Bitcoin (BTC) begins a brand new week having a completely different feel to last as BTC/USD seals its cheapest weekly close since December 2020.

An evening of losses into June 13 implies that the biggest cryptocurrency has become edging nearer to beating its ten-month lows from May.

The weakness leaves couple of guessing: shock inflation data in the U . s . States a week ago sparked a series reaction across risk assets and occasional weekend liquidity made an appearance to exacerbate the effects for crypto assets.

The macro discomfort continues now. The Fed is a result of showcase rate hikes and also the economy more broadly — the very first official policy update because the inflation figures.

The atmosphere among analysts on Bitcoin and altcoins — whilst not unanimously bearish — is thus certainly one of resignation. A time period of painful buying and selling and hodling conditions might have to be suffered before coming back towards the upside, a thing that a minimum of chimes using the historic patterns of Bitcoin’s halving cycles.

What is the marketplace triggers within the coming week? Cointelegraph analyzes five things to consider like a Bitcoin trader.

Celsius “collapse” looms, delivering Bitcoin tumbling

It had been a lengthy time coming, but Bitcoin has finally damaged from the tight range that has traded since first dipping to 10-month lows recently.

After bouncing from $23,800, BTC/USD then circled the $30,000 zone for days on finish, neglecting to generate a decisive progress or lower. Now, whilst not what investors would really like, the direction appears obvious.

#BTC is around the cusp of performing its first Weekly Candle Close underneath the Macro Range Low area$BTC #Crypto #Bitcoin pic.twitter.com/jwqBHfFV1F

— Rekt Capital (@rektcapital) June 12, 2022

It is not only one range that Bitcoin has exited, as trader and analyst Rekt Capital noted on June 12. In abandoning the zone near $30,000, BTC/USD can also be ditching a macro buying and selling range in position since the beginning of 2021.

As a result, the newest weekly close, around $26,600, was Bitcoin’s cheapest since December 2020, data from Cointelegraph Markets Pro and TradingView shows.

“Worst has ended. $BTC 25k defended. Think can squeeze just a little now, resume selling tomorrow with equities,” economist, trader and entrepreneur Alex Krueger predicted.

An associated chart demonstrated a gang of buy support in position at $25,000, helping peg 24-hour losses at 12%.

The marketplace during the time of writing was nevertheless inside a condition of flux because the dust chosen a harsh indication of the items happened during May’s spike below $24,000.

Whereas it was Blockchain protocol Terra’s (LUNA) and TerraUSD (UST) tokens imploding, a few days ago, it had been the turn of fintech platform Celsius and it is CEL token to follow along with suit.

Lower 40% at the time in USD terms, CEL predictably endured from the decision by Celsius to prevent withdrawals and transfers altogether to be able to “stabilize liquidity.”

“Due to extreme market conditions, today we’re announcing that Celsius is pausing all withdrawals, Swap, and transfers between accounts. We’re using this action right now to put Celsius inside a stronger position to recognition, with time, its withdrawal obligations,” your blog publish issued on June 13 reads.

Reacting, Bitcoin pundits already skeptical from the altcoin space following a Terra debacle wasted virtually no time in pinning the culprit for that extent of BTC cost losses on occasions at Celsius.

gox hack was rough, ICO bubble was frustrating, but celsius hits the toughest because it’s as if we learned nothing from 2008

it had been literally on page one from the bitcoin white-colored paper

but time seems like a set circle sometimes

— juthica (@juthica) June 13, 2022

“Celsius appears like it might collapse and take a lot of customer cash with it,” Robert Breedlove, host from the What’s Money podcast, added partly of Twitter comments.

Given policy update looms on 40-year record inflation

A black swan event copying Terra is perhaps the final factor that Bitcoin needs, because of the already shaky macro conditions.

Regardless, the scope for fresh turmoil remains now because the Fed’s Federal Open Markets Committee (FOMC) prepares because of its June policy meeting which starts June 15.

Coming after June 10’s 8.6% inflation readout, expectations are the gathering will hasten the interest rate of key rate hikes — a thing that neither stocks nor crypto assets would welcome.

Capitulation -> Retest -> Rinse Repeat #Bitcoin has witnessed this 31-day pattern frequently in 2022

If Jay Powell & FOMC surprises with anything further than 50 basis point rate hike, it’s certainly new leg Lower pic.twitter.com/qMUeGp3gjR

— Matt C⚡️ (@mithcoons) June 12, 2022

Krueger, like others, added the Given would definitely function as the clinch element in figuring out the rest of the downside for risk assets.

“For the underside need to wait for a Given (or equities) to show,” he authored:

“Can scalps levels, but seriously doubt any level brings a pattern change alone. Slight chance the Given doesn’t turn hawkish on Get married therefore rally hard. Hawkish acceleration much more likely.”

An Asian sell-off made existence worse for equities at the beginning of a few days, impacting risk-sensitive currencies like the Japanese yen and Australian dollar.

