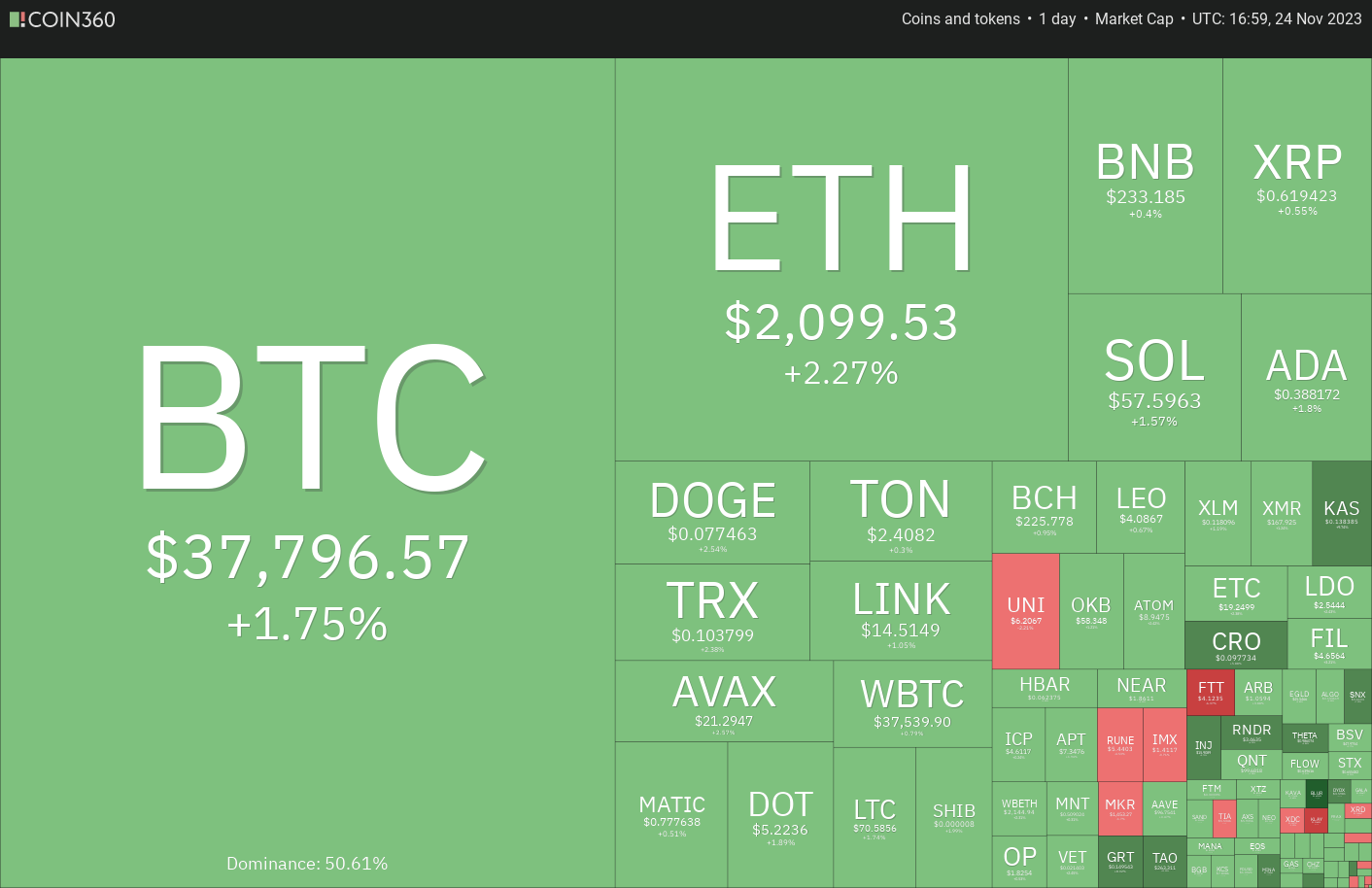

Bitcoin (BTC) broke over the overhead resistance of $38,000 on November. 24, indicating the sentiment is positive and bulls have stored in the pressure. Independent Reserve Chief executive officer Adrian Przelozny told Cointelegraph the “next 2 yrs will be good,” and market activity will probably get at the begining of 2024.

The main catalysts for the coming year may be the Bitcoin halving in April and applications for any place Bitcoin exchange-traded fund, most of which possess a deadline for any decision in The month of january. With two primary occasions coming, Bitcoin will probably find buyers on dips.

Analysts expect a retracement from $40,000 soon. That may be a primary reason why Cathie Wood’s investment firm, ARK Invest, continues to be progressively selling into strength. The firm offered about 700,000 shares from the Grayscale Bitcoin Trust (GBTC) in the last month, but it’s important to note that ARK still holds greater than 4.3 million GBTC shares.

Could crypto traders bulldoze their way with the overhead resistance levels in Bitcoin and major altcoins? Do you know the important levels to take into consideration?

Let’s evaluate the charts from the top ten cryptocurrencies to discover.

Bitcoin cost analysis

Bitcoin pierced the stiff resistance of $37,980 on November. 24, however the bulls are battling to sustain the breakout. This means the bears are intensely guarding the amount.

Both moving averages are sloping up, and also the relative strength index (RSI) is above 61, indicating the road to least resistance would be to the upside. If buyers keep up with the cost above $37,980, the BTC/USDT pair could achieve $40,000.

This level may again witness a difficult fight between your bulls and also the bears, however, if the buyers prevail, the happy couple could skyrocket to $48,000. Time is drained for that bears. If they would like to weaken the momentum, they’re going to have to sink the cost underneath the 20-day EMA. Rapid-term trend will turn negative below $34,800.

