Major cryptocurrency tracking website CoinGecko is available to acquisitions, although not at this time, based on a co-founding father of the woking platform.

CoinGecko continues to be hit through the current crypto bear market, however the firm is way from selling off, CoinGecko chief operating officer Bobby Ong told Cointelegraph.

Ong believes that crypto-related companies are influenced by the cyclical nature of the profession because they usually prosper during bull runs and struggle during bear markets.

“During this crypto winter, we at CoinGecko are similarly impacted. This is our third crypto winter and we’re centered on improving CoinGecko to organize for that eventual bull run which will come back,” Ong stated.

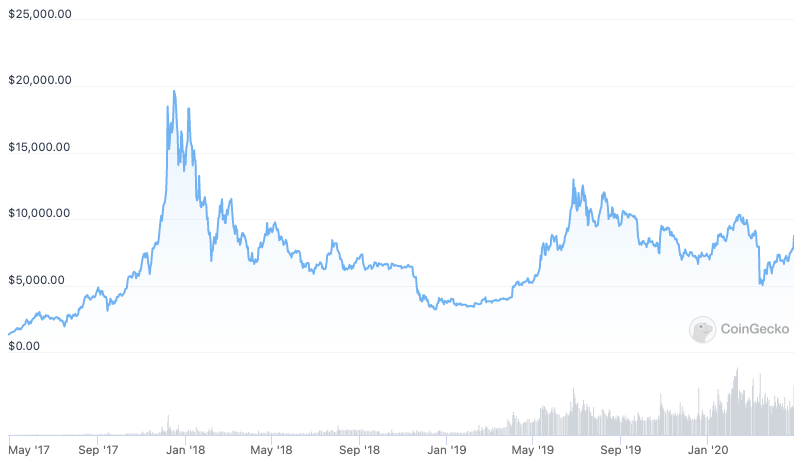

Based on the chief operating officer, CoinGecko had 100 million monthly pageviews in This summer, experiencing an 85% reduction in traffic when compared to peak in November 2021. The traffic decline comes using the cost movement of Bitcoin (BTC), which arrived at an all-time high above $68,000 last November.

“This has certainly impacted revenue, as advertising is among our major revenue motorists and it is the purpose of pageviews received,” Ong noted. Also, he stated that new token listings on CoinGecko dropped about 70% from this past year.

Despite shrinking revenues and also the ongoing uncertainty round the crypto market, CoinGecko continues to be holding strong when it comes to its headcount. The firm nearly bending its staff in the last seven several weeks from 30 to 57 team people and it has not let go any employees. CoinGecko hasn’t implemented any hiring freeze too, Ong stated.

“In fact, we simply compensated out a little bonus to any or all team people for that first 1 / 2 of 2022 regardless of the bear market. We’re also while reviewing our salaries to really make it more competitive to employ and support the best talents,” Ong mentioned, noting that CoinGecko includes a couple of remaining open roles throughout the entire year.

CoinGecko may be the greatest rival of CoinMarketCap, the crypto cost-tracking site that was bought by Binance in April 2020. The purchase came throughout the publish-2017 crypto winter, with Bitcoin buying and selling between $7,000-8,000 throughout the month of acquisition. Binance hasn’t formally announced the price of the offer, although it was rumored to cost the firm $400 million.

Following CoinMarketCap’s acquisition, Ong stated the firm was contacted multiple occasions by exchanges, vc’s and private investors, but CoinGecko opted you prioritized independence and remain neutral. Their views have somewhat altered since, as CoinGecko views it could sell the woking platform eventually, Ong stated, stating:

“At some time later on, we are available to selling the firm but at this time, it’s too soon to market. The crypto market is still in the first inning and you will see high development in in the future.”

Ong once more predicted that “anything that may be tokenized is going to be tokenized later on,” which may need a reliable source to trace all individuals tokens.

Related: ‘Builders rejoice’: Experts on why bear markets are great for Bitcoin

“CoinGecko aims to empower the decentralized future when you are the foundational infrastructure to help individuals obtain the information they require around the countless tokens that’ll be listed later on,” the main noted.

Also, he emphasized the bear market is the greatest time to pay attention to building great products as there’s “significantly less noise and distraction from short-term trends.”