“At some time financial conditions will tighten enough and/or growth will weaken enough so that the Given can pause from hiking,” Goldman Sachs strategists including Zach Pandl authored inside a note quoted by Bloomberg on June 13:

“But we still appear far from there, which implies upside risks to bond yields, ongoing pressure on dangerous assets, and sure broad US dollar strength for the time being.”

Bloomberg furthermore reported that the 75-basis-point rate hike might be up for grabs, as markets cost in base rates of threePercent or even more through the finish of the season.

U.S. dollar wastes virtually no time challenging 20-year highs

Where risk assets suffer, the U . s . States dollar makes probably the most of their power in the last 2 yrs.

That trend looks set to carry on as macro conditions pressure practically almost every other world currency and risk assets to supply no realistic safe place.

The U.S. dollar index (DXY), despite retracing in recent days, has become firmly during the saddle and individuals highs of 105 observed in May. These reflect peak USD strength since 2002 and during the time of writing, are simply .5 points away.

“$DXY goes strong, no question assets are tanking,” Tony Edward, host from the Thinking Crypto Podcast, responded.

Because the mix-market crash of March 2020, DXY strength is a reliable counter-indicator for BTC cost performance. Until a substantial trend change enters, the outlook for Bitcoin could thus stay skewed towards the sell-side.

“Dollar strength frequently results in contractions in corporate earnings globally. Today’s inflation problem adds even more pressure on income to become squeezed,” Otavio Costa, founding father of global macro asset management firm Crescat Capital, told Twitter supporters concerning the dollar in comparison to the Fed’s inflation narrative on June 12:

“Only dependent on time prior to the ‘soft landing’ narrative becomes the same kind of ‘transitory’ nonsense.”

“Misery Index” underscores market fear

There won’t be any surprises with regards to cryptocurrency market sentiment now, using the macro mood likewise going for a turn for that worse.

The Crypto Fear & Avarice Index, which utilizes a gift basket of things to find out overall conditions among traders, is teetering around the fringe of a use single figures.

Getting spent a lot of 2022 within an area typically restricted to market bottoms, Fear & Avarice has yet to convince anybody that the floor might be in.

On June 13, it measured 11/100, just three points greater than its macro lows from March 2020.

Last week’s inflation print similarly required its toll around the traditional market Fear & Avarice Index, that is now in its “fear” zone at 28/100, according to data from CNN.

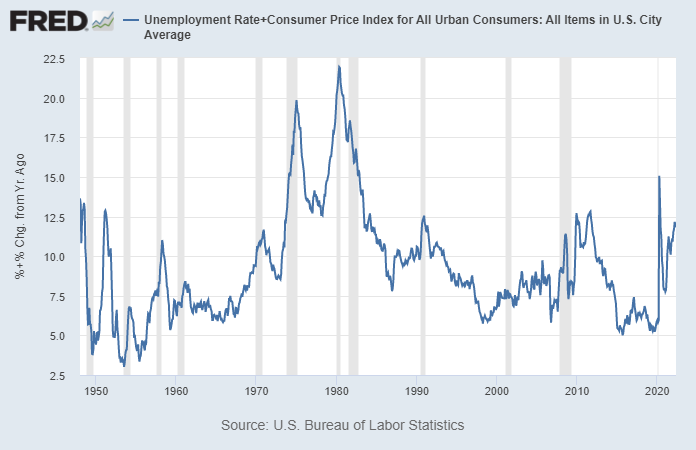

It is not only the financial world feeling the pinch, the so-known as “Misery Index,” which measures inflation and unemployment, is giving signs that economist Lyn Alden describes as “not great.”

“Combined with just how much debt/GDP exists now when compared to past, no question consumer sentiment reaches record lows,” she commented on Given data.

“Opportunity a person can have?”

Given current conditions, it might seem like there aren’t any Bitcoin bulls left to provide a silver lining towards the multiple clouds coming.

Related: 5 Best cryptocurrencies to look at now: BTC, FTT, XTZ, KCS, HNT

Zooming out, however, there are lots of who see the market setup like a golden investment chance if exploited properly.

Included in this is Filbfilb, co-founding father of buying and selling suite DecenTrader, who over the past weekend known as Bitcoin the “opportunity a person can have.”

“Just to become obvious, despite short/medium term issues which regrettably are overall, if you’re able to survive and play your moves right without growing or risking an excessive amount of so you’ve no capital, this really is IMO the chance a person can have,” he authored included in a Twitter thread.

Like others, Filbfilb tied BTC performance to stocks, warning the average hodler is unaware of the “overleveraged” problems that remain on exchanges.

“They will have the pinch,” he ongoing.

Contextualizing Bitcoin now within its four-year halving cycle, analyst Venturefounder, meanwhile, contended the max discomfort scenario could type in the coming days.

#Bitcoin cycle finish capitulation is possibly happening now.

Yet another 15% disadvantage to achieve #200WMA and 1 fib extension level ($22-23k) from #BTC cycle top, this could happen rapidly, within the next couple of days. pic.twitter.com/8cp6Oes7PK

— venturefoundΞr (@venturefounder) June 13, 2022

Presently halfway through its cycle, BTC is somewhere that has felt like bearish capitulation two times before — both in 2014 and 2018.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.