Jurrien Timmer, Fidelity’s director of worldwide macro, has contended that Bitcoin (BTC) might be “cheaper of computer looks”, highlighting evidence on Tuesday the cryptocurrency might be both undervalued and oversold.

Addressing his 126,000 Twitter supporters, Timmer described that although Bitcoin has fallen to 2020 levels, its cost-to-network ratio has reeled completely to 2013 and 2017 levels, that they stated may suggest it’s undervalued.

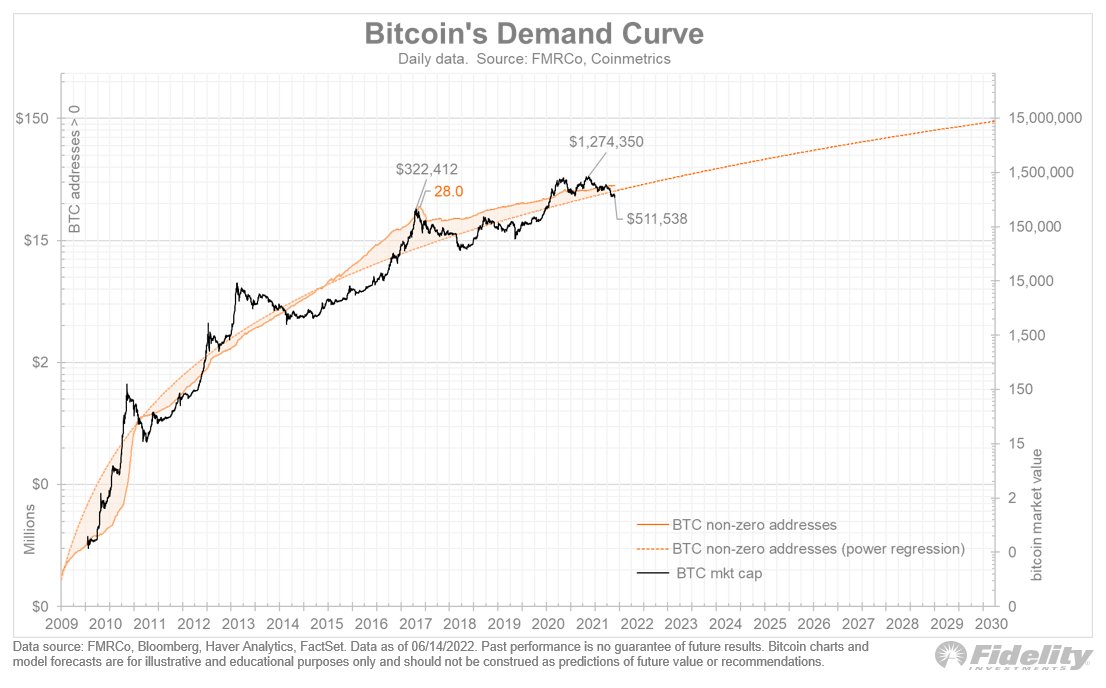

Is BTC less expensive than it appears? When we think about a simple “P/E” metric for BTC is the cost/network ratio, then that ratio has returned to 2017 and 2013 levels, despite the fact that BTC is only to late 2020 levels. Valuation frequently is much more important than cost. /THREAD pic.twitter.com/6XMPrtRUzF

— Jurrien Timmer (@TimmerFidelity) June 15, 2022

Bitcoin undervalued

The cost-to-network ratio is really a crypto-riff on the popular metric utilized by traditional stock exchange investors known as the cost-to-earnings (P/E) ratio, which is often used to find out whether a regular has ended or undervalued.

A higher ratio could suggest a good thing is overvalued, although a minimal ratio could signal an undervalued asset.

Timmer highlighted a chart of Bitcoin’s demand curve overlaid with Bitcoin’s non-zero addresses against its marketcap, noting the “price has become sitting underneath the network curve.”

