The Chicago Mercantile Exchange (CME) Bitcoin (BTC) futures happen to be buying and selling below Bitcoin’s place cost on regular exchanges since November. 9, a scenario that’s technically known as backwardation. Although it does indicate a bearish market structure, you will find multiple factors that induce momentary distortions.

Typically, these CME fixed-month contracts trade in a slight premium, indicating that sellers are requesting more income to withhold settlement for extended. Consequently, futures should trade in a .5% to twoPercent premium in healthy markets, a scenario referred to as contango.

However, a leading futures contract seller may cause a momentary distortion within the futures premium. Unlike perpetual contracts, these fixed-calendar futures don’t have a funding rate, so their cost may vastly vary from place exchanges.

Aggressive sellers caused a 5% discount on BTC futures

Whenever there’s aggressive activity from shorts (sellers), the 2-month futures contract will trade in a 2% or greater discount.

Notice how 1-month CME futures have been buying and selling close to the fair value, either presenting a .5% discount or .5% premium versus place exchanges. However, throughout the November. 9 Bitcoin cost crash, aggressive futures contracts sellers caused the CME futures to trade 5% underneath the regular market cost.

The current 1.5% discount remains atypical but it may be described through the contagion risks brought on by the FTX and Alameda Research personal bankruptcy. The audience was supposedly among the largest market makers in cryptocurrencies, so their downfall was certain to send shockwaves throughout all crypto-related markets.

The insolvency has seriously impacted prominent over-the-counter desks, investment funds and lending services, including Genesis, BlockFi and Galois Capital. Consequently, traders should be expecting less arbitrage activity between CME futures and also the remaining place market exchanges.

The possible lack of market makers exacerbated the negative impact

As market makers scramble to lower their exposure and assess counterparty risks, the eventual excessive interest in longs and shorts at CME will cause distortions within the futures premium indicator.

The backwardation in contracts may be the primary indicator of the structural and bearish derivatives market. This type of movement can happen during liquidation orders or when large players choose to short the marketplace using derivatives. This is also true when open interest increases because new positions are now being produced under these unusual conditions.

However, an excessive discount can create an arbitrage chance because it’s possible to purchase the futures contract while concurrently selling exactly the same amount on place (or margin) markets. This can be a neutral market strategy, generally referred to as ‘reverse cash and bear.’

Institutional investors’ curiosity about CME futures remains steady

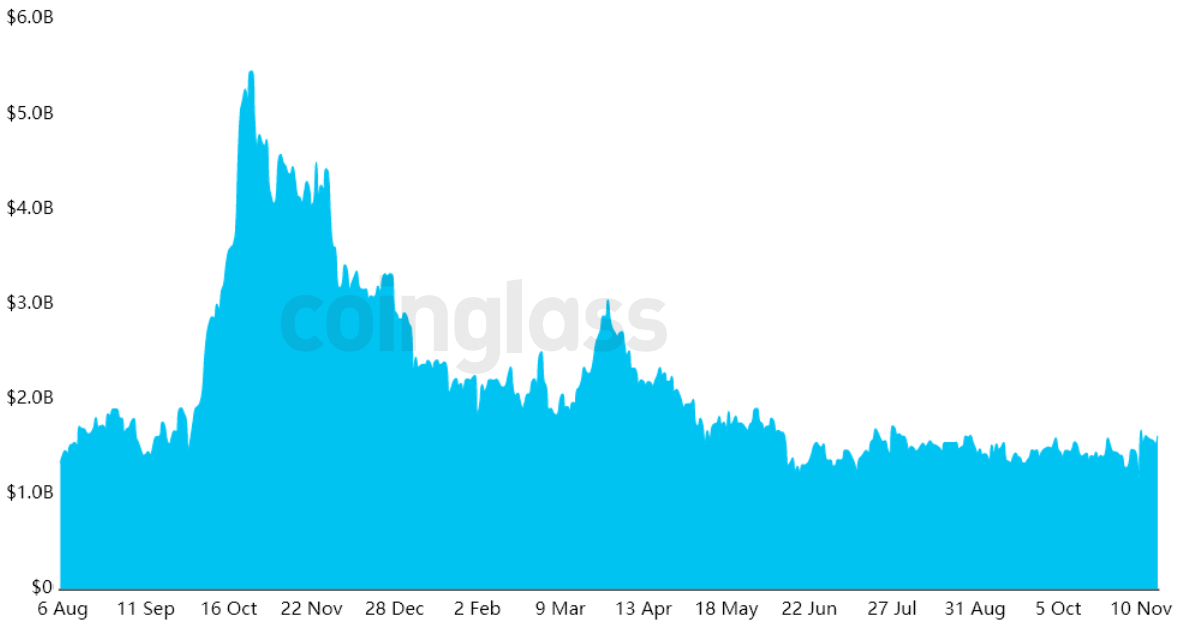

Strangely enough, outdoors interest on CME Bitcoin futures arrived at its greatest level in four several weeks on November. 10. This data measures the mixture size consumers using CME’s derivatives contracts.

Observe that the $5.45 billion record-high happened on March. 26, 2021, but Bitcoin’s cost was near $60,000 then. Consequently, the $1.67 billion CME futures open interest on November. 10, 2022, remains relevant in the amount of contracts.

Related: US crypto exchanges lead Bitcoin exodus: Over $1.5B in BTC withdrawn in a single week

Traders frequently use open interest being an indicator to verify trends or, a minimum of, institutional investors’ appetite. For example, an increasing quantity of outstanding futures contracts is generally construed as new money entering the marketplace, regardless of the bias.

Even though this data can not be considered bullish on the standalone basis, it will signal that professional investors’ curiosity about Bitcoin isn’t disappearing.

As further proof, observe that outdoors interest chart above implies that savvy investors didn’t reduce their positions using Bitcoin derivatives, it doesn’t matter what critics have stated about cryptocurrencies.

Thinking about the uncertainty surrounding cryptocurrency markets, traders shouldn’t think that single.5% discount on CME futures denotes lengthy-term bearishness.

There’s unquestionably a requirement for shorts, but the possible lack of appetite from market makers may be the primary factor leading to the present distortion.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.