Bitcoin (BTC) support in the $30,000 level has shown to be quite resilient amongst the turmoil of history two days with lots of tokens within the best players now showing indications of consolidation after prices bounced business recent lows.

During high volatility then sell-offs, it’s tough to consider a contrarian view and traders might consider putting far all the noise and negative news-flow to pay attention to their core convictions and reason behind initially purchasing Bitcoin.

Several data points claim that Bitcoin might be approaching a bottom that is likely to be adopted with a extended duration of consolidation. Let us check out what experts say.

BTC might have already arrived at “max discomfort”

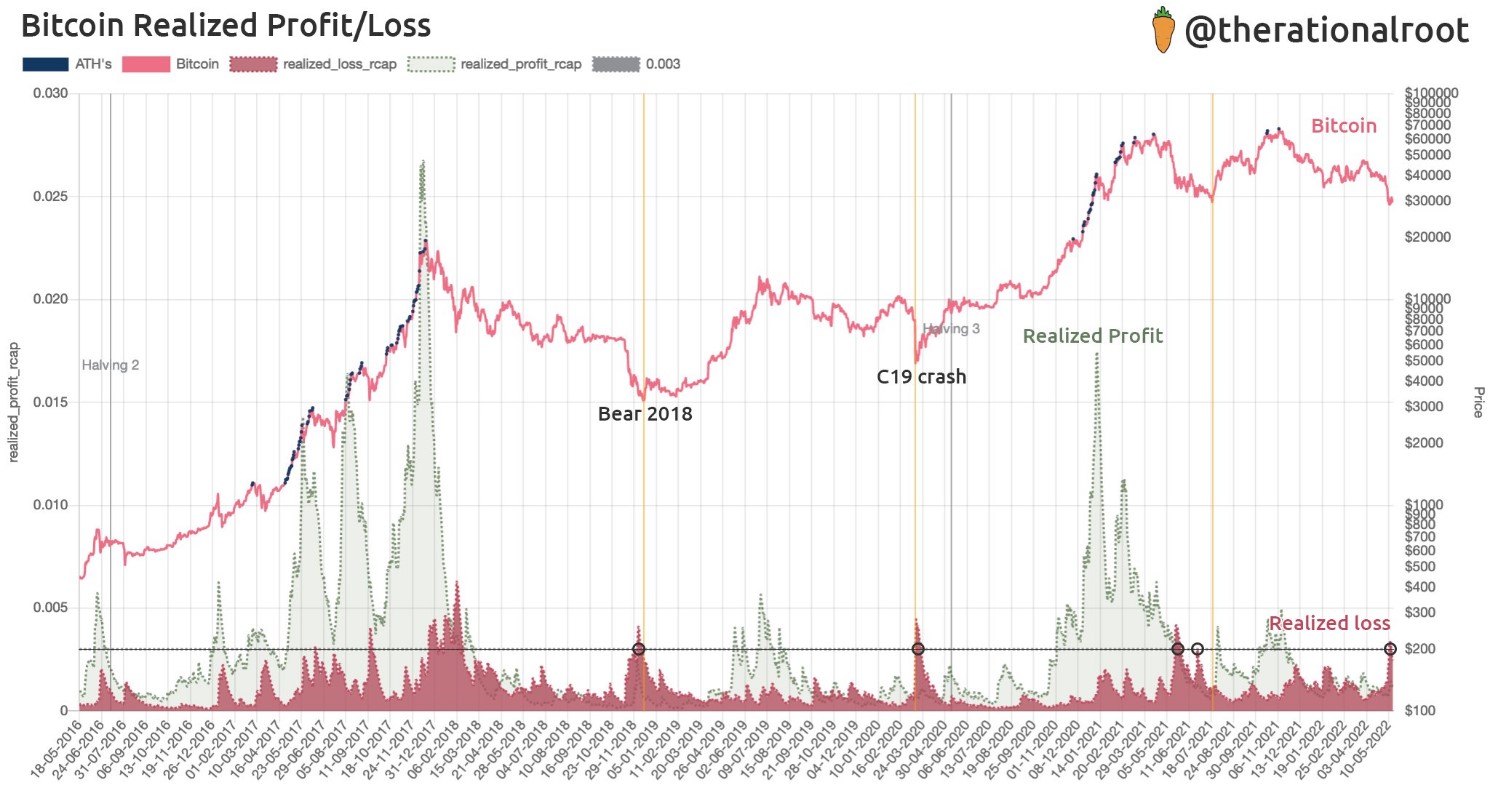

The spike in recognized losses by Bitcoin holders was discussed by ‘Root’ a pseudonymous analyst who tweeted the next chart and said realized losses are “reaching bear market highs.”