Technically oversold

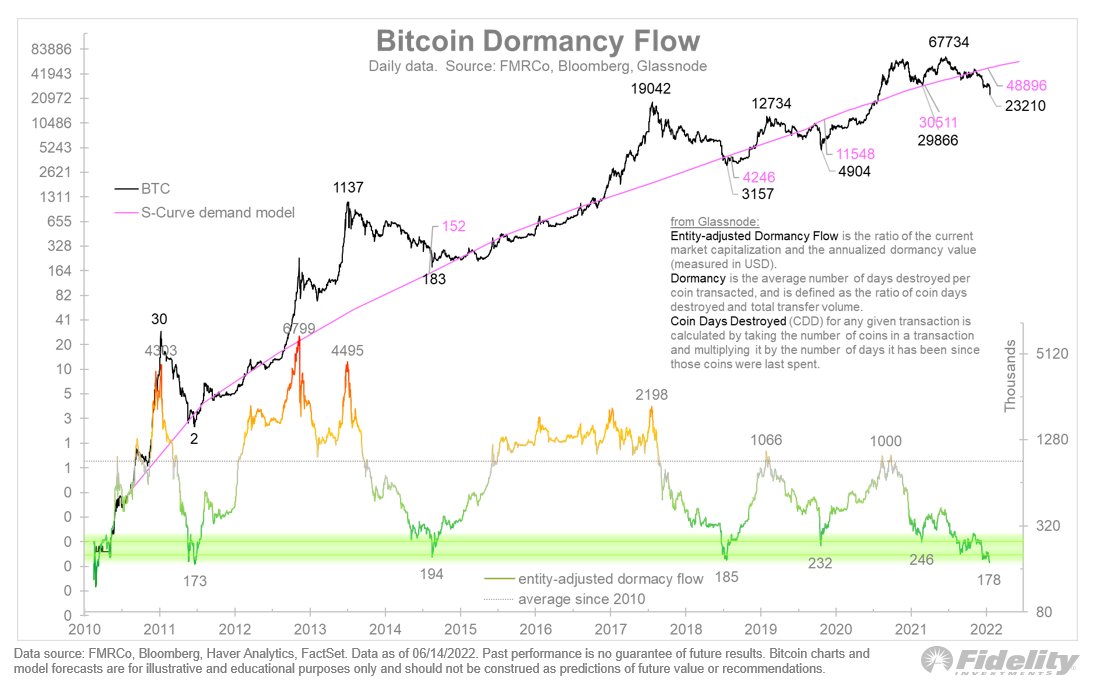

The macro analyst also shared a graph using Glassnode’s dormancy flow indicator, that they stated suggests “how technically oversold Bitcoin is.”

Entity-adjusted Dormancy Flow is a well-liked metric for knowing Bitcoin value by evaluating the cost to spending behavior.

Based on Glassnode, a minimal dormancy flow value can suggest elevated lengthy-term holder conviction — meaning lengthy-term Bitcoin HODLers are purchasing up from queasy short-term sellers.

“Glassnode’s dormancy flow indicator has become to levels not seen since 2011.”

Morgan Creek Digital co-founder and Youtuber Anthony Pompliano gave an identical view to Fox Business Monday, explaining that Bitcoin’s “value and cost are diverging” which “weak hands can sell to strong hands.”

“What we’re watching at this time may be the transfer from weak, short-term oriented individuals with weak hands in to the lengthy-term oriented strong hands.”

Bitcoin’s Fear and Avarice Index fell to 7, indicating “Extreme Fear” on Wednesday, falling to the cheapest levels since Q3 2019. Previously, low index figures have frequently recommended a buying chance.

Related: Bitcoin cost climbs to $22.5K after Given 75 basis point hike aims to cap runaway inflation

Fidelity Investments and it is analyst Timmer happen to be bullish on Bitcoin. An investment giant has worked on launching a Bitcoin retirement investment plan, which may allow 401(k) retirement saving customers to purchase Bitcoin directly. Timmer continues to be predicting that Bitcoin may soon visit a revival.

I became a member of Fox Business to go over bitcoin and also the macro atmosphere.

Value and cost are diverging. Weak hands can sell to strong hands. We’ve been here before.

Thanks @LizClaman for getting me. pic.twitter.com/1S6TckUguE

— Pomp (@APompliano) June 13, 2022