto interest back for that lengthy term.”

Inside a similar note of optimism, Nexo co-founder and executive chairman Kosta Kantchev told Cointelegraph, “‘The occasions, they’re a-altering,’ but crypto yields continue to be multiple occasions greater than individuals of traditional banks.” Inside a nod towards the cost of Bitcoin flatlining around the $30,000 mark, Kantchev stated:

“While interest on some assets is becoming more stable, this mirrors the assets themselves. I believe people largely disregard the sky-high rates on a few of the newer assets on the market.Inches

Ultimately, as well as in agreement with Di Bartolomeo, “regardless of methods in the past volatile crypto continues to be, the chance is definitely there.” CeFi providers continuously offer more appealing rates of interest than legacy banking institutions.

It’s worth noting that Nexo operates another model, which may explain why minute rates are not technically shedding (as proven within the above table). Users experience greater interest levels when they secure the asset or hold a proportion from the Nexo token. Resistant to the other CeFi lenders, Kantchev described:

“Rates aren’t shedding. It’s more that yields on older cryptos on Nexo are ensured to become sustainable over time, however the eyebrow-raising minute rates are frequently available either with Nexo Tokens through our loyalty program or a few of the newer coins that we are able to generate such impressive yield.”

Growing adoption and innovation, anticipating regulation

That shedding rates shouldn’t be reason to be concerned: Per Di Bartolomeo, not just are centralized entities “instrumental towards the adoption and evolution of Bitcoin as pristine collateral,” but legacy banks might even turn to “partner” with CeFi players later on. He stated:

“This implies that centralized lenders, like Ledn, will behave as a conduit to create legacy capital to Bitcoin — benefiting both Bitcoiners (allowing them borrow at more and more better rates) and capital providers (by providing them dangerous-adjusted return).”

Related: Can DeFi and CeFi exist together? Three takeaways from experts panel

BlockFi’s Haspel agreed, “CeFi provides a compelling use situation supporting crypto’s narrative for global financial access.” Regardless of the turbulent waters the crypto industry treads in spring 2022, BlockFi sees “an rise in global interest in risk-managed crypto products — for example interest accounts — in other emerging digital assets.”

“While credit report checks and too little credit history harm individuals seeking use of capital on the global scale, CeFi lending provides a solution. Through the use of crypto assets confirmed on the transparent and immutable ledger, CeFi protocols can rapidly verify their possession.”

For Kantchev, innovation, customers and new items are closer than you think: “Compliant, sustainable interest items that address regulatory guidance while profitably having to pay customers will be among the following such products.”

“The industry has matured tremendously, […] so I’m convinced we continuously find risk-free strategies that yield attractive returns and then share all of them the city.Inches

In Nexo’s situation, that means diversifying its product offering for BlockFi, it is constantly on the onboard institutions, while Ledn has branched out into Bitcoin-backed mortgages.

Cointelegraph arrived at to CeFi provider Celsius for comment but didn’t get a response by publishing time.