While previous bear markets have experienced a larger degree of recognized losses than are presently present, additionally they claim that the discomfort could soon start to subside, which may allow Bitcoin to start the slow road to recovery.

Analysts also have noticed that “Bitcoin’s RSI has become entering a period of time which has in the past preceded outsized returns for lengthy-term investors.”

Based on Rekt Capital,

“Previous reversals out of this area include The month of january 2015, December 2018, and March 2020. All bear market bottoms.”

Strong hands hold firm

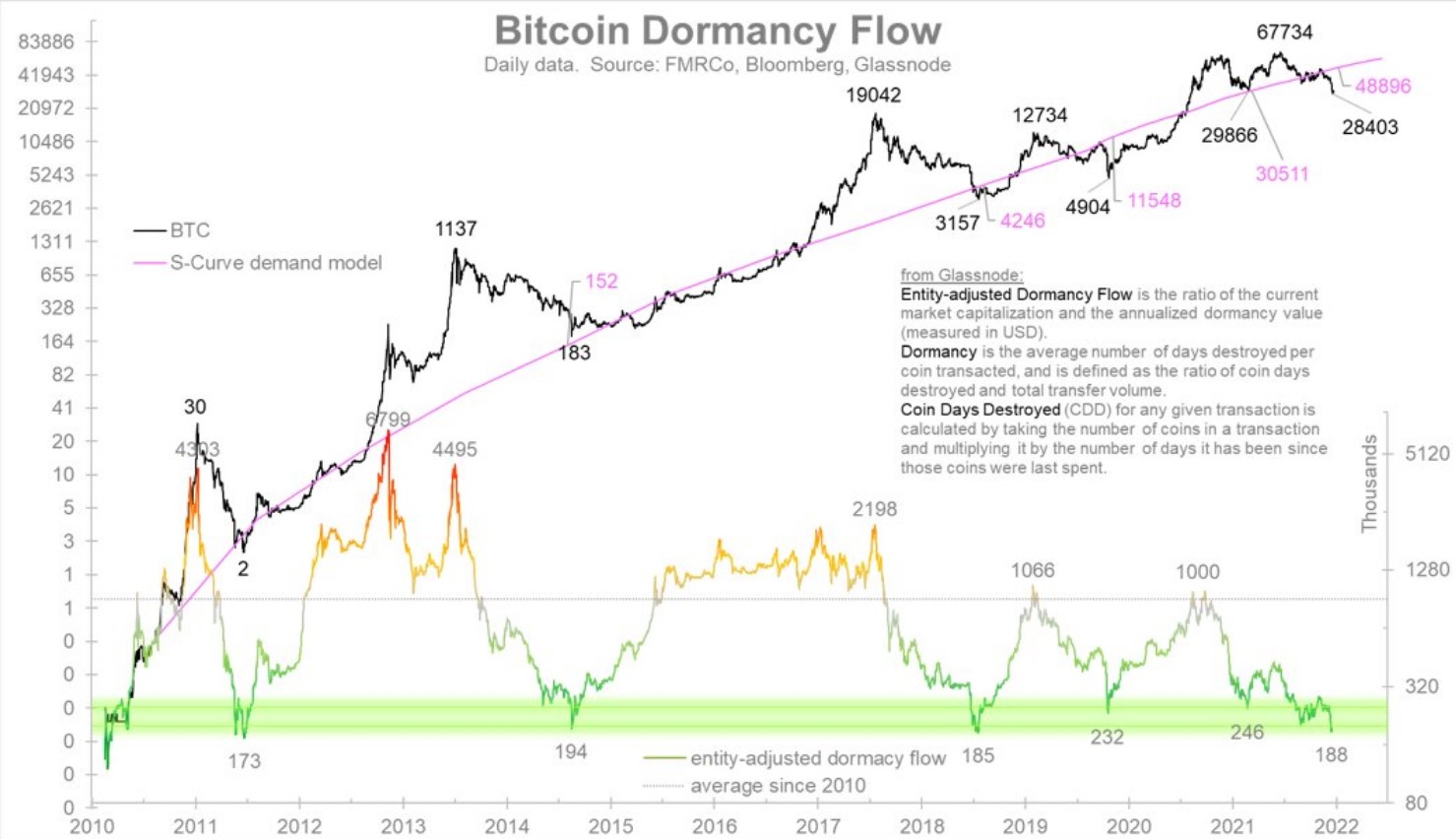

Additional on-chain evidence that Bitcoin may soon visit a revival was supplied by Jurrien Timmer, Global Director of Macro at Fidelity. Based on the Bitcoin Dormancy Flow, a metric that displays the dormancy flow for Bitcoin that “roughly speaking is really a way of measuring strong versus. weak hands.”