Ether cost analysis

The bulls pressed Ether (ETH) over the resistance line on November. 22, suggesting the beginning of the following leg from the up-move.

The bears attempted to drag the cost back underneath the resistance line on November. 23, however the bulls held their ground. This means the bulls are attempting to switch the resistance line into support. When they succeed, the ETH/USDT pair could begin a northward march toward $2,200.

This level may again behave as a formidable resistance, but when bulls overcome it, the happy couple will develop a large climbing triangular pattern. That may open the gates for any potential rally towards the pattern target of $3,400.

This bullish view is going to be invalidated soon when the cost turns lower and plummets underneath the vital support at $1,900.

BNB cost analysis

BNB (BNB) leaped above $235 on November. 22, however the bulls couldn’t overcome the obstacle in the 20-day EMA ($239). This means that bears are attempting to seize control.

The 20-day EMA has began to show lower, and also the RSI is simply underneath the midpoint, indicating a small benefit to the bears. Rapid-term trend will turn negative away and shut underneath the crucial support at $223. That may obvious the road for any fall to $203.

If bulls wish to avoid the downside, they’re going to have to push and sustain the cost over the 20-day EMA. The BNB/USDT pair will then take the additional time within the large range from $223 and $265.

XRP cost analysis

The bulls are attempting to shove XRP (XRP) over the 20-day EMA ($.62), which implies strong buying at ‘abnormal’ amounts.

The 20-day EMA has flattened out, and also the RSI is close to the midpoint, indicating range-bound action for the short term. The XRP/USDT pair may swing between $.56 and $.74 for any couple of days.

When the cost increases and sustains over the 20-day EMA, the happy couple could progressively climb to $.67 and after that to $.74. Buyers will need to overcome this hurdle to point the beginning of a brand new up-move.

On the other hand, when the cost turns lower in the current level and breaks below $.56, it’ll signal the beginning of a sharper correction to $.46.

Solana cost analysis

Solana (SOL) continues to be attempting to break over the $59 resistance within the last 2 days, however the bears have held their ground. A small positive in support of the bulls is they haven’t ceded ground towards the bears.

The increasing 20-day EMA ($52.80) and also the RSI within the positive territory claim that bulls possess the upper hands. That improves the prospects of the rally over the overhead resistance. In the event that happens, the SOL/USDT pair could ascend to $68.

Unlike this assumption, when the cost turns lower in the current level, the bears will make an effort to tug the happy couple underneath the 20-day EMA. Whether they can accomplish it, the happy couple may drop to $48, where buyers will probably part of.

Cardano cost analysis

Cardano (ADA) continues to be swinging above and underneath the $.38 level within the last couple of days. This shows uncertainty concerning the next directional move between your bulls and also the bears .

The upsloping moving averages and also the RSI within the positive territory indicate the bulls possess a slight edge. When the cost increases above $.40, it’ll signal the beginning of a brand new up-proceed to $.42 and then to $.46.

If bears wish to trap the aggressive bulls, they’re going to have to yank the cost below $.34. That can lead to an autumn towards the 50-day SMA ($.31). The ADA/USDT pair will then oscillate between $.24 and $.38 for some time longer.

Dogecoin cost analysis

Dogecoin (DOGE) continues to be maintaining over the 20-day EMA ($.08) within the last 2 days, however the rise lacks momentum. This signifies that bulls are careful at greater levels.

Buyers will need to propel the cost above $.08 to signal strength. The DOGE/USDT pair could then surge toward the prospective purpose of $.10. This level may again witness a difficult fight between your bulls and also the bears.

When the cost turns lower from $.08, it’ll claim that bears remain active at greater levels. The happy couple will then drop towards the immediate support at $.07. The flattish 20-day EMA and also the RSI just over the midpoint tendency to slack a obvious advantage with the idea to the bulls or even the bears.

Related: ‘Enjoy sub-$40K Bitcoin’ — PlanB stresses $100K average BTC cost from 2024

Toncoin cost analysis

Buyers are attempting to push Toncoin (TON) towards the overhead resistance of $2.59. The repeated retest of the level of resistance has a tendency to weaken it.

If bulls drive and sustain the cost over the $2.59 to $2.77 resistance zone, it’ll develop a cup-and-handle pattern. That may begin a new upward trend to $3.28 and after that towards the pattern target of $4.03.

Alternatively, when the TON/USDT pair turns lower in the overhead resistance, it’ll claim that bears are very protecting the amount. That could cause moving lower towards the 50-day SMA ($2.20). A slide below this level will open the doorways for any fall to $2 and subsequently to $1.89.

Chainlink cost analysis

Chainlink (LINK) is facing selling in the downtrend line, as seen in the lengthy wick around the November. 23 candlepower unit.

However, the bulls haven’t quit and also have again pressed the cost towards the downtrend line. The cost is stuck between your downtrend line and also the 61.8% Fibonacci retracement degree of $12.83. It has led to a squeeze, likely resolving having a sharp move ahead each side.

When the cost surges over the downtrend line, the hyperlinkOrUSDT pair may climb to $16.60 after which to $18.30. Rather, when the cost turns lower and plunges below $12.83, the decline could include the 50-day SMA ($11.21).

Avalanche cost analysis

Avalanche (AVAX) has arrived at the overhead resistance at $22, which is a vital level to take into consideration. The bears are anticipated to protect this level with vigor.

However, if bulls tendency to slack up much ground in the current level, it will raise the probability of a rest above $22. The happy couple will then climb to $25 in which the bears will probably mount a powerful defense.

Around the downside, the 20-day EMA ($18.40) continues to be the key level to keep close track of. When the cost turns lower and slips below this level, it’ll suggest the beginning of a much deeper correction to $16. This type of move will indicate the AVAX/USDT pair may take the additional time within the large range from $10.50 and $22.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.