Bitcoin (BTC) futures are beginning to determine record discounts as sentiment among derivatives traders worsens.

In the latest dedicated report issued August. 23, analysis firm Arcane Research colored a worrying picture of morale among BTC futures participants.

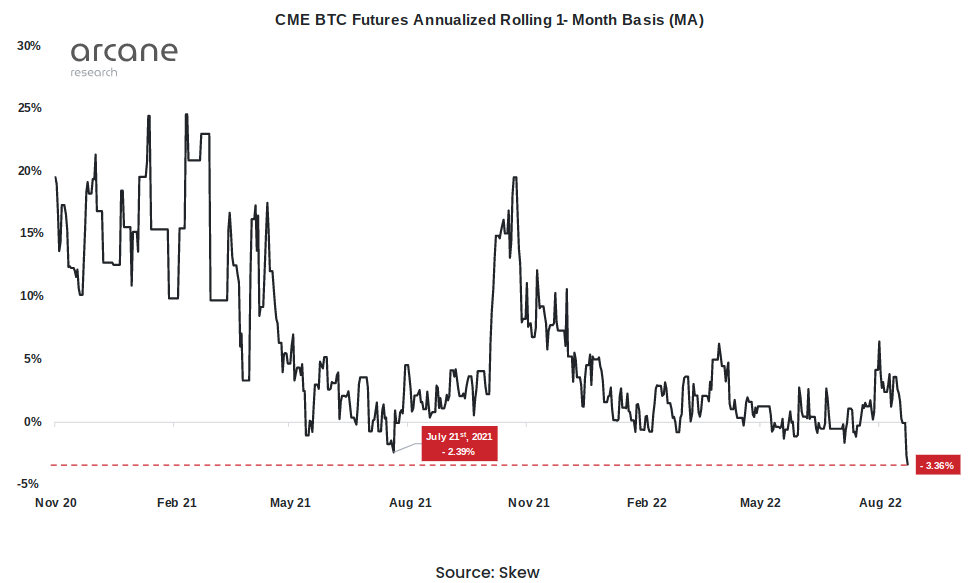

Futures basis revisits June lows

After an initial shock during June’s BTC cost drop, that has since held like a macro bottom, Bitcoin derivatives haven’t been exactly the same.

After a preliminary bounce, metrics are trending downwards, which month are challenging records.

Futures basis — the main difference between futures contract prices and also the Bitcoin place cost — has already been back at lows only seen during June’s dip to $17,600. The move came because of last week’s sudden sell-off on BTC/USD, which led to multiple visits underneath the $21,000 mark.

“Overall, the present futures basis sits at levels only experienced briefly throughout the June crash,” Arcane confirmed, adding the information is “indicative of the very bearish sentiment among futures traders.”

More discouraging figures originate from CME Group’s front-month futures contract cost.

Beating out prior lows from This summer 2021, individuals contracts now trade in their greatest-ever discount to place cost.

“Overall, CME’s futures have tended to trade for a cheap price within the last two several weeks but saw a good short-resided recovery noisy . August strength on the market,” the report ongoing.

Arcane contended that “structural effects” inside the derivatives market may go a way to explaining the behaviour, however that “worsening liquidity or general de-risking” were both still a danger.

“While BTC derivatives might signal an environment ripe for any short squeeze, the choppy buying and selling range alongside global market turmoil speaks in support of conservative positioning and gradual accumulation within the place market,” it concluded.

GBTC lingers near record lows

After U . s . States regulators rejected its application for any Bitcoin place cost exchange-traded fund (ETF) in June, meanwhile, the biggest institutional Bitcoin investment vehicle is constantly on the struggle.

Related: Aussie asset manager to provide crypto ETF using unique license variation

The Grayscale Bitcoin Trust (GBTC) continues to be buying and selling at greater than a 30% discount towards the Bitcoin place cost.

The latest data, which Cointelegraph formerly reported, puts the GBTC discount — when a premium — at 32.5%. The discount also saw records in June, if this briefly passed 34%.

For investor and investigator Jeroen Blokland, indications of a pattern change remain elusive.

“I expect that ‘physical’ bitcoin ETFs can get approved sooner or later. Following the recent SEC ruling, that does not appear imminent, but futures ETFs (also) get their menaces,” he contended this week.

Blokland stated that institutional investors were “massively” selecting BTC exposure options apart from GBTC.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.