Timmer stated,

“The entity-adjusted dormancy flow from Glassnode has become in the cheapest level because the 2014 and 2018 lows.”

One metric that implies the weak hands might be nearing capitulation may be the Advanced NVT signal, which compares the Network Value to Transactions Ratio (NVT) and includes standard deviation (SD) bands to recognize when Bitcoin is overbought or oversold.

As proven around the chart above, the advanced NVT signal that is highlighted see how to avoid blue has become greater than 1.2 standard deviations underneath the mean, suggesting that Bitcoin is presently oversold.

Previous cases of the NVT signal falling underneath the -1.2 SD level happen to be adopted by increases within the cost of BTC, even though it can occasionally take several several weeks to manifest.

Related: Bitcoin cost predictions abound as traders concentrate on the next BTC halving cycle

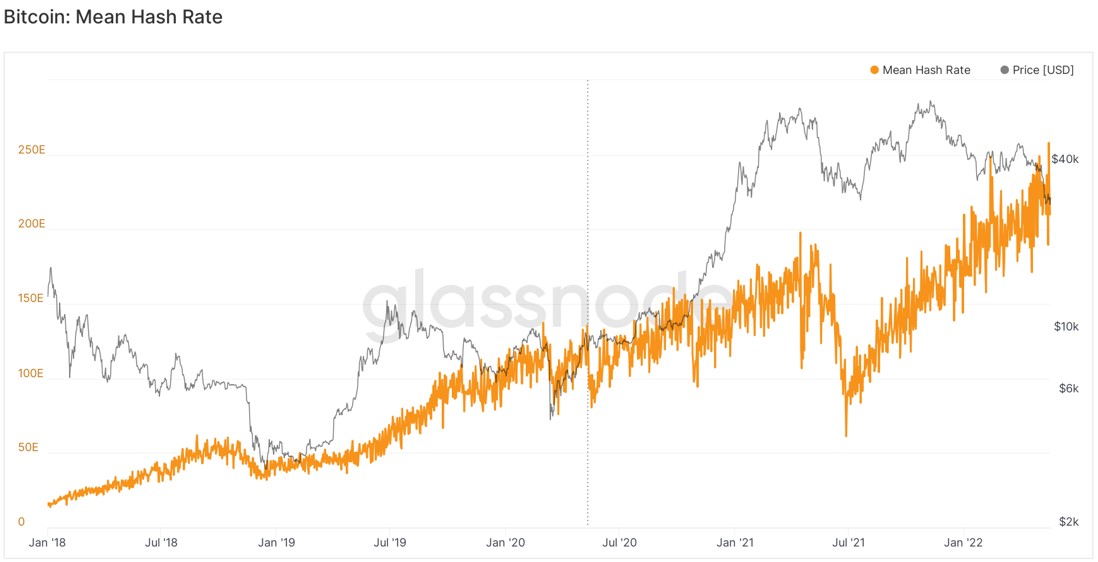

Hash rate hits a brand new all-time high

Apart from complex on-chain metrics, there are many additional factors that suggest Bitcoin often see a lift in momentum soon.

Data from Glassnode implies that the hashrate for that Bitcoin network has become in an all-time high, indicating that there’s been a considerable rise in investments in mining infrastructure most abundant in growth happening within the U . s . States.

In line with the chart above, the cost of BTC has in the past trended greater alongside increases within the mean hash rate, suggesting that BTC could soon attempt an upward trend.

The last little bit of hope are available searching in the Google Trends data for Bitcoin, which notes an increase searching interest following a recent market downturn.

Previous spikes in the search engines search interest have largely coincided with a rise in the cost of Bitcoin, therefore it is entirely possible that BTC could a minimum of visit a relief bounce soon if sidelined investors check this out being an chance to scoop up some Satoshis for a cheap price.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.